Diving deep into the world of compound interest investments, this introduction sets the stage for an exciting exploration of how money can work for you over time. Get ready to uncover the secrets of financial growth and long-term wealth building in a way that’s fresh and relatable.

In the following section, we’ll break down the different types of compound interest investments and how they can impact your financial future.

Introduction to Compound Interest Investments

Compound interest is a powerful concept in the world of investments that allows your money to grow exponentially over time. Unlike simple interest, which is calculated only on the initial principal amount, compound interest takes into account both the principal and the accumulated interest from previous periods.

How Compound Interest Differs from Simple Interest

With compound interest, your money earns interest not only on the initial investment but also on the interest that has already been added to the principal. This compounding effect leads to faster growth of your investment compared to simple interest, where the interest is only calculated on the original amount.

Impact of Compound Interest on Investment Returns

Let’s consider an example: If you invest $1,000 at an annual interest rate of 5% compounded annually, after the first year, you would earn $50 in interest. In the second year, you would earn interest not just on your initial $1,000 but also on the $50 interest from the first year. This compounding effect continues to grow your investment exponentially over time.

Types of Compound Interest Investments

Compound interest investments come in various forms, each with its own risk levels, benefits, and drawbacks. Let’s explore the different types of investment vehicles that utilize compound interest.

Savings Accounts

Savings accounts are a popular choice for individuals looking to earn interest on their money while keeping it easily accessible. These accounts typically offer lower interest rates compared to other investment options, but they provide a safe and secure way to grow your savings. The risk level associated with savings accounts is relatively low, making them suitable for short-term goals or emergency funds.

Bonds

Bonds are debt securities issued by governments or corporations to raise capital. They offer fixed interest payments at regular intervals until maturity, at which point the principal amount is returned to the investor. Bonds can vary in risk levels depending on the issuer’s credit rating and the type of bond. While they provide a steady income stream, the risk of default and changes in interest rates can impact bond investments.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer a convenient way to access professional management and diversification, but they also come with management fees and other expenses. The risk level of mutual funds can vary based on the underlying assets and investment strategy. Long-term investors may benefit from the potential for higher returns, while short-term investors should consider the liquidity and volatility of mutual fund investments.

Factors Influencing Compound Interest Investments

Compound interest investments are influenced by several key factors that play a significant role in determining the growth and final value of your investments. Understanding these factors is crucial for making informed decisions and maximizing your returns.

Interest Rate Impact

The interest rate is a critical factor in determining the growth of your investments. A higher interest rate means that your investments will grow at a faster pace, leading to a larger final value. On the other hand, a lower interest rate will result in slower growth and a smaller final amount.

Compounding Frequency Effect

The compounding frequency refers to how often the interest is added to the principal amount. The more frequent the compounding, the higher the investment returns. For example, investments that compound quarterly will grow faster than those that compound annually, even if the interest rate is the same.

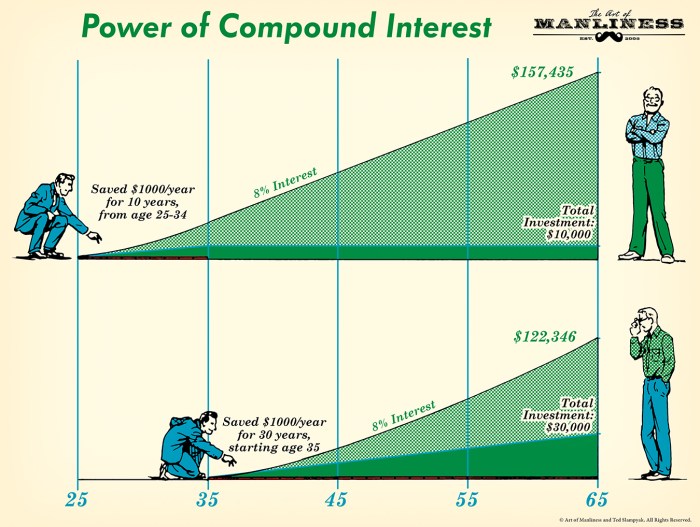

Initial Investment and Time Horizon Influence

Your initial investment amount and the time horizon play a crucial role in determining the final value of your investments. A larger initial investment will lead to higher returns, especially when combined with a longer time horizon. This is due to the compounding effect, where your earnings generate additional earnings over time.

Strategies for Maximizing Compound Interest Investments

Compound interest investments can be a powerful tool for growing your wealth over time. To maximize the returns on your investments, it’s crucial to employ effective strategies tailored to your financial goals and risk tolerance.

Selecting the Right Investment Vehicles

When choosing investment vehicles for compound interest, consider your financial goals and risk tolerance. For long-term growth, consider options like stocks and mutual funds. If you prefer lower risk, bonds and certificates of deposit (CDs) may be more suitable.

Reinvesting Earnings for Compound Growth

To leverage the power of compound interest, it’s essential to reinvest your earnings. By reinvesting dividends, interest, or capital gains, you allow your investment to grow exponentially over time. This continuous reinvestment accelerates the compounding effect, leading to significant returns in the long run.

Importance of Regular Contributions and Discipline

Regular contributions and disciplined saving habits are key to maximizing compound interest returns. By consistently adding funds to your investments, you increase the principal amount that generates compound interest. Setting up automatic contributions can help you stay on track and ensure a steady growth trajectory for your investments.