How to improve credit history sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Credit history plays a crucial role in shaping our financial well-being. It’s like the report card of our financial life, influencing our ability to secure loans, buy a house, or even land a job. In this guide, we’ll dive deep into the world of credit history and explore the strategies to enhance it for a brighter financial future.

Understanding Credit History

Credit history is a record of your financial behavior regarding credit accounts, such as loans and credit cards. It shows how responsible you are in managing your debts and payments. Your credit history impacts your financial health by influencing your ability to borrow money, get approved for loans, or even rent an apartment.

Maintaining a positive credit history is crucial for building a good credit score, which is a numerical representation of your creditworthiness. A good credit score can help you qualify for better interest rates on loans, credit cards, and other financial products.

Factors Influencing Credit History

- Payment History: This is the most significant factor in your credit history, showing whether you have paid your bills on time.

- Credit Utilization: This refers to the amount of credit you are using compared to your total credit limit. Keeping this ratio low can positively impact your credit history.

- Length of Credit History: The longer your credit history, the more information lenders have to assess your creditworthiness.

- New Credit Inquiries: Applying for multiple new credit accounts within a short period can negatively impact your credit history.

- Types of Credit Used: Having a mix of credit types, such as credit cards, loans, and a mortgage, can show that you can manage different types of credit responsibly.

Checking Credit Reports

When it comes to improving your credit history, checking your credit reports is a crucial step in understanding where you stand financially. By reviewing your credit reports, you can identify any errors or inaccuracies that may be negatively impacting your credit score. Additionally, monitoring your credit reports regularly can help you spot any suspicious activities, such as identity theft, before they cause significant damage.

Obtaining and Reviewing Credit Reports

- Obtain a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year at AnnualCreditReport.com.

- Review each credit report carefully, looking for any discrepancies in personal information, account balances, payment history, or inquiries.

- Check for any accounts that you don’t recognize, as they may be a sign of identity theft.

Identifying Errors or Inaccuracies

- If you find any errors or inaccuracies on your credit report, file a dispute with the credit bureau reporting the incorrect information.

- Provide any supporting documentation that proves the information is inaccurate, such as payment receipts or correspondence with the creditor.

- Monitor your credit report after disputing errors to ensure they have been corrected.

Importance of Regular Monitoring

- Regularly monitoring your credit reports can help you catch any fraudulent activity early on, minimizing the damage to your credit score.

- By staying vigilant and checking your credit reports regularly, you can take proactive steps to protect your financial reputation.

- Consider setting up credit monitoring services or alerts to receive notifications of any changes to your credit report.

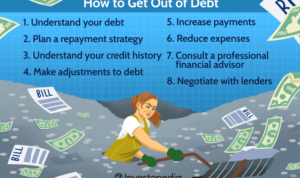

Managing Debt Responsibly

When it comes to improving your credit history, managing debt responsibly plays a crucial role. By effectively handling your debts, you can work towards a better financial future and a stronger credit score.

- Avoid accumulating more debt: One of the first steps in managing debt is to stop adding to it. Cut back on unnecessary expenses and focus on paying off existing balances.

- Create a payment plan: Develop a realistic payment plan to tackle your outstanding debts. Prioritize high-interest debts first and make consistent payments to reduce your overall debt load.

- Monitor your debt-to-income ratio: Your debt-to-income ratio is a key factor in determining your creditworthiness. Aim to keep this ratio below 30% by either increasing your income or decreasing your debt.

- Communicate with creditors: If you’re struggling to make payments, don’t hesitate to reach out to your creditors. They may be able to offer alternative payment arrangements or assistance programs to help you manage your debt more effectively.

Building a Positive Payment History

Building a positive payment history is crucial for improving your credit score and overall financial health. By consistently making on-time payments on your credit accounts, you demonstrate to lenders that you are a responsible borrower.

Setting Up Payment Reminders

One way to ensure you never miss a payment is to set up payment reminders. You can do this by scheduling alerts on your phone, setting up email reminders, or using automatic payment services provided by your bank or credit card issuer.

Benefits of Automatic Payments

Setting up automatic payments for your credit obligations can be a game-changer. Not only does it help you avoid late fees and penalties, but it also ensures that your payments are always made on time, which is a key factor in building a positive payment history.

Utilizing Credit Wisely

When it comes to improving your credit history, utilizing credit wisely is key. By understanding how to manage your credit utilization ratio, you can make significant strides in building a positive credit profile.

Maintaining a Low Credit Utilization Ratio

- Aim to keep your credit utilization ratio below 30% – this means only using up to 30% of your available credit.

- Regularly monitor your credit card balances and make timely payments to keep your ratio low.

- Consider requesting a credit limit increase to lower your utilization ratio if needed.

Spreading Out Balances

- Avoid maxing out any single credit card – instead, spread out your balances across multiple accounts.

- Distributing your debt can help lower your overall credit utilization ratio and show responsible credit management.

- Utilize different types of credit accounts, such as credit cards and personal loans, to demonstrate diversity in managing debt.

Avoiding Unnecessary Credit Card Purchases

- Think twice before making impulse purchases with your credit card – only use it for necessary expenses.

- Create a budget and stick to it to avoid overspending and accumulating unnecessary debt.

- Avoid carrying a balance on your credit cards whenever possible to prevent interest charges from piling up.

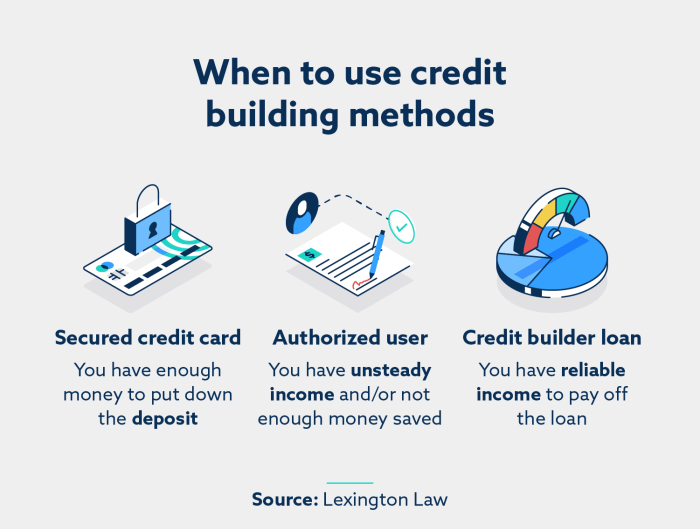

Establishing and Diversifying Credit

Establishing and diversifying credit is crucial for building a strong credit history and improving your credit score. By having a mix of credit accounts, such as credit cards, installment loans, and mortgages, you can demonstrate to lenders that you can responsibly manage different types of credit.

Benefits of Diversifying Credit

- Diversifying credit accounts shows lenders that you can handle various types of credit responsibly.

- Having a mix of credit can improve your credit score by showcasing your ability to manage different financial obligations.

- It can also help you qualify for better interest rates and terms on future loans or credit cards.

Impact of Opening New Credit Accounts

- Opening new credit accounts can initially lower your credit score due to the hard inquiry and reduced average account age.

- However, over time, responsibly managing these new accounts can have a positive impact on your credit history.

- It’s important to only open new accounts when necessary and to keep your credit utilization low to avoid any negative effects.

Managing Multiple Credit Accounts Responsibly

- Make all payments on time and in full to avoid any negative marks on your credit report.

- Keep your credit utilization ratio low by not maxing out your credit cards or lines of credit.

- Avoid opening too many new accounts at once, as this can signal risk to lenders.

- Regularly monitor your credit report to ensure all information is accurate and up to date.