Hey guys, diving into the world of personal loan tips where financial savvy meets borrowing wisdom. Get ready for a ride filled with insights, strategies, and all the know-how you need to make smart money moves.

Let’s kick things off by exploring the essentials of personal loan tips and how they can level up your financial game.

Importance of Personal Loan Tips

Understanding personal loan tips is essential for maintaining financial well-being. By following these tips, individuals can make informed decisions when borrowing money, ultimately saving them money and preventing them from falling into debt traps.

How Personal Loan Tips Can Help

- Comparing Interest Rates: Personal loan tips often emphasize the importance of comparing interest rates from different lenders. This allows borrowers to choose the most affordable option and save money on interest payments.

- Checking Loan Terms: Tips on personal loans also highlight the significance of reviewing loan terms carefully. By understanding the terms and conditions, borrowers can avoid hidden fees or penalties that could lead to financial strain.

- Budget Planning: Personal loan tips typically include advice on budget planning before taking out a loan. This helps individuals determine how much they can afford to borrow and repay without causing financial stress.

Factors to Consider Before Applying for a Personal Loan

Before diving into the world of personal loans, it’s crucial to take a step back and consider a few key factors that can greatly impact your financial well-being. From interest rates to credit scores, here are some important things to keep in mind:

Interest Rates

When applying for a personal loan, one of the first things you should look at is the interest rate. This is essentially the cost of borrowing money, and even a small difference in interest rates can add up to significant savings or costs over time. Be sure to shop around and compare rates from different lenders to find the best deal.

Fees

In addition to interest rates, it’s important to consider any fees associated with the personal loan. These can include origination fees, prepayment penalties, or late payment fees. Make sure you understand all the fees involved and factor them into your decision-making process.

Repayment Terms

Another crucial factor to consider is the repayment terms of the loan. This includes the length of the loan, the monthly payment amount, and whether there are any flexibility options such as deferment or forbearance. Choose a loan with repayment terms that align with your financial goals and capabilities.

Credit Score Impact

Your credit score plays a significant role in the approval process for a personal loan and can also affect the interest rate you are offered. A higher credit score typically leads to lower interest rates and better loan terms. Before applying for a personal loan, check your credit score and take steps to improve it if necessary.

Evaluating Financial Situation

Before taking out a personal loan, it’s crucial to evaluate your current financial situation. Consider your income, expenses, existing debts, and overall financial goals. Make sure that taking on a personal loan is a responsible decision that aligns with your long-term financial plans.

Tips for Choosing the Right Personal Loan

When it comes to choosing the right personal loan, there are a few key factors to consider to ensure you make the best decision for your financial needs. From comparing different types of loans to shopping around for the best terms, here are some tips to help you navigate the process.

Compare Different Types of Personal Loans

- Secured vs. Unsecured Loans: Understand the difference between secured and unsecured loans. Secured loans require collateral, while unsecured loans do not. Consider which option aligns best with your financial situation and risk tolerance.

Shopping Around for the Best Loan Terms and Offers

- Importance of Research: Take the time to research and compare loan terms from various lenders. Look for competitive interest rates, fees, and repayment options to find the best fit for your needs.

- Consider Credit Score: Your credit score plays a significant role in the loan terms you qualify for. Improve your credit score before applying to access better offers and rates.

Comparing Loan Options Based on Interest Rates and Fees

- Interest Rates: Compare the annual percentage rates (APRs) of different loans to understand the total cost of borrowing. Lower APRs mean less interest paid over the life of the loan.

- Fees: Pay attention to any additional fees associated with the loan, such as origination fees, prepayment penalties, or late fees. Factor these costs into your decision-making process.

Managing Personal Loan Repayments Effectively

When it comes to repaying personal loans, it’s crucial to have a solid plan in place to avoid financial stress and potential consequences. Here are some strategies to help you manage your personal loan repayments effectively:

Create a Realistic Repayment Plan

- Calculate your monthly budget: Determine how much you can afford to allocate towards loan repayments without compromising other essential expenses.

- Set up automatic payments: Consider setting up automatic transfers to ensure timely payments and avoid missing deadlines.

- Look for extra income sources: Find ways to increase your income to have more funds available for loan repayments.

Consequences of Missing Loan Payments

- Damage to credit score: Missing loan payments can negatively impact your credit score, making it harder to secure credit in the future.

- Accumulation of fees: Late fees and additional charges may accumulate, increasing the overall cost of the loan.

- Potential legal action: Defaulting on a loan could lead to legal action by the lender, resulting in further financial strain.

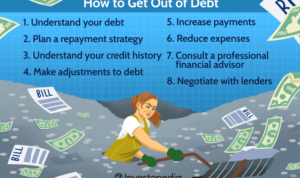

Negotiating with Lenders in Financial Difficulties

- Contact your lender early: If you anticipate financial difficulties, reach out to your lender as soon as possible to discuss potential solutions.

- Explain your situation: Be honest about your financial challenges and provide relevant information to support your case for a modified repayment plan.

- Explore alternative options: Lenders may offer forbearance, deferment, or restructuring options to help you manage repayments during tough times.