Getting hitched? Buckle up as we dive into the world of saving for a wedding with tips and tricks that will make your special day stress-free and budget-friendly. From setting a realistic budget to exploring investment options, this guide has got you covered.

Ready to say ‘I do’ to smart financial planning for your dream wedding? Let’s get started!

Importance of Saving for a Wedding

Saving for a wedding is crucial for a smooth and stress-free planning process. Having adequate savings allows couples to focus on enjoying their special day rather than worrying about financial constraints. It provides a sense of security and peace of mind knowing that there is a financial cushion to rely on.

Reducing Stress During Wedding Planning

- By saving in advance, couples can avoid last-minute financial pressures and unexpected expenses that often arise during wedding planning.

- Adequate savings enable couples to make informed decisions without compromising their vision for the wedding due to budget constraints.

- Having a financial plan in place helps to prioritize expenses and allocate funds efficiently, reducing the stress of managing finances during the planning process.

Financial Benefits of Saving for a Wedding

- Saving in advance allows couples to take advantage of early booking discounts and negotiate better deals with vendors, ultimately saving money in the long run.

- Having savings set aside specifically for the wedding helps to prevent incurring debt or dipping into emergency funds, ensuring financial stability post-wedding.

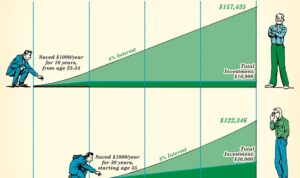

- By starting to save early, couples can benefit from the power of compound interest and potentially grow their savings over time, providing a financial cushion for future goals.

Setting a Realistic Wedding Budget

Planning a wedding can be an exciting but expensive venture. Setting a realistic budget is crucial to ensure you don’t overspend and start your marriage in debt.

Steps to Setting a Realistic Wedding Budget

- Calculate your total budget based on what you and your partner can realistically afford.

- Break down the budget into categories such as venue, catering, attire, decorations, and entertainment.

- Research average costs in your area for each category to get an idea of how much you should allocate.

- Consider any financial contributions from family members and factor those into your budget.

- Leave a buffer for unexpected expenses that may arise during the planning process.

Tips for Prioritizing Expenses within the Budget

- Identify your top priorities for the wedding, whether it’s the venue, food, or photography, and allocate more budget to those areas.

- Consider areas where you can cut costs, such as opting for a buffet dinner instead of a plated meal or DIY decorations.

- Be willing to compromise on certain elements to stay within budget, such as choosing a local band over a DJ.

- Remember that the most important thing is celebrating your love with family and friends, not having the most extravagant wedding.

Importance of Sticking to the Budget

- Sticking to your budget helps you avoid starting your marriage with unnecessary debt that can cause stress and strain on your relationship.

- By adhering to your budget, you can prioritize what truly matters to you as a couple and allocate funds accordingly.

- Overspending on your wedding day can lead to financial strain in the long run, affecting your ability to save for other important milestones in your life.

- Remember that a beautiful and meaningful wedding doesn’t have to break the bank; it’s about the love and commitment you share with your partner.

Strategies for Saving Money for a Wedding

Planning a wedding can be costly, but with the right strategies, you can save money without sacrificing your dream day. From traditional saving methods to modern digital tools, there are various ways to cut costs and save efficiently for your special day.

Automate your savings

Automating your savings is a great way to set aside money for your wedding without even thinking about it. Set up automatic transfers from your checking account to a separate wedding savings account. This way, you can consistently save a portion of your income without the temptation to spend it elsewhere.

Cut back on unnecessary expenses

Take a close look at your monthly expenses and identify areas where you can cut back. Consider reducing dining out, canceling unused subscriptions, or finding more affordable alternatives for your everyday purchases. Every dollar saved can contribute to your wedding fund.

Utilize cashback and rewards programs

Take advantage of cashback and rewards programs offered by credit cards or shopping apps. Use credit cards that offer cashback on wedding-related purchases, and save the cashback rewards directly into your wedding savings account. Additionally, consider using rewards points to offset wedding expenses like hotel stays or flights.

DIY decorations and favors

Get creative and DIY your wedding decorations and favors. From centerpieces to wedding favors, there are plenty of tutorials and ideas online to help you create beautiful and personalized elements for your big day. Not only will this save you money, but it will also add a personal touch to your wedding.

Consider a smaller guest list

One of the most significant expenses for a wedding is often the catering costs for a large guest list. Consider trimming down your guest list to include only close family and friends. This not only reduces the cost per head but also allows you to have a more intimate and meaningful celebration.

Investment Options for Wedding Savings

When it comes to growing your wedding savings, exploring investment options can help you maximize your funds. By understanding the risks and benefits of different investment vehicles, you can make informed decisions that align with your financial goals.

Stocks and Bonds

- Stocks: Investing in individual stocks or exchange-traded funds (ETFs) can offer high returns but also come with higher risks due to market volatility.

- Bonds: Bonds are considered safer investments than stocks as they provide a fixed income, making them a more stable option for wedding savings.

Mutual Funds

- Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, offering a balanced approach to investing.

- They are managed by professional fund managers who make investment decisions on behalf of the investors, providing expertise and guidance.

Real Estate

- Investing in real estate can be a long-term strategy to grow your wedding savings through rental income and property appreciation.

- While real estate can provide steady returns, it also comes with costs such as maintenance, property taxes, and market fluctuations.

High-Yield Savings Accounts

- High-yield savings accounts offer higher interest rates than traditional savings accounts, allowing your wedding savings to grow at a faster pace.

- They are a low-risk option for short-term savings goals like a wedding, providing liquidity and security for your funds.

Understanding Your Risk Tolerance

- Before investing your wedding funds, it’s crucial to assess your risk tolerance to determine the right investment mix for your financial situation.

- Consider factors like your timeline, financial goals, and comfort level with market fluctuations to make strategic investment decisions.

Monitoring and Adjusting Wedding Savings Plan

Planning for a wedding involves not only setting a budget and saving money but also monitoring and adjusting your savings plan as needed. It’s essential to stay on track and make changes when circumstances require it.

Tracking Progress

- Regularly review your savings account to see how much you have saved.

- Compare your savings to your target wedding budget to ensure you are on the right path.

- Use budgeting apps or spreadsheets to track your expenses and savings progress.

Adjusting the Plan

- If unexpected expenses arise, reassess your budget and adjust your savings plan accordingly.

- Consider cutting back on non-essential expenses to boost your wedding savings.

- Explore alternative ways to earn extra income to supplement your savings.

Importance of Flexibility

- Flexibility is key when saving for a wedding, as circumstances can change unexpectedly.

- Being adaptable allows you to make necessary adjustments to your savings plan without derailing your wedding goals.

- Stay open to new ideas and approaches to continue saving effectively for your special day.