Kicking off with Annuities explained, this opening paragraph is designed to captivate and engage the readers, setting the tone american high school hip style that unfolds with each word.

As we dive into the world of finance, annuities play a crucial role in shaping one’s financial future. Understanding the different types, how they work, and their benefits is essential for anyone looking to secure their financial well-being.

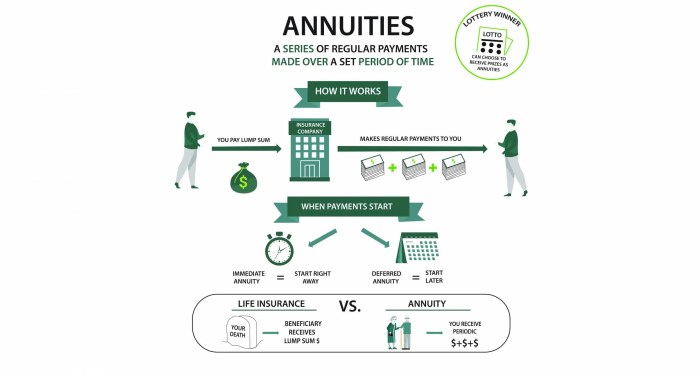

Annuities Overview

Annuities are financial products that provide a steady stream of income over a period of time, commonly used for retirement planning. They are typically purchased from insurance companies and can offer tax-deferred growth on investments.

Types of Annuities

- Fixed Annuities: These offer a guaranteed interest rate for a specific period, providing a stable income stream.

- Variable Annuities: These allow the investor to choose from a selection of investment options, with returns tied to the performance of those investments.

- Immediate Annuities: These start paying out immediately after a lump sum payment is made, providing an instant income stream.

Purpose of Annuities in Financial Planning

Annuities play a crucial role in financial planning by ensuring a steady income stream during retirement. They can help individuals manage their savings effectively and provide a source of income that is guaranteed for life. By diversifying income sources, annuities offer a level of security and stability in retirement planning.

How Annuities Work

Annuities function as an investment vehicle where individuals make a lump-sum payment or series of payments to an insurance company. In return, the insurance company provides regular disbursements, either immediately or at a future date.

Benefits of Investing in Annuities

- Guaranteed income stream: Annuities offer a reliable source of income, especially during retirement.

- Tax-deferred growth: Earnings on annuities grow tax-free until withdrawals are made.

- Flexible payment options: Investors can choose between immediate or deferred annuities to suit their financial goals.

Drawbacks of Investing in Annuities

- High fees: Annuities often come with high fees and charges that can eat into returns.

- Lack of liquidity: Some annuities have restrictions on withdrawals, limiting access to funds.

- Complexity: Understanding the different types of annuities and their features can be challenging for some investors.

Importance of Annuitization

Annuitization is the process of converting the accumulated value of an annuity into a series of regular payments. This step is crucial as it ensures a steady income stream for the annuitant, especially during retirement. By annuitizing, individuals can protect themselves from outliving their savings and have a predictable source of income for their future expenses.

Types of Annuities

When it comes to annuities, there are three main types to consider: fixed, variable, and indexed annuities. Each type comes with its own set of features and potential risks, catering to different financial goals and risk tolerance levels.

Fixed Annuities

Fixed annuities offer a guaranteed payout over a specific period, providing a stable income stream for the annuitant. The interest rate is set at the time of purchase and remains fixed throughout the contract. While this type offers stability, it may not keep up with inflation, potentially reducing the purchasing power of the payments over time.

Variable Annuities

Variable annuities allow the annuitant to invest in sub-accounts, typically consisting of mutual funds. The payout amount fluctuates depending on the performance of the underlying investments. This type offers the potential for higher returns but also comes with greater risk due to market volatility.

Indexed Annuities

Indexed annuities provide returns based on the performance of a specific market index, such as the S&P 500. They offer a balance between fixed and variable annuities, providing a minimum guaranteed return while allowing for potential growth linked to the index performance. However, there may be caps or limits on the returns earned.

It’s essential to consider your financial goals, risk tolerance, and time horizon when choosing the right type of annuity. Fixed annuities are suitable for those seeking stability, variable annuities for growth-oriented investors willing to take on more risk, and indexed annuities for a mix of guaranteed income and market-linked returns.

Annuities vs. Other Investment Options

When it comes to investing your hard-earned money, you have various options to choose from. One common dilemma is deciding between annuities and other traditional investment vehicles like stocks and bonds. Let’s break down the key differences to help you make an informed decision.

Risk and Return Comparison

- Annuities: Annuities are generally considered to be lower risk investments compared to stocks. They offer a guaranteed income stream, which can provide a sense of security for some investors. However, this comes at the cost of potentially lower returns compared to stocks.

- Stocks: Stocks are known for their higher potential returns but also come with higher risk. The stock market can be volatile, leading to fluctuations in the value of your investment.

- Bonds: Bonds are typically considered safer than stocks but riskier than annuities. They offer a fixed income stream, making them a more stable investment option.

Tax Implications

- Annuities: One of the key benefits of investing in annuities is their tax-deferred growth. This means you don’t have to pay taxes on your earnings until you start withdrawing funds. However, withdrawals may be subject to ordinary income tax and potential penalties if taken before a certain age.

- Stocks and Bonds: Both stocks and bonds are subject to capital gains taxes. This means you may have to pay taxes on any profits you make when selling your investments. Dividend income from stocks is also taxable in the year it is received.

Annuity Fees and Charges

When investing in annuities, it’s crucial to understand the various fees and charges that may be associated with them. These costs can significantly impact the overall performance and returns of your annuity investment. Let’s dive into some common fees and charges and how they can affect your annuity.

Common Fees Associated with Annuities

- Surrender Charges: These fees are incurred if you withdraw funds from your annuity before a specific period, typically within the first few years of the contract.

- Management Fees: Charged by the insurance company for managing your annuity investments, these fees are usually a percentage of your account value.

- Mortality and Expense Risk Fees (M&E): These fees cover the insurance and administrative costs associated with the annuity contract.

- Administrative Fees: These fees are charged for the administrative tasks related to your annuity, such as processing paperwork and maintaining account records.

Impact of Fees on Annuity Performance

These fees can eat into your investment returns over time, reducing the overall growth of your annuity. High fees can significantly diminish your earnings and hinder the potential benefits of investing in an annuity.

Tips to Minimize Fees

- Compare Different Annuity Options: Look for annuities with lower fees and charges to maximize your returns.

- Avoid Excessive Trading: Frequent buying and selling of investments within your annuity can lead to higher fees. Stick to a long-term investment strategy.

- Consider Fee Structures: Understand how fees are calculated in different types of annuities and choose the one that aligns with your investment goals.

Annuity Payout Options

When it comes to annuities, understanding the payout options is crucial for maximizing the benefits of your investment. Different payout options offer flexibility and cater to various financial goals. Let’s dive into the details of the various annuity payout options available to you.

Lump-Sum Payment

- A lump-sum payment option allows you to receive the full amount of your annuity in one payment.

- This option is ideal for individuals who want immediate access to a large sum of money for a specific purpose, such as a major purchase or investment.

- Keep in mind that taking a lump sum may have tax implications, so it’s important to consult with a financial advisor before making a decision.

Periodic Payments

- Periodic payments involve receiving regular, scheduled payments from your annuity over a specific period of time.

- This option provides a steady income stream, making it suitable for retirees looking for a reliable source of income.

- You can choose the frequency of payments, whether monthly, quarterly, or annually, based on your financial needs.

Annuitization

- Annuitization is the process of converting your annuity into a stream of income payments for a set period or for the rest of your life.

- This option offers guaranteed income for the long term, providing financial security during retirement.

- With annuitization, you can choose between a fixed period certain annuity or a life annuity, depending on your preferences and financial goals.