Diving into the world of refinancing vs consolidation loans, get ready for a wild ride filled with financial twists and turns. It’s time to break down the differences and find out which option could save you big bucks.

Let’s start by defining what refinancing and consolidation loans actually mean and how they can impact your financial situation.

Refinancing vs Consolidation Loans

Refinancing involves taking out a new loan to replace an existing loan, usually with better terms such as a lower interest rate or monthly payment. On the other hand, consolidation loans combine multiple loans into a single loan with one monthly payment.

Key Differences

- Refinancing involves replacing an existing loan with a new one, while consolidation loans combine multiple loans into a single loan.

- Refinancing often results in a lower interest rate or monthly payment, while consolidation loans may simplify repayment but not necessarily lower interest rates.

- Refinancing is typically used to secure better loan terms, while consolidation loans are used to streamline payment obligations.

Benefits of Refinancing over Consolidation Loans

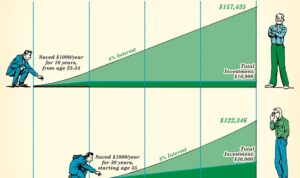

- When you have a high-interest rate loan that you can refinance at a lower rate, saving money on interest payments over time.

- If your credit score has improved since taking out the original loan, you may qualify for a better rate through refinancing.

- For borrowers looking to shorten the term of their loan or switch from an adjustable-rate to a fixed-rate loan, refinancing can be more beneficial.

Refinancing Loans

When it comes to refinancing loans, it’s all about restructuring your current loan terms to potentially save money or get better conditions. This process involves taking out a new loan to pay off the existing one, usually with improved terms.

Refinancing your loan can offer several benefits, such as potentially lowering your interest rate, reducing your monthly payments, consolidating multiple loans into one, or even shortening the loan term to pay it off faster. It can also help you access equity in your home or get better terms if your credit score has improved since you initially took out the loan.

Types of Loans Commonly Refinanced

- Mortgage Loans: Homeowners often refinance their mortgage loans to take advantage of lower interest rates or to switch from an adjustable-rate mortgage to a fixed-rate mortgage.

- Student Loans: Refinancing student loans can help borrowers secure a lower interest rate and reduce monthly payments, making it easier to manage debt.

- Auto Loans: Refinancing auto loans can lead to lower monthly payments, a shorter loan term, or a reduced interest rate, potentially saving you money in the long run.

Consolidation Loans

When it comes to consolidating loans, the process typically involves combining multiple debts into a single loan with one monthly payment. This can be done through a financial institution or a specialized consolidation loan provider.

Consolidating your loans can offer several advantages, such as simplifying your finances by having only one monthly payment to manage. It can also potentially lower your overall interest rate, reduce the total amount you pay each month, and extend the repayment period to make it more manageable.

Types of Debts that can be Consolidated

- Credit card balances

- Personal loans

- Student loans

- Medical bills

- Payday loans

Factors to Consider

When deciding between refinancing and consolidation loans, there are several key factors to take into consideration. Your credit score, interest rates, and financial goals play a significant role in determining which option is best for you.

Impact of Credit Score

Your credit score is a crucial factor in determining the type of loan you qualify for and the interest rate you will be offered. For refinancing, lenders typically require a good credit score to secure a lower interest rate. On the other hand, consolidation loans may be more lenient with credit score requirements, but a higher score can still help you secure a better interest rate.

Role of Interest Rates

Interest rates play a vital role in choosing between refinancing and consolidation loans. Refinancing allows you to potentially lower your interest rate, saving you money over time. In contrast, consolidation loans may not always offer lower interest rates but can simplify your payments by combining multiple debts into one.