Get ready to dive into the world of retirement funds strategies – an essential aspect of financial planning that can make or break your golden years. This guide will take you through the ins and outs of building a solid retirement fund strategy, ensuring you’re well-equipped for a secure future.

From understanding the importance of these strategies to maximizing your contributions, this guide has got you covered with all the information you need to make informed decisions about your retirement funds.

Importance of Retirement Funds Strategies

Having a solid retirement fund strategy is crucial for financial security in the long run. It ensures that individuals can maintain their standard of living and cover expenses even after they stop working. Without a clear strategy in place, retirees may face financial challenges and struggle to make ends meet during their golden years.

Impact on Quality of Life

Effective retirement fund strategies can significantly impact one’s quality of life post-retirement. For example, individuals with well-planned retirement funds can enjoy a comfortable lifestyle, travel, pursue hobbies, and engage in leisure activities without financial stress. On the other hand, those without a clear strategy may have to rely solely on social security benefits or family support, limiting their choices and opportunities in retirement.

Comparison of Outcomes

When comparing the outcomes of individuals with well-planned retirement funds versus those without a clear strategy, the difference is stark. Those with a solid retirement fund strategy can enjoy financial independence, peace of mind, and the freedom to pursue their interests. In contrast, individuals without a clear plan may struggle to cover basic expenses, face financial hardships, and experience a lower quality of life during retirement.

Types of Retirement Funds

When planning for retirement, it’s important to consider the different types of retirement funds available to help you reach your financial goals. Each type of retirement fund has its own benefits and drawbacks, as well as unique tax implications. Let’s take a closer look at some of the most common types of retirement funds:

401(k) Plans

- 401(k) plans are employer-sponsored retirement accounts that allow employees to contribute a portion of their pre-tax income towards retirement savings.

- One of the main benefits of a 401(k) plan is that contributions are typically tax-deductible, reducing your taxable income for the year.

- However, withdrawals from a 401(k) plan are taxed as ordinary income in retirement, and there may be penalties for early withdrawal before age 59 ½.

Individual Retirement Accounts (IRAs)

- IRAs are retirement accounts that individuals can open on their own, rather than through an employer.

- One key benefit of an IRA is the potential for tax-deferred growth, allowing your investments to grow without being taxed until you make withdrawals in retirement.

- Depending on the type of IRA (traditional or Roth), contributions may be tax-deductible or made with after-tax dollars, respectively.

Roth IRA

- Roth IRAs are similar to traditional IRAs, but contributions are made with after-tax dollars, meaning withdrawals in retirement are tax-free.

- One major advantage of a Roth IRA is that there are no required minimum distributions (RMDs) during the account holder’s lifetime, allowing for more flexibility in retirement planning.

- However, there are income limits for contributing to a Roth IRA, so not everyone may be eligible to open one.

Pension Plans

- Pension plans are retirement accounts funded by employers, providing a guaranteed income stream in retirement based on years of service and salary history.

- One of the main benefits of a pension plan is the security of a steady income throughout retirement, regardless of market fluctuations.

- However, fewer employers offer traditional pension plans today, and the responsibility for retirement savings has shifted more towards individuals with 401(k) plans and IRAs.

Creating a Retirement Fund Strategy

When it comes to creating a retirement fund strategy, it’s essential to tailor it to your individual financial goals. This personalized approach can help ensure that you have enough funds to support your desired lifestyle during retirement.

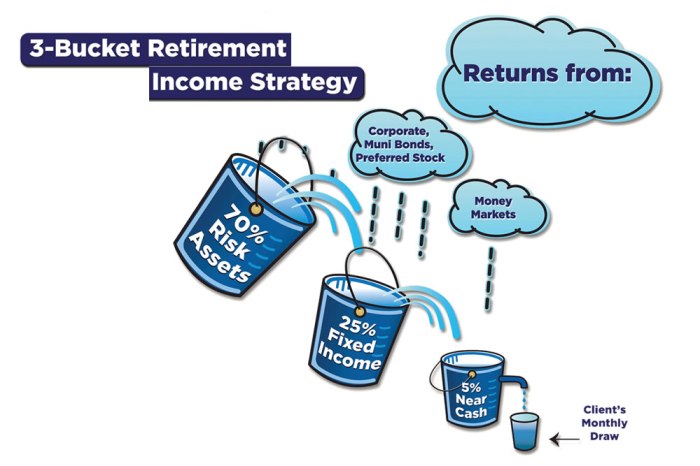

Role of Risk Tolerance in Investment Mix

Understanding your risk tolerance is crucial in determining the investment mix within your retirement fund. Risk tolerance refers to your comfort level with the possibility of losing money in exchange for potentially higher returns. It’s important to strike a balance between risk and reward based on your risk tolerance, as this can impact the growth of your retirement savings over time.

- Assess your risk tolerance: Before deciding on the investment mix for your retirement fund, take the time to assess your risk tolerance. Consider factors such as your age, financial goals, and comfort level with market fluctuations.

- Diversify your investments: Diversification is key to managing risk within your retirement fund. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can reduce the impact of market volatility on your overall portfolio.

- Review and adjust regularly: As your financial circumstances change, it’s important to review and adjust your retirement fund strategy accordingly. This may involve rebalancing your portfolio, reallocating assets, or making changes based on market conditions.

Adjusting Retirement Fund Strategy Over Time

Over time, your financial goals and circumstances may change, requiring adjustments to your retirement fund strategy. Here are some tips on how to adapt your strategy to changing financial circumstances:

- Regularly review your retirement savings goals: As you approach retirement age, reassess your savings goals to ensure they align with your desired lifestyle during retirement.

- Consider increasing contributions: If possible, consider increasing your contributions to your retirement fund to boost your savings and meet your financial goals faster.

- Seek professional advice: If you’re unsure about how to adjust your retirement fund strategy, consider seeking advice from a financial advisor who can help you navigate changes and make informed decisions.

Maximizing Retirement Fund Contributions

When it comes to maximizing retirement fund contributions, there are several strategies that can help you boost your savings and secure a comfortable retirement. By taking advantage of opportunities like employer matching and catch-up contributions, you can significantly increase the amount of money you have set aside for your golden years.

Employer Matching

Employer matching is a great way to supercharge your retirement savings. Many companies offer to match a portion of your contributions to a retirement account, such as a 401(k) or 403(b). This essentially means that your employer is giving you free money to save for retirement. By contributing enough to receive the full match, you can maximize the benefits of this program and grow your retirement fund faster.

Catch-Up Contributions

Catch-up contributions are specifically designed for individuals who are nearing retirement age and want to accelerate their savings. Once you reach the age of 50, you are eligible to make additional contributions to your retirement accounts beyond the standard limits. By taking advantage of catch-up contributions, you can make up for lost time and boost your retirement savings before you retire.

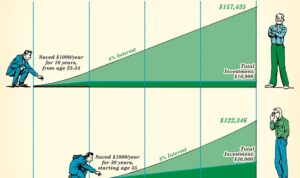

Starting Early vs. Starting Late

The impact of starting to contribute to retirement funds early versus later in your career cannot be overstated. When you start saving for retirement early, you give your money more time to grow through compound interest. This means that even small contributions made early on can have a big impact on your overall savings by the time you retire. On the other hand, starting to save for retirement later in your career may require larger contributions to catch up, which can be more challenging to achieve.

Accelerating Retirement Savings Growth

Increasing your contributions to your retirement fund can have a significant impact on the growth of your savings. For example, let’s say you increase your contributions by just 1% each year. Over time, this small change can lead to a substantial increase in your retirement fund balance. By consistently increasing your contributions, you can accelerate the growth of your savings and build a more secure financial future for yourself.