With Building a diversified investment portfolio at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

Diving into the world of investment, we explore the art of diversification and how it can shape your financial future. From managing risk to maximizing returns, we uncover the key strategies and types of investments that can elevate your portfolio to the next level.

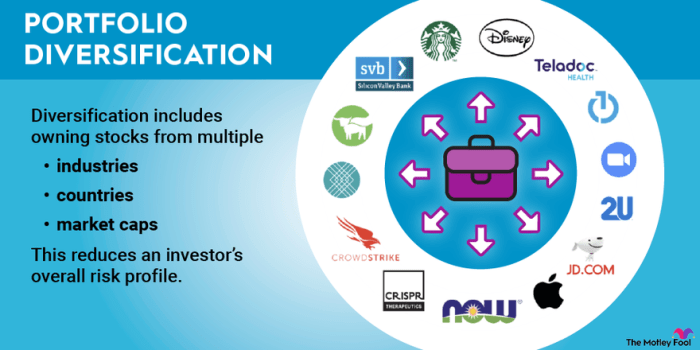

Importance of Diversification

Diversification is a crucial strategy when building an investment portfolio as it helps in managing risk and maximizing returns. By spreading investments across different asset classes, investors can reduce the impact of volatility in any single asset on the overall portfolio.

Managing Risk

Diversification helps in managing risk by reducing the potential impact of a decline in any particular asset or sector. For example, if one industry experiences a downturn, having investments in other sectors can help mitigate losses and stabilize the overall portfolio.

- Different asset classes such as stocks, bonds, real estate, commodities, and cash equivalents can be included in a diversified portfolio to spread risk.

- International investments can also be considered to further diversify geographically and reduce exposure to any single country’s economic performance.

Maximizing Returns

Diversification can also help in maximizing returns by capturing the performance of different asset classes that may perform well at different times. For instance, while stocks may offer high returns during periods of economic growth, bonds can provide stability during market downturns.

- Including growth assets like stocks and real estate alongside income-generating assets such as bonds and dividend-paying stocks can help achieve a balance between risk and return.

- Alternative investments like hedge funds, private equity, and venture capital can also be considered for diversification, offering exposure to unique opportunities not available in traditional asset classes.

Types of Investments for Diversification

When building a diversified investment portfolio, it is essential to consider different types of investments to spread out risk and maximize returns. Let’s explore various investment options and how they can contribute to a well-rounded portfolio.

Stocks

Stocks represent ownership in a company and can offer high returns but also come with high volatility. They are suitable for investors seeking growth and willing to take on more risk in exchange for potentially higher rewards.

Bonds

Bonds are debt securities issued by governments or corporations. They provide a steady stream of income through interest payments and are generally considered less risky than stocks. Bonds are ideal for investors looking for a more conservative option with lower volatility.

Real Estate

Investing in real estate involves purchasing properties to generate rental income or capital appreciation. Real estate investments can provide diversification by offering returns that are not closely correlated with traditional markets like stocks and bonds.

Commodities

Commodities like gold, silver, oil, and agricultural products can act as a hedge against inflation and currency fluctuations. Including commodities in a portfolio can help reduce overall risk and provide a source of diversification.

Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum have gained popularity as alternative investments with the potential for high returns. However, they also come with high volatility and regulatory risks. Adding cryptocurrencies to a portfolio can introduce a new asset class and diversify risk exposure.

Strategies for Building a Diversified Portfolio

Building a diversified investment portfolio involves implementing various strategies to minimize risk and maximize returns. One of the key strategies is asset allocation, which involves spreading your investments across different asset classes like stocks, bonds, real estate, and commodities. Another important strategy is rebalancing, which involves periodically adjusting your portfolio to maintain the desired asset allocation.

Correlation Among Assets and Its Impact on Diversification

Correlation refers to the degree to which the price movements of two assets are related. Understanding correlation among assets is crucial for diversification because it helps in determining how effectively different assets can offset each other’s risks. Assets with low or negative correlation can provide better diversification benefits as they tend to move in opposite directions.

Step-by-Step Guide to Constructing a Diversified Investment Portfolio

Constructing a diversified investment portfolio requires careful planning and consideration. Here is a step-by-step guide to help you build a well-diversified portfolio:

- Evaluate Your Risk Tolerance: Determine your risk tolerance level based on your financial goals, time horizon, and comfort with market fluctuations.

- Set Your Investment Goals: Define your investment objectives, whether it’s long-term growth, income generation, or capital preservation.

- Choose Asset Classes: Select a mix of asset classes based on your risk tolerance and investment goals, including stocks, bonds, real estate, and alternative investments.

- Select Investments within Each Asset Class: Diversify within each asset class by choosing different types of investments, such as large-cap stocks, small-cap stocks, government bonds, corporate bonds, and REITs.

- Monitor and Rebalance: Regularly review your portfolio’s performance and make adjustments to rebalance your asset allocation if it deviates from your target percentages.

Risk Management in Diversified Portfolios

When it comes to building a diversified investment portfolio, risk management plays a crucial role in protecting your investments from potential losses. One key risk management technique used in diversified portfolios is hedging, which involves offsetting potential losses in one asset by investing in another asset that moves in the opposite direction.

Role of Hedging in a Diversified Portfolio

- Hedging helps reduce the overall risk exposure of a portfolio by balancing out losses in one asset with gains in another.

- For example, if you hold stocks in a company that is sensitive to changes in oil prices, you can hedge your risk by investing in oil futures to offset potential losses.

- By hedging, investors can protect themselves from unexpected market events and minimize the impact of negative price movements on their portfolio.

Assessing and Managing Risks Across Asset Classes

- Each asset class comes with its own set of risks, such as market risk, inflation risk, and credit risk.

- Investors need to assess the risk associated with each asset class in their portfolio and allocate their investments accordingly.

- Diversification across different asset classes, such as stocks, bonds, real estate, and commodities, can help spread out risk and reduce overall portfolio volatility.

Mitigating Specific Investment Risks through Diversification

- Diversification can mitigate specific risks, such as company-specific risk, sector risk, and geographic risk.

- For example, by investing in a mix of companies across various industries and regions, investors can reduce the impact of a negative event on a single company or sector.

- Similarly, diversifying into different asset classes can help protect against fluctuations in any single market or sector.