Ready to dive into the world of mortgages? Buckle up as we take you on a wild ride filled with financial jargon, lender hunting, and credit score magic. Get your popcorn ready, ‘cause this is one rollercoaster you won’t want to miss!

From understanding the basics to navigating the application process, we’ve got your back every step of the way. Get ready to rock your mortgage application like a boss!

Understanding Mortgage Application

When it comes to applying for a mortgage, it’s essential to understand the process and requirements involved. Let’s break down the key components needed and the importance of your credit score in this application process.

Basic Concept of a Mortgage

A mortgage is a type of loan that is specifically used to purchase a home or real estate property. The borrower agrees to repay the loan amount plus interest over a set period, typically ranging from 15 to 30 years.

Key Components Needed to Apply for a Mortgage

- Proof of income: Lenders will require documentation such as pay stubs, tax returns, and bank statements to verify your ability to repay the loan.

- Down payment: The initial upfront payment you make towards the purchase of the property, typically ranging from 3% to 20% of the home’s value.

- Debt-to-income ratio: Lenders assess your ability to manage monthly payments by comparing your total monthly debt payments to your gross monthly income.

Importance of Credit Score

Your credit score plays a crucial role in the mortgage application process as it reflects your creditworthiness. A higher credit score can help you qualify for better interest rates and loan terms, while a lower score may result in higher rates or loan denial.

Different Types of Mortgages

- Fixed-rate mortgage: Offers a stable interest rate throughout the loan term, providing predictability in monthly payments.

- Adjustable-rate mortgage (ARM): Features an interest rate that can fluctuate based on market conditions, potentially resulting in lower initial rates but higher risk.

- Government-insured loans: Programs such as FHA, VA, and USDA loans offer benefits like lower down payment requirements and more lenient credit score criteria.

Financial Preparation

When applying for a mortgage, it’s crucial to have your finances in order. Lenders will require various financial documents to assess your eligibility and determine the loan amount you can afford. Additionally, factors like debt-to-income ratio and credit score play a significant role in the approval process.

Required Financial Documents

Before applying for a mortgage, gather the following documents:

- Recent pay stubs

- W-2 forms

- Tax returns for the past two years

- Bank statements

- Proof of additional income

- Proof of assets

- Identification documents

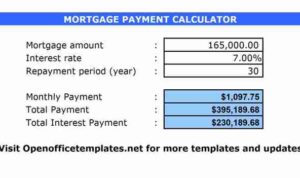

Calculating Maximum Mortgage Amount

To determine the maximum mortgage amount you can afford, consider factors like your income, expenses, and down payment. Use this formula:

Mortgage Amount = (Gross Income x Debt-to-Income Ratio) – Monthly Debt Payments

Debt-to-Income Ratio Importance

Your debt-to-income ratio is a key factor in mortgage approval. Lenders prefer a ratio below 43%. To calculate it, use this formula:

Debt-to-Income Ratio = (Total Monthly Debt Payments / Gross Monthly Income) x 100

Improving Credit Score

Before applying for a mortgage, work on improving your credit score:

- Check your credit report for errors

- Pay bills on time

- Reduce credit card balances

- Avoid opening new credit accounts

- Keep old accounts open

Choosing the Right Lender

When it comes to applying for a mortgage, choosing the right lender is crucial for a smooth and successful process. Here’s what you need to know.

Compare Different Types of Lenders

- There are various types of lenders you can consider, including banks, credit unions, and online lenders.

- Each type of lender has its own advantages and disadvantages, so it’s important to research and compare them.

Shopping Around for the Best Mortgage Rates

- Don’t settle for the first mortgage rate you come across. Shop around and compare rates from different lenders.

- Even a small difference in interest rates can lead to significant savings over the life of your loan.

The Pre-Approval Process

- Getting pre-approved for a mortgage can give you a clear picture of how much you can borrow and what you can afford.

- It also shows sellers that you are a serious buyer, giving you an edge in a competitive market.

Evaluating and Selecting the Right Lender

- Consider factors such as interest rates, fees, customer service, and reputation when evaluating lenders.

- Read reviews, ask for recommendations, and don’t hesitate to ask questions before making your decision.

The Mortgage Application Process

When it comes to applying for a mortgage, there are several important steps to keep in mind. From gathering all necessary documents to working with a mortgage broker, the process can seem overwhelming at first. However, with the right guidance and preparation, you can navigate through it smoothly.

Steps Involved in the Mortgage Application Process

- 1. Pre-Approval: This is the initial step where you get a pre-approval from a lender to determine how much you can borrow.

- 2. Application: You will need to fill out a detailed application form with information about your finances, employment, and the property you wish to purchase.

- 3. Documentation: Gather all necessary documents such as pay stubs, tax returns, bank statements, and proof of assets to submit with your application.

- 4. Appraisal and Underwriting: The lender will order an appraisal of the property and review all your documents to make a decision on your application.

- 5. Approval and Closing: If everything checks out, you will receive final approval, sign the necessary paperwork, and close on your mortgage.

Timeline for a Typical Mortgage Application

On average, the mortgage application process can take anywhere from 30 to 45 days from start to finish. However, this timeline can vary depending on various factors such as the complexity of your financial situation, the lender’s workload, and the current housing market conditions.

Role of a Mortgage Broker

- A mortgage broker acts as an intermediary between you and potential lenders, helping you find the best mortgage product for your specific needs.

- They can save you time by shopping around for the best rates and terms, and they can also provide valuable advice and guidance throughout the application process.

Common Challenges Faced During the Mortgage Application Process and How to Overcome Them

- 1. Poor Credit Score: Work on improving your credit score before applying by paying off debts and ensuring all your payments are made on time.

- 2. Insufficient Income: Consider finding a co-signer or looking for ways to increase your income through a second job or side hustle.

- 3. High Debt-to-Income Ratio: Paying down your debts or consolidating them into a single loan can help lower your debt-to-income ratio.

- 4. Documentation Delays: Stay organized and keep all your documents in one place to avoid delays in the application process.