Tax-deferred accounts open the door to a world of financial possibilities, offering a unique opportunity to grow your wealth while minimizing tax burdens. Get ready to dive into the realm of tax-deferred accounts with a fresh perspective that combines practicality and style.

In this guide, we’ll explore the ins and outs of tax-deferred accounts, from understanding the concept to maximizing their benefits for a secure financial future.

What are Tax-Deferred Accounts?

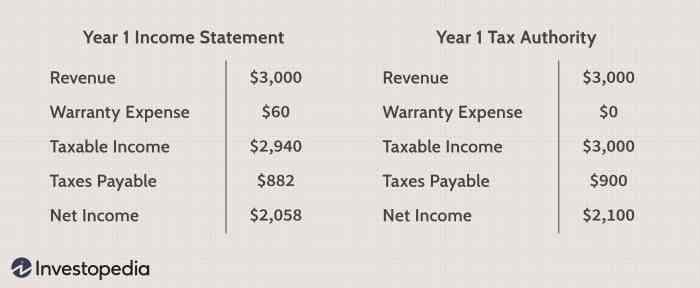

Tax-deferred accounts are investment accounts where taxes on investment gains are postponed until a later date, allowing your money to grow tax-free until withdrawal. This can be advantageous for individuals looking to save for retirement or other long-term goals.

Types of Tax-Deferred Accounts

There are several types of tax-deferred accounts available, including:

- Traditional IRA: Contributions are made with pre-tax dollars, and withdrawals are taxed as income.

- 401(k): Employer-sponsored retirement plan where contributions are deducted from your paycheck before taxes.

- 403(b): Similar to a 401(k) but offered to employees of non-profit organizations.

- 457(b): Available to state and local government employees, allowing for pre-tax contributions.

- Roth IRA: Contributions are made with after-tax dollars, but withdrawals are tax-free in retirement.

Comparison with Other Investment Options

Tax-deferred accounts differ from other investment options like taxable brokerage accounts or savings accounts in that they offer potential tax advantages. While taxable accounts are subject to annual taxes on dividends, interest, and capital gains, tax-deferred accounts allow your investments to grow without immediate tax implications. This can lead to greater overall growth potential over time, especially for long-term investors.

Benefits of Tax-Deferred Accounts

Investing in tax-deferred accounts comes with several advantages that can help individuals in their long-term financial planning. By deferring taxes on investment gains, individuals can potentially grow their savings faster over time.

Types of Tax-Deferred Accounts

- 401(k): One of the most popular tax-deferred retirement accounts offered by employers. Contributions are made with pre-tax dollars, reducing taxable income in the present.

- Traditional IRA: Individuals can contribute to this account with pre-tax dollars, allowing for tax-deferred growth until withdrawals are made during retirement.

- 403(b): Similar to a 401(k) but offered to employees of non-profit organizations, schools, and certain government entities.

Advantages of Tax-Deferred Accounts

- Compound Growth: By deferring taxes on investment gains, individuals can benefit from compounding returns over time, leading to potentially higher account balances.

- Tax Bracket Management: Tax-deferred accounts allow individuals to manage their tax liabilities by potentially withdrawing funds during retirement when they may be in a lower tax bracket.

- Lower Current Tax Bill: Contributions to tax-deferred accounts can lower an individual’s taxable income in the present, providing immediate tax savings.

How to Open a Tax-Deferred Account

To open a tax-deferred account, you need to follow a few simple steps to ensure you are setting yourself up for financial success.

Steps to Open a Tax-Deferred Account

- Research Different Account Options: Start by researching various tax-deferred accounts such as Traditional IRAs, 401(k)s, or annuities to determine which best suits your financial goals.

- Choose a Financial Institution: Once you have decided on the type of account, choose a reputable financial institution that offers the account you are interested in.

- Fill Out an Application: Complete the application form for the tax-deferred account you have chosen. Be sure to provide accurate information to avoid any delays in the process.

- Deposit Funds: Some tax-deferred accounts require an initial deposit, so make sure you have the necessary funds ready to invest.

- Set Up Contribution Plan: Determine how much you want to contribute regularly to your tax-deferred account and set up a contribution plan that aligns with your financial goals.

- Monitor and Adjust: Keep track of your account performance regularly and make adjustments as needed to ensure you are on track to meet your financial objectives.

Tips for Selecting the Right Tax-Deferred Account

- Consider Your Investment Goals: Choose an account that aligns with your long-term financial goals whether it be retirement savings or education funding.

- Compare Fees and Expenses: Different accounts may have varying fees and expenses, so make sure to compare these costs before making a decision.

- Review Tax Benefits: Understand the tax benefits associated with each type of tax-deferred account to maximize your savings potential.

- Seek Professional Advice: If you are unsure which account is best for you, consider consulting with a financial advisor who can provide guidance based on your individual needs.

Eligibility Criteria for Opening Tax-Deferred Accounts

- Age Requirement: Some tax-deferred accounts have age restrictions for opening, such as Traditional IRAs where you must be under the age of 70 ½ to contribute.

- Income Limits: Certain accounts like Roth IRAs have income limits that determine eligibility for contributions based on your annual income.

- Employment Status: Some tax-deferred accounts like 401(k)s are offered through employers, so you must be employed by a company that offers this benefit to participate.

Strategies for Maximizing Tax-Deferred Accounts

When it comes to maximizing returns within tax-deferred accounts, there are several key strategies to keep in mind. By balancing contributions and withdrawals effectively and adjusting investment strategies over time, you can make the most of these accounts for long-term financial growth.

Regularly Review and Rebalance Your Portfolio

- Regularly review your investment portfolio to ensure it aligns with your financial goals and risk tolerance.

- Rebalance your portfolio periodically to maintain the desired asset allocation and risk level.

- Consider adjusting your investment mix as you near retirement to reduce risk and preserve capital.

Maximize Contributions and Take Advantage of Employer Matches

- Maximize your contributions to tax-deferred accounts each year to take full advantage of their tax benefits.

- If your employer offers a matching contribution, contribute enough to receive the full match to maximize your savings potential.

- Consider increasing your contributions over time as your income grows to make the most of tax-deferred growth.

Utilize Tax-Efficient Investment Strategies

- Focus on tax-efficient investment strategies within your tax-deferred accounts to minimize taxes on investment gains.

- Consider investing in index funds or ETFs that have lower turnover and capital gains distributions.

- Avoid frequent buying and selling within your account to reduce tax liabilities and maximize long-term growth.