Diving into the world of student loans, we explore the art of paying them off quickly. From smart strategies to increasing income, get ready to tackle your student debt like a pro.

Importance of Paying Off Student Loans Quickly

Paying off student loans quickly comes with a plethora of benefits that can positively impact your financial future. By taking steps to eliminate your student debt as soon as possible, you can save a significant amount of money in the long run. Not only does paying off student loans quickly reduce the total amount of interest that accrues over time, but it also allows you to free up funds for other financial goals and investments.

Benefits of Paying Off Student Loans Fast

- Reduced Interest Costs: By paying off your student loans quickly, you can minimize the amount of interest that accumulates, saving you money in the long term.

- Improved Credit Score: Eliminating student loan debt promptly can positively impact your credit score, making it easier to qualify for future loans and credit cards at favorable rates.

- Financial Freedom: Paying off student loans fast frees up your income for other expenses, savings, or investments, allowing you to achieve financial stability sooner.

Impact of Student Loan Debt on Credit Scores and Financial Stability

- High Debt-to-Income Ratio: Carrying a large amount of student loan debt can increase your debt-to-income ratio, making it harder to qualify for additional credit in the future.

- Default Risk: Failing to repay student loans can negatively impact your credit score and financial stability, leading to potential consequences such as wage garnishment or asset seizure.

- Delayed Financial Goals: Student loan debt can delay your ability to achieve other financial goals, such as buying a home, starting a business, or saving for retirement.

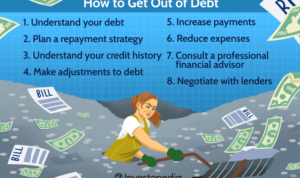

Strategies for Paying Off Student Loans Faster

Paying off student loans quickly can help you save money on interest and achieve financial freedom sooner. By using specific strategies, you can accelerate the repayment process and get rid of your student debt faster.

The Snowball Method for Paying Off Student Loans

The snowball method is a debt repayment strategy where you focus on paying off the smallest loan balance first while making minimum payments on all other loans. Once the smallest loan is paid off, you move on to the next smallest balance, creating a snowball effect as you tackle larger debts. This method can help you stay motivated by providing quick wins early in the repayment process.

The Avalanche Method and How It Can Help in Paying Off Loans Quickly

The avalanche method involves prioritizing loans based on their interest rates. You start by paying off the loan with the highest interest rate first, while making minimum payments on the rest. Once the highest interest rate loan is paid off, you move on to the next highest interest rate loan. This method can save you money on interest over time, as you tackle the most expensive debts first.

The Benefits of Making Extra Payments Towards Student Loans

Making extra payments towards your student loans can help you pay off the principal balance faster, reducing the total amount of interest you’ll pay over the life of the loan. By allocating additional funds towards your loans each month, you can shorten the repayment period and become debt-free sooner. Consider using any extra income, windfalls, or bonuses to make additional payments towards your student loans.

Increasing Income to Accelerate Student Loan Repayment

Increasing your income is a great way to speed up the process of paying off your student loans. By bringing in more money, you can make larger payments towards your loans, reducing the overall interest and time it takes to become debt-free.

Side Hustle Ideas to Generate Extra Income

- Freelancing: Offer your skills and services online, such as graphic design, writing, or social media management.

- Ridesharing: Drive for companies like Uber or Lyft in your spare time to earn extra cash.

- Tutoring: Share your knowledge in a subject you excel in by tutoring students in your community.

- Virtual Assistant: Provide administrative support to businesses or entrepreneurs remotely.

Negotiating a Raise or Finding Higher-Paying Job Opportunities

- Document Your Achievements: Keep track of your accomplishments at work to make a strong case for a raise.

- Research Market Rates: Understand the salary range for your position and industry to negotiate effectively.

- Network: Connect with professionals in your field to explore job opportunities that offer higher pay.

- Further Education: Consider obtaining certifications or degrees that can lead to higher-paying roles.

Budgeting Techniques for Effective Loan Repayment

Creating a budget is crucial when it comes to paying off student loans quickly. It helps you allocate your funds efficiently, prioritize loan repayment, and stay on track with your financial goals. Here are some budgeting techniques to consider:

Track Your Expenses

- Start by tracking all your expenses to get a clear picture of where your money is going each month.

- Use budgeting apps like Mint or YNAB to categorize your spending and identify areas where you can cut back.

- Set a realistic budget that allows you to cover your necessities while still making extra payments towards your student loans.

Create a Debt Repayment Plan

- List all your debts, including student loans, and prioritize them based on interest rates or outstanding balances.

- Consider using the debt snowball or debt avalanche method to pay off your loans strategically.

- Allocate a specific amount from your budget towards debt repayment each month to accelerate the process.

Automate Your Payments

- Set up automatic payments for your student loans to ensure you never miss a payment and incur additional fees.

- Automating your payments can also help you stick to your budget and avoid overspending on non-essential items.

- Consider setting up bi-weekly or extra payments to reduce the overall interest you’ll pay over time.