Yo, we’re diving into the world of saving for that sweet home down payment. Get ready to learn some key strategies and tips to make that dream home a reality. From budgeting to investment options, we got you covered!

Let’s break it down and get you on the path to homeownership success.

Importance of Saving for a Home Down Payment

Saving for a home down payment is crucial for several reasons. Not only does it demonstrate financial responsibility and discipline, but it also opens up opportunities for better mortgage terms and lower monthly payments.

Benefits of Having a Substantial Down Payment

- Lower Loan Amount: A larger down payment means borrowing less money, resulting in a smaller loan amount.

- Better Interest Rates: Lenders often offer lower interest rates to borrowers with substantial down payments, saving money over the life of the loan.

- Reduced Mortgage Insurance: With a down payment of 20% or more, borrowers can avoid paying private mortgage insurance (PMI), which can add to monthly expenses.

Impact of a Larger Down Payment on Mortgage Terms and Monthly Payments

A higher down payment can lead to more favorable mortgage terms, such as lower interest rates and reduced fees.

- Shorter Loan Term: With a larger down payment, borrowers may qualify for a shorter loan term, leading to quicker loan repayment and less interest paid over time.

- Lower Monthly Payments: A substantial down payment can result in lower monthly mortgage payments, making homeownership more affordable in the long run.

Strategies for Saving for a Home Down Payment

Saving for a home down payment can be a daunting task, but with the right strategies, you can make it more manageable. Here are some tips to help you reach your goal:

Creating a Budget

Creating a budget is essential when saving for a home down payment. Start by tracking your monthly expenses and income to determine how much you can realistically save. Set a specific savings goal and prioritize it in your budget.

Different Saving Methods

Setting up a dedicated savings account specifically for your down payment can help you keep your savings separate from your regular spending. Consider automated transfers from your checking account to your savings account to ensure consistent savings each month.

Cutting Expenses or Increasing Income

To save more effectively, look for ways to cut expenses in your budget. This could mean reducing dining out, canceling subscription services, or finding more affordable alternatives for everyday expenses. Additionally, consider ways to increase your income, such as taking on a side hustle or freelance work.

Timeline and Goals for Saving

Setting realistic timelines and goals for saving for a home down payment is crucial for achieving your dream of homeownership. By monitoring your progress and adjusting your goals as needed, you can stay on track and make your goal a reality. Here are some tips to help you establish short-term and long-term saving milestones.

Short-term Saving Milestones

- Set a monthly savings target based on your budget and income.

- Track your expenses and identify areas where you can cut back to save more.

- Automate your savings by setting up automatic transfers to your savings account.

- Celebrate reaching small milestones along the way to stay motivated.

Long-term Saving Milestones

- Calculate the total amount needed for a down payment and set a timeline for reaching that goal.

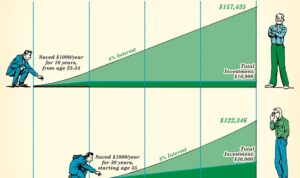

- Consider investing in high-yield savings accounts or other investment options to grow your money faster.

- Reassess your goals periodically and adjust them based on changes in your financial situation.

- Visualize your goal of homeownership to stay focused and motivated throughout your saving journey.

Investment Options for Down Payment Savings

When it comes to saving for a home down payment, exploring different investment options can help you grow your money faster. Let’s compare some popular investment choices along with their risks and benefits to help you make an informed decision.

High-Yield Savings Accounts

High-yield savings accounts offer higher interest rates compared to traditional savings accounts, allowing your money to grow faster. While they are low-risk investments, the returns may not be as high as other options like stocks or real estate.

Certificates of Deposit (CDs)

CDs are time deposits that offer higher interest rates than regular savings accounts. They are considered low-risk investments, but you may face penalties for withdrawing your money before the CD matures.

Stocks

Investing in stocks can potentially offer higher returns, but they also come with higher risks. Stock prices can be volatile, so it’s important to diversify your portfolio to mitigate risks.

Real Estate Investments

Real estate can be a lucrative investment option, as properties tend to appreciate over time. However, it requires significant capital and comes with risks such as market fluctuations and property maintenance costs.

Tips for Diversifying Investments

– Consider a mix of different investment options to spread out risks.

– Rebalance your portfolio regularly to ensure it aligns with your financial goals.

– Consult with a financial advisor to get personalized advice based on your risk tolerance and investment timeline.

Considerations for First-Time Homebuyers

When it comes to buying your first home, there are a few key considerations to keep in mind to help make the process smoother and more manageable. From programs and incentives to credit scores and debt-to-income ratios, being well-informed can make a big difference in achieving your homeownership goals.

Programs and Incentives for First-Time Homebuyers

For first-time homebuyers, there are various programs and incentives available to help with down payment savings. These can include government-backed programs like FHA loans, VA loans for veterans, or USDA loans for rural homebuyers. Additionally, some states offer down payment assistance programs or grants to qualifying individuals. It’s important to research and explore these options to see if you qualify for any assistance that can make homeownership more accessible.

Impact of Credit Scores and Debt-to-Income Ratios

Credit scores and debt-to-income ratios play a significant role in determining down payment requirements and mortgage approval. A higher credit score can result in lower interest rates and better loan terms, while a lower debt-to-income ratio shows lenders that you can manage your finances effectively. It’s essential to work on improving your credit score and reducing debt before applying for a mortgage to increase your chances of approval and secure a favorable loan.

Navigating the Mortgage Application Process

Applying for a mortgage can be a complex process, especially for first-time homebuyers. It’s crucial to gather all necessary documents, such as pay stubs, tax returns, and bank statements, to demonstrate your financial stability to lenders. Additionally, working with a reputable mortgage lender can help guide you through the application process and provide insights on available down payment assistance programs. By being proactive and organized, you can increase your chances of securing a mortgage and achieving your dream of homeownership.