Payday loan alternatives set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As we delve into the world of alternative financial options, we uncover a treasure trove of possibilities that can pave the way to a brighter financial future.

With a focus on personal loans, credit union loans, and peer-to-peer lending, this guide will equip you with the knowledge needed to make informed decisions about your financial well-being. Say goodbye to the pitfalls of payday loans and hello to a world of alternatives that can lead you towards financial freedom.

Payday Loan Alternatives

When faced with a financial emergency, many individuals turn to payday loans as a quick solution. However, these loans often come with high interest rates and fees that can trap borrowers in a cycle of debt. Fortunately, there are alternative options to payday loans that can help individuals in need without the same risks.

One alternative to payday loans is a personal installment loan from a credit union or online lender. These loans typically have lower interest rates and more flexible repayment terms than payday loans.

Another option is to borrow from friends or family members who may be willing to help in times of need. While this option may not be available to everyone, it can be a more affordable and less risky way to borrow money.

Additionally, individuals can explore borrowing from their employer through a salary advance or utilizing a credit card cash advance. These options may also come with lower interest rates and fees compared to payday loans.

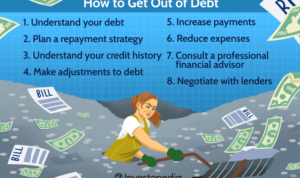

It’s important to weigh the risks associated with payday loans, such as high interest rates, short repayment terms, and potential for debt traps, against the benefits of opting for these alternative options. By considering these alternatives, individuals can make more informed decisions when faced with a financial crisis.

Risks Associated with Payday Loans

- High interest rates that can exceed 400% APR

- Short repayment terms often leading to rollovers and additional fees

- Potential for getting trapped in a cycle of debt

Benefits of Opting for Alternatives

- Lower interest rates and fees

- More flexible repayment terms

- Less risk of falling into a debt trap

Comparison of Interest Rates

| Loan Type | Interest Rate |

|---|---|

| Payday Loan | 400% APR |

| Personal Installment Loan | 10-36% APR |

| Credit Card Cash Advance | 25-30% APR |

Personal Loans

Personal loans are a type of loan that can be used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. Unlike payday loans, personal loans typically have lower interest rates and longer repayment terms.

How Personal Loans Work

- Personal loans are usually unsecured, meaning you don’t need to provide collateral to qualify.

- Lenders determine your eligibility based on factors like your credit score, income, and debt-to-income ratio.

- Once approved, you receive a lump sum that you repay in fixed monthly installments over a predetermined period.

Eligibility Criteria

- Good to excellent credit score

- Stable income and employment history

- Low debt-to-income ratio

Advantages of Personal Loans

- Lower interest rates compared to payday loans

- Flexible repayment terms

- Potential to borrow larger amounts

Disadvantages of Personal Loans

- May require a good credit score to qualify

- Longer application and approval process compared to payday loans

- Risk of accumulating more debt if not managed properly

Comparison with Payday Loans

| Aspect | Personal Loans | Payday Loans |

|---|---|---|

| Interest Rates | Lower | Higher |

| Repayment Terms | Longer | Shorter |

| Application Process | More extensive | Quick and simple |

Credit Union Loans

Credit union loans are financial products offered by credit unions, which are member-owned financial cooperatives. These loans differ from traditional bank loans as credit unions are non-profit organizations that typically offer lower interest rates and fees compared to banks.

Eligibility Requirements

To obtain a credit union loan, individuals usually need to become a member of the credit union by meeting specific criteria such as residency, employment, or affiliation with certain organizations. Membership requirements vary by credit union, but generally, they are more flexible than those of traditional banks.

Interest Rates and Fees

Credit union loans often have lower interest rates and fees compared to payday loans. The interest rates are typically fixed and are based on the borrower’s creditworthiness. Credit unions also tend to have more favorable terms and repayment options, making them a more affordable borrowing option.

Benefits of Borrowing from a Credit Union

– Lower interest rates and fees

– More flexible eligibility requirements

– Personalized customer service

– Access to other financial products and services

– Ability to build credit history and improve credit score

Peer-to-Peer Lending

Peer-to-peer lending, often referred to as P2P lending, is a method of borrowing and lending money without the use of a traditional financial institution. Instead, individuals can lend money directly to other individuals through online platforms. This form of lending cuts out the middleman and can offer borrowers more favorable terms than traditional loans.

Risks and Benefits of Peer-to-Peer Lending

- Benefits:

- Lower interest rates: Peer-to-peer lending platforms often offer lower interest rates compared to payday loans, making it a more affordable option for borrowing money.

- Flexible repayment terms: Borrowers may find more flexible repayment terms with peer-to-peer lending, allowing them to tailor the loan to their financial situation.

- Risks:

- Less regulation: Peer-to-peer lending is not as heavily regulated as traditional loans, which could lead to potential risks for both borrowers and lenders.

- Default risk: There is a risk of borrowers defaulting on their loans, which could result in financial losses for lenders.

Popular Peer-to-Peer Lending Platforms

- Lending Club: One of the largest peer-to-peer lending platforms, connecting investors with borrowers for personal loans, business loans, and more.

- Prosper: Another well-known platform that allows individuals to borrow and lend money directly without going through a bank.

- Upstart: Known for using artificial intelligence to assess borrower risk, offering competitive rates for personal loans.

Interest Rates and Repayment Terms

- Interest Rates:

Peer-to-peer lending platforms typically offer interest rates ranging from 6% to 36%, depending on the borrower’s creditworthiness and the loan amount.

- Repayment Terms:

Repayment terms for peer-to-peer loans can vary but generally range from 3 to 5 years, giving borrowers a longer period to repay their loans compared to payday loans.