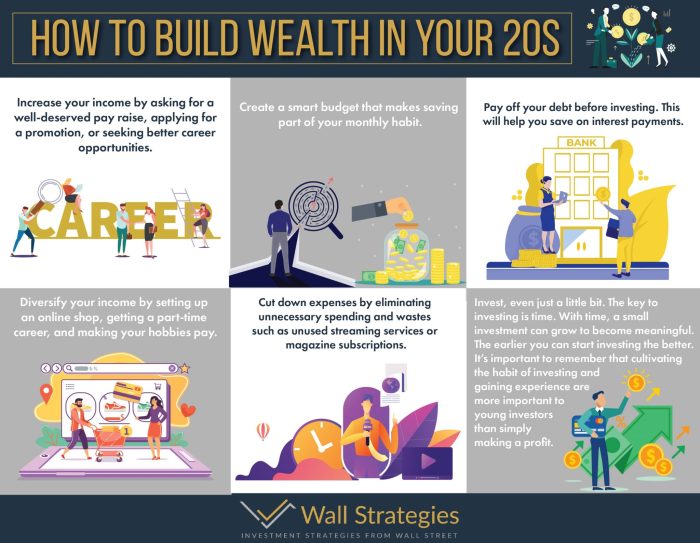

Diving into the realm of wealth building tips, this introduction sets the stage for a captivating exploration of strategies that can pave the way to financial success. From budgeting and saving to investment strategies and passive income sources, this guide offers valuable insights to help you build a solid financial foundation.

Importance of Wealth Building

Building wealth is crucial for achieving financial security in the long run. It involves creating a solid financial foundation that can support you and your family through various life stages and unexpected circumstances. By actively working towards building wealth, individuals can enjoy numerous benefits that can lead to long-term financial stability.

Benefits of Wealth Building

- Financial Independence: Building wealth allows individuals to gain control over their finances and reduce reliance on external sources for financial support.

- Retirement Planning: Accumulating wealth enables individuals to plan for a comfortable retirement and maintain their desired lifestyle after leaving the workforce.

- Emergency Fund: Wealth building helps in creating an emergency fund that can cover unexpected expenses such as medical emergencies, job loss, or home repairs.

- Generational Wealth: By building wealth, individuals can create a legacy for future generations and provide financial security for their loved ones.

Budgeting and Saving

When it comes to building wealth, budgeting and saving are essential components that can help individuals achieve their financial goals. By effectively managing expenses and creating a savings plan, individuals can increase their wealth accumulation over time.

Effective Budgeting Techniques

- Track your spending: Keep a record of all your expenses to identify areas where you can cut back.

- Create a budget: Set limits for different spending categories to ensure you stay within your means.

- Use cash or debit cards: Avoid using credit cards to prevent overspending and accumulating debt.

- Avoid impulse purchases: Think carefully before making a purchase to distinguish between wants and needs.

Importance of Creating a Savings Plan

- Emergency fund: Having savings set aside can help cover unexpected expenses without resorting to debt.

- Financial goals: Setting specific savings targets can motivate you to save consistently and achieve your goals.

- Investment opportunities: Building up savings can provide capital for future investments to grow your wealth.

Tips to Cut Expenses and Increase Savings

- Reduce discretionary spending: Cut back on non-essential expenses like dining out or entertainment.

- Negotiate bills: Contact service providers to see if you can lower your monthly bills for utilities or subscriptions.

- Avoid lifestyle inflation: As your income increases, resist the temptation to increase your spending proportionally.

- Automate savings: Set up automatic transfers to a savings account to ensure consistent savings each month.

Investment Strategies

Investing is a crucial component of wealth building as it allows individuals to grow their money over time. There are various investment options available, each with its own risk and return potential. Understanding different investment strategies can help individuals make informed decisions to achieve their financial goals.

Stocks

- Stocks represent ownership in a company and offer the potential for capital appreciation and dividends.

- Research companies before investing, consider factors like financial health, industry trends, and growth potential.

- Diversification is key to reducing risk – consider investing in different industries and company sizes.

- Regularly review and adjust your stock portfolio based on market conditions and your financial goals.

Real Estate

- Real estate investment involves buying properties to generate rental income or capital appreciation.

- Consider factors like location, market trends, and potential rental income before investing in real estate.

- Diversify your real estate portfolio by investing in different types of properties and locations.

- Regularly monitor property market trends and make informed decisions based on your investment objectives.

Mutual Funds

- Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Choose mutual funds based on your risk tolerance, investment goals, and time horizon.

- Diversification is inherent in mutual funds, reducing individual stock risk.

- Regularly review your mutual fund investments and rebalance your portfolio as needed.

Passive Income Sources

When it comes to building wealth, having passive income sources can be a game-changer. These are earnings that come in regularly with minimal effort on your part, allowing you to grow your wealth even when you’re not actively working.

Rental Properties

Owning rental properties can be a lucrative passive income source. By renting out real estate, you can earn a steady stream of income each month. The key is to find properties in high-demand areas and to properly manage them to ensure a positive cash flow.

Dividend-Paying Stocks

Investing in dividend-paying stocks is another way to generate passive income. When you own shares in a company that pays dividends, you receive a portion of the company’s profits on a regular basis. This can be a great way to earn passive income while also benefiting from potential stock price appreciation.

Benefits of Passive Income Streams

Having passive income streams alongside your regular earnings can provide financial stability and security. It can help you diversify your income sources, reduce reliance on a single paycheck, and ultimately accelerate your wealth-building journey.

Tips to Start Creating Passive Income Streams

1. Research different passive income opportunities such as rental properties, dividend-paying stocks, or creating an online business.

2. Set clear financial goals and create a plan to achieve them through passive income streams.

3. Start small and gradually scale up your passive income ventures as you gain experience and confidence.

4. Stay informed about market trends and investment opportunities to maximize your passive income potential.