Diving into the world of financial investments, buckle up as we take you on a journey through the various avenues of investing your hard-earned cash. Get ready to learn about stocks, bonds, and everything in between in a way that’s both informative and engaging.

In the following paragraphs, we’ll break down different types of financial investments, discuss risk management strategies, and explore various investment vehicles to help you navigate the complex world of finance with style.

Types of Financial Investments

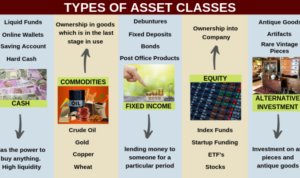

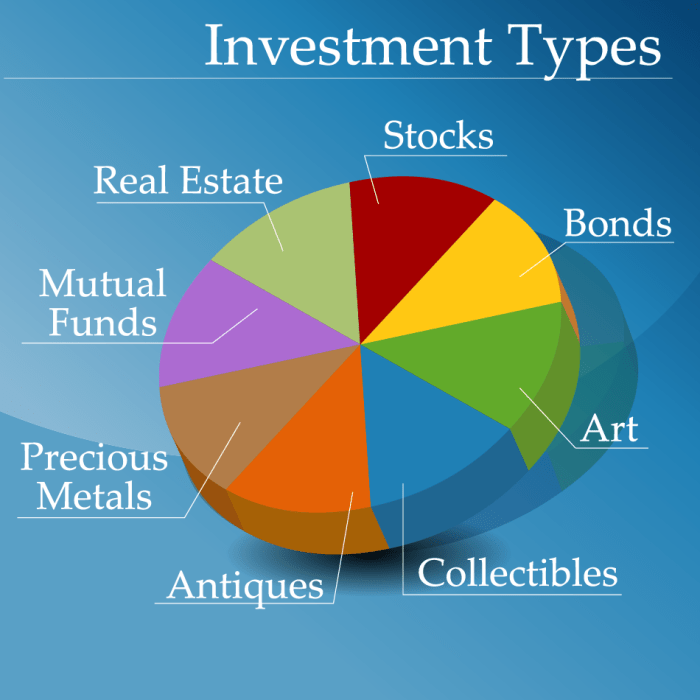

Financial investments are assets that are purchased with the expectation of generating income or profit. These investments can include stocks, bonds, real estate, mutual funds, and more. Diversification is essential in financial investment portfolios to spread risk and maximize returns.

Stocks

Stocks represent ownership in a company and can provide capital gains through price appreciation and dividends.

Bonds

Bonds are debt securities issued by governments or corporations, providing fixed interest payments over a specified period.

Real Estate

Investing in real estate involves purchasing properties to generate rental income or capital appreciation.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks, offering diversification and liquidity.

Commodities

Commodities include physical goods like gold, oil, and agricultural products, providing a hedge against inflation and economic uncertainty.

Options

Options give investors the right, but not the obligation, to buy or sell assets at a predetermined price within a specific timeframe.

Traditional Investments

Traditional investments are classic options for individuals looking to grow their wealth over time. They typically include stocks, bonds, and cash equivalents.

Stocks

Stocks represent ownership in a company and are bought and sold on stock exchanges. They offer the potential for high returns but come with higher risks due to market volatility.

- Example: Apple Inc. stock

- Characteristics: Growth potential, dividends, voting rights

Bonds

Bonds are debt securities issued by governments or corporations. They provide a fixed income stream and are considered less risky than stocks.

- Example: U.S. Treasury bond

- Characteristics: Fixed interest payments, maturity date

Cash Equivalents

Cash equivalents include money market funds, certificates of deposit (CDs), and Treasury bills. They are low-risk investments with lower potential returns.

- Example: Vanguard Prime Money Market Fund

- Characteristics: Stability, liquidity

Alternative Investments

Alternative investments refer to non-traditional assets that investors include in their portfolios to diversify and potentially increase returns. These investments often have a low correlation with stocks and bonds, offering a way to spread risk.

Real Estate

Real estate is a popular alternative investment that involves purchasing properties such as residential homes, commercial buildings, or land. Investors can generate income through rental payments and property appreciation.

Commodities

Commodities are raw materials or primary agricultural products that can be traded on exchanges. Examples include gold, oil, wheat, and coffee. Investors can profit from price fluctuations in commodity markets.

Hedge Funds

Hedge funds are investment funds that use various strategies to generate returns for their investors. These funds are typically only available to accredited investors and have the potential for high returns but also come with higher fees and risks.

Benefits of Alternative Investments

- Increased portfolio diversification

- Potential for higher returns

- Lower correlation to traditional investments

Challenges of Alternative Investments

- Higher fees compared to traditional investments

- Less liquidity, making it harder to sell assets quickly

- Complexity and higher risk levels

Risk Management in Financial Investments

When it comes to financial investments, risk management plays a crucial role in determining the success of an investment portfolio. It involves assessing and mitigating the potential risks associated with different types of investments to protect capital and achieve financial goals.

Impact of Risk Tolerance and Time Horizon

Risk tolerance refers to an investor’s ability to withstand fluctuations in the value of their investments. It is essential to consider risk tolerance when making investment decisions as it determines the level of risk an individual is comfortable with taking. On the other hand, time horizon represents the length of time an investor plans to hold an investment before needing to access the funds. It impacts investment decisions by influencing the choice of investment vehicles and risk exposure.

Strategies for Managing Risks

- Diversification: One of the most common risk management strategies is diversifying the investment portfolio across different asset classes, industries, and geographic regions. This helps reduce the impact of a single investment underperforming.

- Asset Allocation: By strategically allocating assets based on risk tolerance and investment goals, investors can balance the risk and return potential of their portfolio.

- Regular Monitoring: It is crucial to regularly review and adjust the investment portfolio to ensure it aligns with changing market conditions and financial goals.

- Use of Stop-Loss Orders: Implementing stop-loss orders can help limit potential losses by automatically selling an investment if it reaches a predetermined price level.

Investment Vehicles

Investment vehicles are essentially the different types of assets or securities that investors can use to invest their money in financial markets. These vehicles play a crucial role in helping individuals and institutions achieve their financial goals by providing access to various investment opportunities.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make investment decisions on behalf of the investors. Mutual funds offer diversification and are suitable for investors looking for a hands-off approach to investing.

ETFs (Exchange-Traded Funds)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They are passively managed and aim to track a specific index or asset class. ETFs provide investors with diversification, liquidity, and flexibility in trading throughout the day. They are a cost-effective way to gain exposure to various markets.

Individual Stocks

Individual stocks represent ownership in a specific company. Investing in individual stocks involves buying shares of a publicly-traded company with the expectation of capital appreciation and/or dividends. While individual stocks can offer high returns, they also come with higher risk compared to diversified investment options like mutual funds and ETFs.

Role of Investment Vehicles in Building Diversified Portfolios

Investment vehicles play a crucial role in building diversified investment portfolios by offering investors exposure to different asset classes, sectors, and regions. Diversification helps reduce risk by spreading investments across various opportunities, which can help minimize the impact of volatility in any single asset or market. By combining different investment vehicles, investors can create a well-balanced portfolio that aligns with their risk tolerance and financial goals.

Investment Strategies

When it comes to investing, having a solid strategy in place can make all the difference in achieving your financial goals. Let’s explore some common investment strategies and how they can help you navigate the world of investing.

Buy and Hold

The buy and hold strategy involves purchasing investments with the intention of holding onto them for the long term, regardless of short-term market fluctuations. This strategy is based on the belief that the market will trend upwards over time, allowing investors to benefit from long-term growth.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy where investors regularly invest a fixed amount of money into a particular investment, regardless of market conditions. This approach helps to mitigate the impact of market volatility by spreading out the cost of investment over time.

Value Investing

Value investing involves looking for undervalued investments that have the potential to increase in value over time. This strategy focuses on finding quality investments trading below their intrinsic value, aiming to capitalize on their future growth.

Successful investment strategies are often a result of thorough research, disciplined execution, and a clear understanding of one’s financial goals and risk tolerance.