As 529 college savings plans take the spotlight, get ready to dive into a world where financial smarts meet higher education dreams. This ain’t your average savings plan discussion – it’s a guide to securing your future with style.

Let’s break down everything you need to know about 529 college savings plans, from tax advantages to investment options, in a way that’s as cool as the other side of the pillow.

What are 529 college savings plans?

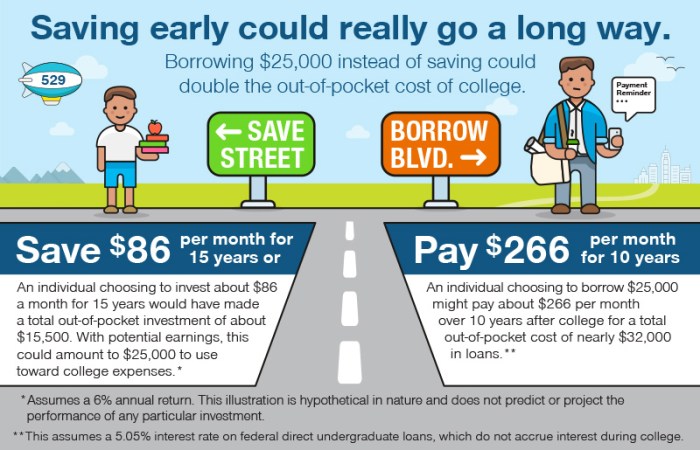

529 college savings plans are tax-advantaged investment accounts designed to help families save for future education expenses. These plans offer a range of benefits, including potential tax breaks and flexibility in fund usage.

Purpose and Benefits of 529 Plans

529 plans are specifically created to save for higher education costs, such as tuition, fees, books, and room and board. They offer tax advantages, including tax-free growth and withdrawals for qualified education expenses. Additionally, some states provide tax deductions or credits for contributions made to 529 plans.

Types of Expenses Covered by 529 Plans

Expenses covered by 529 plans typically include tuition and fees at eligible institutions, as well as expenses for books, supplies, and equipment required for enrollment. Room and board costs for students attending at least half-time are also considered qualified expenses.

Differences from Other Savings Options

529 plans differ from traditional savings accounts in that they are specifically earmarked for education expenses and offer tax advantages that traditional accounts do not. While traditional savings accounts may provide more flexibility in fund usage, they do not offer the same tax benefits for education savings.

Tax advantages of 529 college savings plans

When it comes to saving for college, 529 plans offer some pretty sweet tax benefits that can help you grow your savings faster. Let’s dive into the details of how these plans can give you a financial edge.

Tax Benefits of Contributing to a 529 Plan

- Contributions to a 529 plan are made with after-tax dollars, meaning you don’t get a federal tax deduction for your contributions. However, some states offer tax deductions or credits for contributions to their own state’s plan.

- The real magic happens with the investment growth in a 529 plan. Earnings on your contributions grow tax-deferred, and as long as you use the money for qualified education expenses, you won’t owe any federal income tax on the withdrawals.

- Additionally, some states offer tax-free withdrawals for qualified education expenses, meaning you can potentially avoid state income taxes on your earnings as well.

Comparison with Other Investment Options

- Unlike other investment accounts, such as a regular brokerage account, the earnings in a 529 plan are not subject to capital gains taxes as long as the money is used for qualified education expenses.

- Traditional IRAs and Roth IRAs have different tax implications compared to 529 plans. While IRAs offer tax benefits for retirement savings, 529 plans are specifically designed for education expenses and offer unique tax advantages in that context.

Tax-Free Withdrawals for Qualified Education Expenses

- Qualified education expenses include tuition, fees, books, supplies, and certain room and board costs at eligible institutions. When you make withdrawals from a 529 plan to cover these expenses, you won’t owe any federal income tax on the earnings.

- It’s important to keep receipts and documentation of your qualified expenses to ensure you’re using the funds appropriately and can provide proof if needed.

Contribution limits and rules

When it comes to contributing to a 529 college savings plan, there are specific limits and rules that you need to be aware of to make the most out of your investment. Let’s break down the key details for you.

Maximum Contribution Limits

In general, 529 plans have high maximum contribution limits that can vary by state. These limits can range from $235,000 to over $500,000 per beneficiary, depending on the plan. It’s essential to check with your specific plan to determine the exact limit.

Restrictions and Eligibility Criteria

While there are no income restrictions for contributors to 529 plans, there are some eligibility criteria to keep in mind. The contributor must be a U.S. citizen or resident alien and must have a valid Social Security number or taxpayer identification number.

Contributions Management and Distribution

Contributions to a 529 plan are typically managed by the plan administrator, who invests the funds on behalf of the account owner. The distributions are then made to cover qualified education expenses, such as tuition, fees, books, and room and board. It’s crucial to keep track of these expenses to ensure they meet the criteria for tax-free withdrawals.

Overall, understanding the contribution limits and rules of a 529 plan is essential for maximizing the benefits and savings for your loved one’s future education. Make sure to consult with a financial advisor or the plan administrator to get personalized advice based on your specific situation.

Investment options within 529 plans

When it comes to investing in a 529 college savings plan, there are various options available to help grow your savings for education expenses. Each option comes with its own level of risk and potential return on investment.

Types of Investment Options

- Age-Based Portfolios: These portfolios automatically adjust the investment mix to become more conservative as the beneficiary approaches college age.

- Static Portfolios: These portfolios maintain a fixed investment mix, allowing you to choose a specific risk level based on your preferences.

- Individual Investment Options: These options allow you to select specific mutual funds or other investments to build your own portfolio.

Risk Levels and Impact on Savings

- Age-based portfolios typically start with a higher allocation to stocks, which carry more risk but also have the potential for higher returns.

- Static portfolios offer more control over the risk level, with conservative options focusing more on bonds and cash equivalents.

- Individual investment options give you the most control over risk, as the risk level will depend on the specific investments chosen.

It’s important to consider your risk tolerance and investment timeline when choosing the right option for your 529 plan.

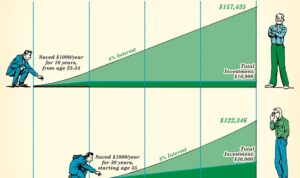

Impact of Investment Performance

- Positive investment performance can significantly increase the overall savings within a 529 plan, allowing your funds to grow faster and cover more education expenses.

- Conversely, poor investment performance can hinder the growth of your savings and may not keep pace with rising college costs.

- Regularly monitoring and adjusting your investment choices can help maximize the potential growth of your 529 plan savings.

Flexibility and portability of 529 plans

When it comes to 529 college savings plans, flexibility and portability are key features that provide peace of mind to account holders.

Using 529 plan funds for different educational institutions

- 529 plan funds can typically be used at any eligible educational institution, including universities, colleges, trade schools, and even some international institutions.

- This flexibility allows beneficiaries to choose the school that best fits their academic and career goals without restrictions.

- It is important to check the specific guidelines of each 529 plan to ensure the institution is eligible for fund use.

Portability of 529 plans for non-higher education pursuits

- If the original beneficiary decides not to pursue higher education, the funds can be transferred to another eligible family member without penalty.

- Eligible family members may include siblings, cousins, parents, or even the account holder themselves if they wish to continue their education later in life.

- It is essential to follow the IRS guidelines and rules for transferring funds to avoid any tax implications.

Limitations and considerations for transferring funds between beneficiaries

- While transferring funds between beneficiaries is allowed, there may be limitations on how often these transfers can occur.

- Some 529 plans have restrictions on the number of beneficiary changes per year, so it’s crucial to be aware of these limitations.

- Additionally, transferring funds between beneficiaries may have tax implications depending on the amount and timing of the transfer.

State-specific 529 plans

When it comes to 529 college savings plans, each state offers its own unique plan with specific features and benefits. It’s important to understand how 529 plans vary by state so you can make an informed decision on which plan is best for you and your child’s future education.

In general, most states offer their own 529 plans, but some states also allow residents to invest in out-of-state plans. Here are some key points to consider when comparing in-state vs. out-of-state 529 plans:

Advantages and Disadvantages of In-State vs. Out-of-State 529 Plans

- Choosing an in-state 529 plan may offer additional state tax benefits, such as deductions or credits on contributions.

- Out-of-state 529 plans may have lower fees or better investment options, providing potentially higher returns on your investment.

- Some states offer matching grants or scholarships for residents who contribute to the in-state 529 plan, providing extra incentives for saving.

- On the other hand, out-of-state plans may offer more flexibility in terms of contribution limits or investment choices.

Unique Features of Specific State Plans

- For example, New York’s 529 College Savings Program offers a wide range of investment options and low fees, making it a popular choice for many investors.

- Virginia’s Invest529 plan allows investors to use their savings at any eligible educational institution in the country, not just in Virginia.

- California’s ScholarShare 529 plan offers a variety of professionally managed portfolios to suit different risk tolerances and investment goals.