Diving into the world of credit repair strategies, we uncover the essential techniques and methods that can help you boost your credit score and financial health. From disputing errors to building a positive credit history, this guide will equip you with the knowledge you need to take control of your finances.

As we delve deeper into each aspect of credit repair, you’ll gain valuable insights into how to navigate the complex world of credit reporting and improvement.

Understanding Credit Repair Strategies

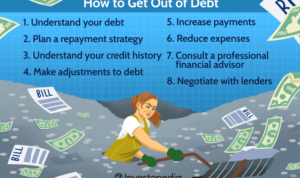

When it comes to credit repair, the goal is to improve your credit score by addressing any negative items on your credit report. This can involve disputing inaccuracies, negotiating with creditors, or creating a plan to pay off outstanding debts.

Common Credit Repair Strategies

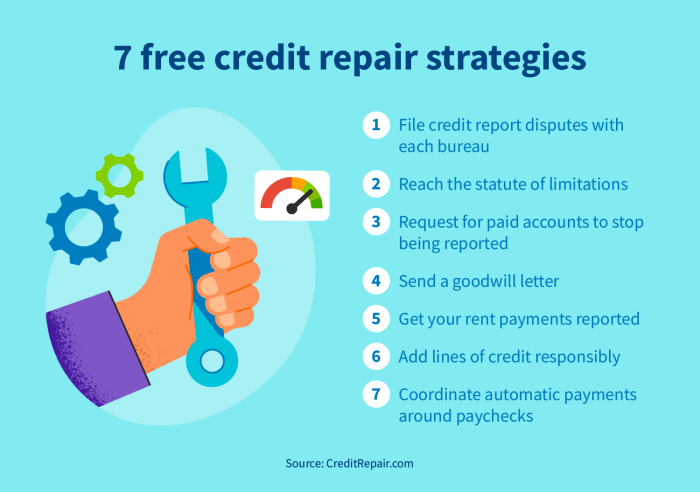

- Disputing inaccuracies: One common strategy is to review your credit report for errors and inaccuracies, such as incorrect late payments or accounts that don’t belong to you. By disputing these items with the credit bureaus, you can potentially have them removed from your report, leading to an increase in your credit score.

- Negotiating with creditors: If you have outstanding debts, you can negotiate with your creditors to settle the debt for less than the full amount owed. This can help you pay off the debt and improve your credit score by showing that you are actively working to resolve your financial obligations.

- Creating a structured repayment plan: Developing a structured plan to pay off outstanding debts can help you manage your finances more effectively and improve your credit score over time. By making consistent, on-time payments, you can demonstrate responsible financial behavior to creditors and boost your credit score.

Identifying Credit Report Errors

When it comes to credit report errors, knowing how to identify them is crucial for maintaining a healthy credit score and financial well-being. By understanding how to obtain and review your credit report, recognizing common errors, and understanding their impact on your credit score, you can take proactive steps to correct any inaccuracies.

Obtaining and Reviewing a Credit Report

To obtain your credit report, you can request a free copy from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year through AnnualCreditReport.com. Once you have your report, carefully review each section to ensure all information is accurate and up-to-date.

- Check for any personal information errors, such as incorrect name, address, or Social Security number.

- Review your account information, including credit accounts, balances, and payment history, to ensure everything is reported correctly.

- Look for any unauthorized accounts or inquiries that may indicate identity theft.

Common Errors Found in Credit Reports

- Misreported or duplicate accounts: Sometimes, the same account may appear multiple times or be incorrectly reported.

- Incorrect personal information: Errors in your name, address, or Social Security number can lead to mix-ups in your credit file.

- Missing account information: If an account is not being reported, it could affect your credit score.

- Incorrect payment history: Make sure that your payment history accurately reflects your on-time payments and any delinquencies.

Impact of Inaccuracies on Credit Scores

Errors in your credit report can lead to a lower credit score, difficulty obtaining loans or credit, and even potential identity theft issues.

It’s important to address any inaccuracies promptly by following the dispute process with the credit bureaus to ensure your credit report reflects accurate information.

Disputing Inaccurate Information

When it comes to disputing errors on your credit report, it’s crucial to take action promptly to ensure your credit standing remains accurate and fair. By following the proper steps and guidelines, you can effectively challenge inaccurate information and potentially improve your credit score.

Tips for Writing Effective Dispute Letters

- Clearly identify the errors: Be specific about the inaccurate information you are disputing, including account numbers, dates, and any other relevant details.

- Provide supporting evidence: Attach any documents or proof that support your claim of inaccuracies, such as payment receipts or correspondence with the creditor.

- Be concise and professional: Keep your dispute letter clear, concise, and professional in tone to demonstrate your seriousness and credibility.

- Send via certified mail: Ensure your dispute letter is sent via certified mail to have a record of when it was sent and received by the credit bureau.

Importance of Following Up on Disputes with Credit Bureaus

- Monitor the progress: Regularly check the status of your dispute with the credit bureaus to ensure it is being processed and investigated.

- Provide additional information if needed: Be prepared to provide any additional information or documentation requested by the credit bureaus to support your dispute.

- Stay persistent: If you do not receive a response within the specified timeframe, follow up with the credit bureaus to ensure your dispute is not overlooked.

- Review updated credit report: Once the dispute is resolved, review your updated credit report to confirm that the inaccuracies have been corrected and reflect accurately on your credit history.

Building a Positive Credit History

Establishing good credit habits is key to building a positive credit history. This involves making timely payments, keeping credit card balances low, and only opening new credit accounts when necessary.

Improving Credit Utilization

- Avoid maxing out credit cards and aim to keep your credit utilization ratio below 30%.

- Consider requesting a credit limit increase to lower your utilization ratio.

- Pay off balances in full each month to show responsible credit management.

Maintaining a Strong Payment History

- Set up automatic payments or reminders to ensure on-time payments.

- Contact creditors if you anticipate difficulty making a payment to explore options.

- Avoid closing old accounts with a positive payment history, as they contribute to your credit score.

Impact of Positive Credit History on Credit Scores

Maintaining a positive credit history can significantly impact your credit scores. Lenders view a strong payment history and low credit utilization positively, leading to higher credit scores. This can result in better interest rates, higher credit limits, and increased access to credit in the future.

Working with Credit Repair Companies

When it comes to credit repair, some individuals may choose to work with credit repair companies to help improve their credit score. These companies specialize in helping consumers dispute inaccurate information on their credit reports, negotiate with creditors, and develop strategies to improve creditworthiness.

Role of Credit Repair Companies

- Credit repair companies act as advocates for consumers in dealing with credit bureaus and creditors.

- They review credit reports, identify errors, and assist in disputing inaccurate information.

- These companies may also provide guidance on building a positive credit history and managing finances responsibly.

Pros and Cons of Hiring a Credit Repair Company

- Pros:

- Expertise: Credit repair companies have experience in dealing with credit issues and can offer valuable insights.

- Time-saving: They can handle the tedious process of credit repair, saving consumers time and effort.

- Potential for results: Working with professionals may lead to more effective outcomes in improving credit scores.

- Cons:

- Cost: Credit repair services can be expensive and may not always guarantee results.

- Risks: Some companies may engage in unethical practices or make false promises, potentially harming consumers.

- DIY option: Consumers can also take steps to improve their credit on their own without the need for a credit repair company.

Tips for Choosing a Reputable Credit Repair Service

- Research and compare: Look into different credit repair companies, read reviews, and compare services and pricing.

- Check credentials: Ensure the company is licensed, bonded, and accredited by reputable organizations.

- Understand the process: Ask about the company’s approach to credit repair and how they plan to assist you.

- Transparency: Choose a company that is transparent about their fees, services, and expected outcomes.

- Avoid guarantees: Be wary of companies that promise specific results or quick fixes, as credit repair is a complex process.