Imagine taking control of your finances with a personal budget as your trusty tool. This guide will walk you through the ins and outs of creating a budget, shedding light on the path to financial empowerment.

From understanding the basics to managing debt and savings, this journey will equip you with the knowledge to make informed financial decisions.

Understanding Personal Budgeting

A personal budget is a financial plan that Artikels an individual’s income and expenses over a specific period. It is crucial for managing money effectively and achieving financial goals.

Creating a personal budget offers several benefits, including:

Benefits of Personal Budgeting

- Helps track spending habits and identify areas for saving

- Allows for better decision-making regarding financial priorities

- Aids in avoiding debt and building savings for emergencies or future plans

Financial stability is closely linked to personal budgeting. By carefully monitoring income and expenses, individuals can maintain control over their finances, reduce financial stress, and work towards long-term financial security.

Setting Financial Goals

Setting financial goals is crucial when creating a personal budget. It helps individuals establish a roadmap for their financial future, whether it be short-term or long-term goals.

Short-term Financial Goals

Short-term financial goals typically involve achieving objectives within a year or less. These goals are essential for immediate financial stability and can include:

- Building an emergency fund

- Paying off credit card debt

- Saving for a vacation

Long-term Financial Goals

Long-term financial goals are focused on achieving objectives over an extended period, usually more than a year. Examples of long-term financial goals include:

- Buying a home

- Saving for retirement

- Investing in education

Role of Financial Goals in Budgeting

Financial goals play a significant role in creating a personal budget by providing a clear direction for how money should be managed and allocated. They help individuals prioritize their spending, savings, and investments to work towards achieving their desired financial outcomes.

Tracking Income and Expenses

When it comes to creating a personal budget, tracking your income and expenses is crucial for financial success. By accurately recording your sources of income and where your money is going, you can gain a better understanding of your financial habits and make informed decisions to reach your financial goals.

Methods for Tracking Income Sources

- Keep detailed records of all sources of income, including paychecks, side hustles, rental income, and any other money coming in.

- Utilize budgeting apps or software that automatically track your income from various sources and categorize them for easy analysis.

- Set up direct deposit for your income to ensure a consistent and reliable flow of money into your accounts.

Ways to Track Expenses Effectively

- Maintain a spending journal or use budgeting apps to track every expense, no matter how small, to get a clear picture of where your money is going.

- Categorize your expenses, such as housing, groceries, transportation, entertainment, and utilities, to identify areas where you can cut back or optimize spending.

- Review your bank and credit card statements regularly to catch any discrepancies or unauthorized charges that may affect your budget.

The Importance of Accurately Recording Income and Expenses

Accurately recording your income and expenses is essential for creating a realistic budget that aligns with your financial goals. By tracking where your money comes from and where it goes, you can identify spending patterns, set priorities, and make adjustments to ensure you are living within your means and saving for the future.

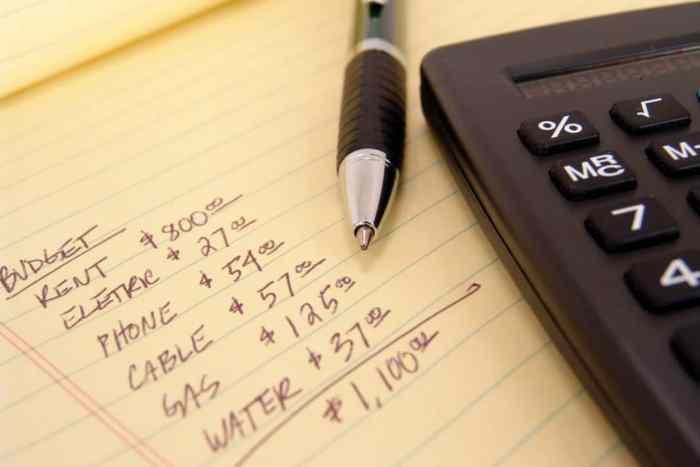

Creating a Budget Plan

Creating a budget plan is crucial for managing your finances effectively. It allows you to track your income and expenses, helping you stay on top of your financial goals.

Steps to Create a Monthly Budget Plan

- List all sources of income: Write down all sources of income, including salaries, side hustles, or any additional income streams.

- Track your expenses: Keep a record of all your expenses, such as bills, groceries, entertainment, and other purchases.

- Categorize your expenses: Divide your expenses into categories like housing, transportation, utilities, and entertainment.

- Set financial goals: Determine your short-term and long-term financial goals to help guide your budget plan.

- Create a budget: Based on your income and expenses, allocate a specific amount to each category, ensuring you prioritize essential expenses.

Tips for Categorizing Expenses in a Budget

- Use broad categories: Start by categorizing expenses into broader categories like fixed expenses (rent, utilities) and variable expenses (groceries, entertainment).

- Be specific: Within each broad category, break down expenses into specific items to get a more detailed view of where your money is going.

- Review regularly: Update your expense categories regularly to reflect any changes in your spending habits or financial situation.

How to Allocate Income to Different Expense Categories

- Determine priority expenses: Allocate a portion of your income to essential expenses like rent, utilities, groceries, and debt payments.

- Set aside savings: Prioritize saving by allocating a percentage of your income to a savings category to build an emergency fund or work towards your financial goals.

- Allocate for discretionary spending: After covering essential expenses and savings, allocate a portion of your income to discretionary spending categories like entertainment or dining out.

- Adjust as needed: Be flexible with your allocations and adjust them as necessary to ensure you stay within your budget and meet your financial goals.

Managing Debt and Savings

When it comes to managing debt and savings within a personal budget, it’s crucial to find a balance that ensures financial stability and growth. Debt can be a burden, but with the right strategies, you can work towards paying it off while still setting aside money for savings.

Strategies for Managing Debt

- Start by identifying all your debts, including credit card balances, loans, and any other outstanding payments.

- Consider prioritizing high-interest debts first to minimize the amount you pay in interest over time.

- Explore debt consolidation options to combine multiple debts into one lower-interest payment.

- Try negotiating with creditors for lower interest rates or payment plans that better suit your budget.

- Avoid accumulating more debt by practicing responsible spending habits and creating a budget that accounts for debt repayment.

The Importance of Including Savings

Including savings in your budget plan is essential for building financial security and preparing for unexpected expenses or future goals. Saving regularly can help you avoid falling back into debt when emergencies arise and ensure you have funds for long-term plans, such as retirement or major purchases.

Tips for Balancing Debt Repayment and Savings Goals

- Allocate a portion of your income towards both debt repayment and savings each month to make progress in both areas.

- Set specific savings goals, such as creating an emergency fund or saving for a down payment, to stay motivated and track your progress.

- Adjust your budget as needed to accommodate changing financial circumstances and prioritize debt repayment or savings based on your current needs.

- Consider automating your savings contributions to ensure consistency and make it easier to stick to your savings goals.

- Seek advice from financial professionals or credit counselors if you’re struggling to manage debt and savings effectively within your budget.

Reviewing and Adjusting the Budget

Regularly reviewing and adjusting your personal budget is crucial to ensure financial stability and progress towards your financial goals. By staying on top of your budget, you can make necessary changes to accommodate any financial fluctuations or unexpected expenses that may arise.

Methods for Adjusting the Budget Based on Financial Changes

- Track your expenses diligently to identify any areas where you may be overspending or where you can cut back.

- Reassess your financial goals periodically and adjust your budget to align with any changes in your priorities or circumstances.

- Consider increasing your savings contributions or debt payments when you have extra income to accelerate your financial progress.

- Be prepared to reallocate funds from one budget category to another as needed to address changing financial needs.

Importance of Flexibility in Budgeting for Unforeseen Circumstances

Having flexibility in your budget allows you to adapt to unexpected events or emergencies without derailing your financial plans. By building a buffer in your budget for unforeseen circumstances, you can maintain financial stability and avoid going into debt to cover unexpected expenses.