Struggling with debt? Buckle up as we dive into the ultimate guide on how to get out of debt, packed with practical tips and strategies to help you regain control of your finances and pave the way to a debt-free future.

In this guide, we’ll explore everything from understanding different types of debt to creating a solid budget and developing a smart debt repayment plan that works for you. Let’s embark on this journey towards financial liberation together.

Understanding Debt

Debt is when you owe money to someone or some institution, and it comes in various forms. The most common types of debt include credit card debt, student loans, mortgages, and personal loans.

Consequences of Debt

Debt can have serious consequences on your financial health. When you’re in debt, you may have to pay high interest rates, which can make it challenging to pay off the debt. If you miss payments, it can negatively impact your credit score, making it harder to borrow money in the future. Debt can also lead to stress and anxiety as you struggle to make ends meet.

Accumulation of Debt

Debt can accumulate in various ways. For example, using credit cards to make purchases without considering how you’ll pay it off can lead to credit card debt. Taking out multiple loans without a clear repayment plan can also result in a mountain of debt. Additionally, unexpected expenses like medical bills or car repairs can quickly add to your debt load.

Assessing Your Debt Situation

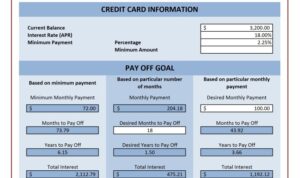

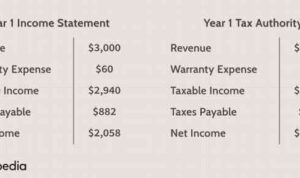

When it comes to getting out of debt, the first step is to assess your current financial situation. This involves calculating your total debt, understanding the interest rates and payment deadlines for each debt, and creating a comprehensive list of debts.

Calculating Total Debt

To calculate your total debt, you need to gather information on all your outstanding balances. This includes credit card balances, loans, mortgage payments, medical bills, and any other debts you may have. Add up all these amounts to determine your overall debt load.

Knowing Interest Rates and Payment Deadlines

It’s crucial to know the interest rates and payment deadlines for each of your debts. This information will help you prioritize which debts to pay off first. High-interest debts should be tackled sooner to prevent accruing more interest over time. Missing payment deadlines can lead to additional fees and damage to your credit score.

Creating a Comprehensive List of Debts

To get a clear picture of your financial situation, create a comprehensive list of all your debts. Include the name of the creditor, outstanding balance, interest rate, minimum monthly payment, and payment deadline for each debt. Organizing your debts in this way will help you track your progress as you work towards becoming debt-free.

Creating a Budget

Creating a budget is essential in managing your income and expenses effectively. By setting up a budget, you can track where your money is going and allocate funds towards paying off debt. Here are the steps to create a budget and tips on cutting down unnecessary expenses to help you reach your financial goals.

Steps to Create a Budget

- List all sources of income: Include your salary, side hustle earnings, and any other money coming in regularly.

- Calculate your expenses: Track your spending for a month to see where your money is going. Categorize expenses into needs (rent, groceries) and wants (eating out, shopping).

- Set financial goals: Determine how much you want to allocate towards debt repayment and savings each month.

- Create a budget plan: Allocate specific amounts to each expense category, making sure to prioritize debt payments.

- Monitor and adjust: Regularly review your budget to see if you are sticking to it. Make adjustments as needed to meet your financial goals.

Tips for Cutting Down Unnecessary Expenses

- Avoid impulse purchases: Make a shopping list and stick to it to prevent overspending.

- Cut back on dining out: Cook meals at home and bring lunch to work to save on eating out costs.

- Cancel unused subscriptions: Review your subscriptions and cancel any that you no longer use or need.

- Reduce utility costs: Turn off lights when not in use, unplug electronics, and adjust the thermostat to save on energy bills.

Importance of Setting Realistic Financial Goals

Setting realistic financial goals within your budget helps you stay motivated and focused on paying off debt. By having clear objectives, you can track your progress and see the impact of your efforts. Make sure your goals are achievable and align with your overall financial situation to maintain consistency in your budgeting efforts.

Developing a Debt Repayment Plan

When it comes to paying off debt, having a solid repayment plan in place is crucial. There are different strategies you can use to tackle your debts effectively.

Snowball Method vs. Avalanche Method

Two popular debt repayment strategies are the snowball method and avalanche method. The snowball method involves paying off your smallest debts first, regardless of interest rate, while the avalanche method focuses on paying off debts with the highest interest rates first.

- Snowball Method: Start by paying off your smallest debt first, then use the freed-up money to tackle larger debts. This method can provide a sense of accomplishment and motivation as you see debts being paid off.

- Avalanche Method: Prioritize debts based on interest rates, starting with the highest. By focusing on high-interest debts first, you can save money on interest payments in the long run.

Prioritizing Debts

It’s essential to prioritize your debts based on either interest rates or balances. By paying off high-interest debts first, you can save money on interest over time. Alternatively, paying off debts with smaller balances can provide a quick win and motivation to keep going.

Negotiating with Creditors and Debt Consolidation

Don’t hesitate to reach out to your creditors to negotiate lower interest rates or payment plans that work for you. Additionally, exploring debt consolidation options, such as taking out a consolidation loan or using a balance transfer credit card, can help simplify your debt and potentially lower your overall interest payments.

Increasing Income and Saving Money

In order to get out of debt faster, it’s essential to find ways to increase your income and save money. This can help you allocate more funds towards debt repayment and achieve financial freedom sooner.

Side Hustles and Freelance Work

- Consider taking on a side hustle or freelance work in your spare time to earn extra income.

- Popular side hustles include dog walking, tutoring, graphic design, or driving for ride-sharing services.

- Freelance platforms like Upwork, Fiverr, or TaskRabbit offer opportunities to showcase your skills and earn money.

Selling Unwanted Items

- Go through your belongings and sell items you no longer need or use on platforms like eBay, Facebook Marketplace, or Poshmark.

- Clothes, electronics, furniture, and collectibles are often in demand and can fetch a good price when sold online.

- Use the extra cash from selling unwanted items to boost your income and make extra debt payments.

Reducing Expenses and Saving Money

- Avoid eating out frequently and opt for home-cooked meals to save money on dining expenses.

- Cancel unused subscriptions or memberships to reduce monthly expenses and allocate more funds towards debt repayment.

- Shop for groceries in bulk, use coupons, and compare prices to save on daily expenses and free up money for debt repayment.

Seeking Professional Help

When dealing with overwhelming debt, seeking professional help can be a crucial step towards getting back on track financially. Financial advisors and credit counselors are trained professionals who can provide guidance and support in creating a solid debt repayment plan.

Debt Relief Programs

Debt relief programs are designed to help individuals struggling with debt by negotiating with creditors to reduce the total amount owed. These programs can lower interest rates, eliminate fees, and consolidate multiple debts into one monthly payment, making it easier to manage and pay off debt over time.

- Debt settlement programs work by negotiating with creditors to settle debts for less than the total amount owed.

- Debt management plans involve consolidating debts into one monthly payment with reduced interest rates.

- Debt consolidation loans combine multiple debts into one loan with a lower interest rate, simplifying repayment.

Bankruptcy

As a last resort, bankruptcy can be an option for individuals with overwhelming debt and no viable way to repay it. It is a legal process that allows individuals to eliminate or restructure their debts under the supervision of a bankruptcy court. However, bankruptcy can have long-lasting negative effects on credit scores and financial stability, so it should only be considered after exploring all other options.

It is essential to consult with a qualified professional before deciding on the best course of action for your specific financial situation.