Impact of credit scores on loans sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Dive into the world of credit scores and loans with a fresh perspective that will keep you engaged throughout.

Exploring the connection between credit scores and loan approval opens up a world of financial possibilities and challenges. Let’s delve deeper into how credit scores wield their influence in the realm of loans.

Importance of Credit Scores

Having a good credit score is crucial when applying for loans as it greatly impacts the approval process and terms of the loan. Lenders use credit scores to assess the borrower’s creditworthiness and ability to repay the loan.

Credit Scores and Loan Approvals

When you have a high credit score, lenders are more likely to approve your loan application. A good credit score shows that you have a history of responsibly managing credit and are less risky to lend to. On the other hand, a low credit score can lead to loan rejection as it indicates a higher risk of defaulting on payments.

Impact on Interest Rates

- Lenders often offer lower interest rates to borrowers with high credit scores. This is because they are seen as less of a risk and more likely to repay the loan on time. On the contrary, borrowers with low credit scores may be charged higher interest rates to compensate for the increased risk of default.

- For example, a borrower with a credit score above 750 may qualify for a mortgage with an interest rate of 3%, while a borrower with a credit score below 600 may end up paying 6% or more for the same loan.

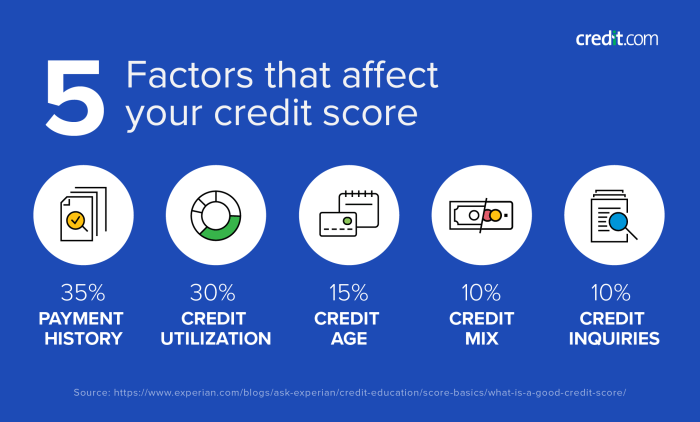

Factors Influencing Credit Scores

Maintaining a good credit score is crucial for financial health and stability. Several key factors play a significant role in determining an individual’s credit score.

Payment History

Your payment history is one of the most important factors influencing your credit score. Making timely payments on loans, credit cards, and other bills demonstrates financial responsibility and positively impacts your credit score. On the other hand, missing payments or making late payments can lower your score significantly.

Credit Utilization

Credit utilization refers to the amount of credit you are using compared to the total amount of credit available to you. Keeping your credit utilization low, ideally below 30%, shows that you are not overly reliant on credit and can manage your finances responsibly. High credit utilization can signal financial distress and negatively impact your credit score.

Types of Loans Affected by Credit Scores

In the world of lending, credit scores play a crucial role in determining the terms and conditions of various types of loans. Let’s explore the different types of loans where credit scores have a significant impact.

Mortgage Loans vs. Personal Loans

When it comes to mortgage loans, credit scores are a key factor in determining the interest rate and loan amount that a borrower may qualify for. Lenders typically offer lower interest rates to borrowers with higher credit scores, as they are seen as less risky. On the other hand, personal loans are usually unsecured and may have higher interest rates for borrowers with lower credit scores.

- Example 1: Mortgage Loan Application

John applies for a mortgage to buy a new home. His credit score is 750, which is considered excellent. As a result, he is offered a lower interest rate and a higher loan amount by the lender.

- Example 2: Personal Loan Application

Sarah needs a personal loan to cover some unexpected medical expenses. Her credit score is 600, which is on the lower end. Due to her credit score, she is offered a personal loan with a higher interest rate compared to someone with a higher credit score.

Strategies to Improve Credit Scores for Loan Approval

Improving your credit score is essential for getting approved for loans with favorable terms and interest rates. Here are some practical steps individuals can take to boost their credit scores:

Monitor Credit Reports Regularly

It’s crucial to check your credit report regularly to look for any inaccuracies or errors that could be dragging down your score. Dispute any incorrect information with the credit bureaus to ensure your report is accurate.

Pay Bills on Time

One of the most impactful ways to improve your credit score is by making timely payments on all your bills, including credit card payments, loans, and utilities. Set up automatic payments or reminders to avoid missing due dates.

Reduce Credit Card Balances

High credit card balances can negatively affect your credit score. Aim to keep your credit utilization ratio below 30% by paying down balances and avoiding maxing out your credit cards.

Limit New Credit Applications

Applying for multiple new credit accounts within a short period can hurt your score. Only apply for credit when necessary and space out applications to minimize the impact on your credit score.

Diversify Credit Mix

Having a mix of different types of credit accounts, such as credit cards, auto loans, and mortgages, can demonstrate responsible credit management. However, only take on new credit if you can manage it responsibly.