Financial planning for couples sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As couples navigate the complexities of their lives together, understanding the importance of financial planning becomes paramount. This guide will delve into the intricacies of setting financial goals, managing shared finances, creating budgets, saving and investing together, and planning for major life events, all with an aim to help couples achieve financial harmony.

Importance of Financial Planning for Couples

Financial planning is crucial for couples as it helps them set clear financial goals, establish a roadmap to achieve those goals, and ensure financial stability for their future together. By working together on a financial plan, couples can effectively manage their finances, reduce stress related to money, and strengthen their relationship through open communication and shared financial goals.

Ensuring Financial Security

Financial planning allows couples to create a safety net for unexpected expenses, emergencies, and retirement. By setting aside savings, investments, and insurance plans, couples can protect themselves and their loved ones from financial hardships in the future.

Building Wealth Together

Through financial planning, couples can focus on building wealth together by investing strategically, managing debt, and maximizing their income potential. By working towards common financial goals, such as buying a home, starting a family, or traveling the world, couples can create a solid foundation for their future.

Improving Communication and Trust

Financial planning encourages couples to communicate openly about their financial values, beliefs, and priorities. By working together to create a budget, track expenses, and make financial decisions, couples can strengthen their trust and deepen their bond, leading to a healthier and more harmonious relationship.

Setting Financial Goals as a Couple

Setting financial goals together as a couple is crucial for building a strong financial foundation and ensuring a secure future. By aligning individual aspirations with shared objectives, couples can work towards a common goal and strengthen their relationship through effective communication and collaboration.

Process of Setting Financial Goals Together

- Start by discussing each other’s individual financial goals and aspirations.

- Identify shared goals that are important to both partners, such as buying a house, saving for retirement, or starting a family.

- Create a budget that reflects your combined income, expenses, and savings goals.

- Set specific, measurable, achievable, relevant, and time-bound (SMART) goals to track your progress effectively.

- Regularly review and adjust your financial goals as your circumstances change.

Examples of Short-Term and Long-Term Financial Goals for Couples

Short-term financial goals:

- Building an emergency fund to cover unexpected expenses.

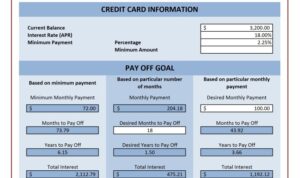

- Paying off high-interest debt, such as credit cards or personal loans.

- Setting aside money for a vacation or home improvement project.

Long-term financial goals:

- Saving for retirement through investment accounts like 401(k)s or IRAs.

- Buying a home or investing in real estate for long-term wealth accumulation.

- Funding children’s education expenses through a 529 savings plan.

Importance of Aligning Individual Goals with Shared Financial Goals

By aligning individual goals with shared financial goals, couples can avoid conflicts and work towards a harmonious financial future. When both partners are on the same page regarding their financial aspirations, they can support each other in achieving their objectives and strengthen their bond through mutual trust and cooperation.

Managing Shared Finances

When it comes to managing shared finances as a couple, there are various approaches you can take to combine your money. Whether you choose to have joint accounts, separate accounts, or a combination of both, it’s essential to communicate openly and make decisions together to ensure financial harmony in your relationship.

Combining Finances: Joint Accounts vs. Separate Accounts

One common way couples manage shared finances is by opening joint accounts. This allows both partners to have equal access to funds and simplifies budgeting and bill payments. On the other hand, some couples prefer to keep separate accounts to maintain financial independence and privacy.

- Joint Accounts:

- Pros:

- Enhanced transparency and shared responsibility

- Simplified financial management and budgeting

- Facilitates joint goals and long-term planning

- Cons:

- Potential for conflicts over spending habits and financial decisions

- Lack of financial autonomy and privacy

- Risk of one partner overspending without accountability

- Pros:

- Separate Accounts:

- Pros:

- Maintains financial independence and autonomy

- Respects individual spending habits and priorities

- Ensures privacy and personal control over finances

- Cons:

- Potential for unequal financial contributions and shared expenses

- Complicates joint budgeting and financial planning

- Lack of transparency and shared responsibility

- Pros:

Effective Communication and Decision-Making

Regardless of whether you choose joint accounts, separate accounts, or a combination of both, effective communication and decision-making are key to managing shared finances successfully. Here are some tips to help you navigate this process:

- Establish open and honest communication about your financial goals, values, and concerns.

- Set regular financial check-ins to review your budget, track expenses, and discuss any upcoming financial decisions.

- Create a joint budget that reflects both partners’ priorities and includes shared expenses, savings goals, and individual discretionary spending.

- Agree on a system for managing financial responsibilities, such as bill payments, investments, and debt repayment.

- Be willing to compromise and find common ground when differences in spending habits or financial priorities arise.

Creating a Budget as a Couple

When it comes to managing finances as a couple, creating a budget is essential to ensure financial stability and alignment of financial goals.

Steps to Create a Budget as a Couple

- Sit down together and discuss your financial goals and priorities.

- List all sources of income for both partners.

- Track your expenses for a month to understand your spending habits.

- Determine fixed expenses (rent, utilities) and variable expenses (groceries, entertainment).

- Allocate a specific amount for savings and emergency funds.

- Create categories for spending and set a limit for each category.

Examples of Budgeting Strategies for Couples

- 50/30/20 Rule: Allocate 50% of income to essentials, 30% to lifestyle choices, and 20% to savings and debt repayment.

- Envelope System: Divide cash into envelopes for different categories and only spend what’s in each envelope.

- Zero-Based Budgeting: Give every dollar a purpose, ensuring income minus expenses equals zero.

Tracking Expenses and Adjusting the Budget

To track expenses, use apps or spreadsheets to monitor spending. Regularly review your budget to see if you’re staying within limits. If necessary, adjust the budget by reallocating funds or cutting back on certain expenses.

Saving and Investing Together

Saving and investing as a couple is crucial for building a secure financial future and achieving shared goals. By working together, couples can maximize their savings potential and grow their wealth over time.

Different Saving and Investment Options

- Traditional Savings Accounts: Couples can start by setting up joint savings accounts to save for short-term goals and emergencies.

- Retirement Accounts: Contributing to retirement accounts like 401(k) or IRA can help couples secure their future and enjoy a comfortable retirement.

- Stocks and Bonds: Couples can consider investing in stocks and bonds to grow their wealth over the long term.

- Real Estate: Investing in real estate properties can provide couples with a stable source of income and potential for appreciation.

Tips for Working Together Towards Saving and Investment Goals

- Set Clear Goals: Discuss and set specific saving and investment goals as a couple to stay focused and motivated.

- Communicate Openly: Regular communication about finances is key to ensure both partners are on the same page and working towards the same objectives.

- Allocate Responsibilities: Divide tasks such as tracking expenses, researching investment options, and monitoring progress to ensure efficient collaboration.

- Seek Professional Advice: Consider consulting a financial advisor to help create a tailored savings and investment plan that aligns with your goals.

Planning for Major Life Events

Financial planning plays a crucial role in preparing couples for major life events such as buying a house, having children, or retirement. By setting clear goals and establishing a solid financial foundation, couples can navigate these milestones with confidence.

Buying a House

- Save for a down payment: Start saving early and consider setting up a separate account specifically for this goal.

- Research mortgage options: Explore different mortgage lenders and loan programs to find the best fit for your financial situation.

- Factor in additional costs: Remember to budget for closing costs, property taxes, and maintenance expenses.

Having Children

- Plan for childcare expenses: Research the cost of childcare in your area and factor this into your budget.

- Review health insurance coverage: Understand your insurance options for prenatal care, labor, and delivery.

- Start a college fund: Consider opening a 529 college savings plan to start saving for your child’s education.

Retirement

- Calculate retirement needs: Determine how much you will need to save for retirement based on your desired lifestyle.

- Maximize retirement accounts: Contribute to 401(k) or IRA accounts to take advantage of tax benefits and employer matches.

- Review investment strategies: Adjust your investment portfolio as you near retirement to minimize risk and maximize returns.

Role of Insurance

Insurance plays a critical role in financial planning for couples by providing protection against unexpected events. Consider the following types of insurance:

“Insurance helps couples mitigate financial risks and protect their assets.”

Creating an Emergency Fund

- Set a savings goal: Aim to have 3-6 months’ worth of living expenses saved in case of emergencies.

- Automate savings: Set up automatic transfers to your emergency fund account each month to ensure consistent saving.

- Use high-yield savings accounts: Opt for accounts that offer higher interest rates to help your emergency fund grow faster.