Diving into the world of budget spreadsheet templates, get ready to discover the ultimate toolkit for managing your finances like a pro. From tracking expenses to planning for the future, these templates offer a versatile solution for individuals and businesses alike.

Whether you’re a budgeting newbie or a seasoned pro, this guide will take you through the ins and outs of budget spreadsheet templates, providing valuable insights and practical tips along the way.

Types of Budget Spreadsheet Templates

When it comes to budgeting, there are various types of spreadsheet templates available to help you track your finances and stay on top of your money management game.

1. Personal Budget Spreadsheet

The personal budget spreadsheet is designed for individuals to track their income, expenses, and savings goals. It typically includes categories such as housing, transportation, groceries, entertainment, and more. This type of template is commonly used by individuals and families to manage their day-to-day expenses and savings.

2. Business Budget Spreadsheet

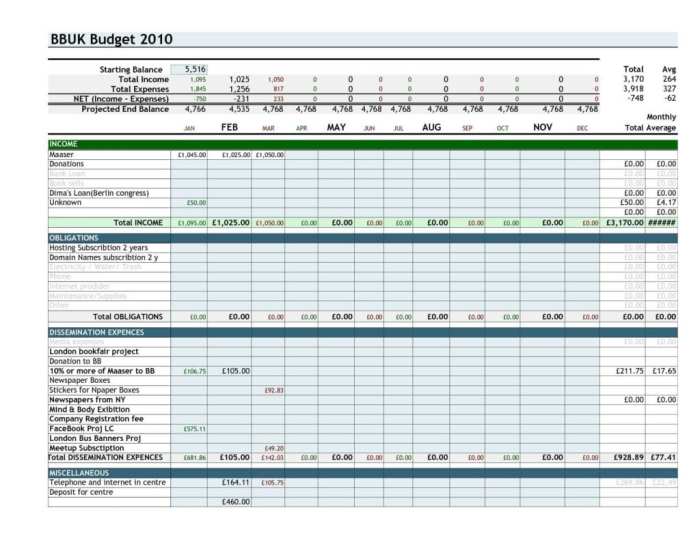

On the other hand, the business budget spreadsheet is tailored for entrepreneurs and small business owners to monitor their revenues, expenses, profits, and cash flow. It includes sections for sales projections, operating costs, marketing expenses, and other financial aspects of running a business. This template is essential for business planning and financial analysis.

3. Event Budget Spreadsheet

For those planning events such as weddings, parties, or corporate functions, the event budget spreadsheet is a lifesaver. It helps you estimate costs, track expenses, and stay within your budget. This template includes categories for venue rental, catering, decorations, entertainment, and more. Event planners and individuals organizing special occasions find this template extremely useful.

4. Travel Budget Spreadsheet

If you love to travel but want to keep your expenses in check, the travel budget spreadsheet is your go-to tool. It allows you to plan your trip expenses, including flights, accommodations, meals, activities, and souvenirs. This template helps travelers stay organized and avoid overspending while exploring new destinations.

5. Debt Payoff Spreadsheet

Lastly, the debt payoff spreadsheet is ideal for individuals looking to tackle their debt and achieve financial freedom. It helps you create a repayment plan, track your progress, and stay motivated on your journey to becoming debt-free. This template includes sections for listing your debts, interest rates, minimum payments, and extra payments to accelerate debt payoff.

Customization Options

When it comes to budget spreadsheet templates, customization is key to making sure your financial tracking is tailored to your specific needs. Here are some tips on how you can customize your budget spreadsheet to suit your individual requirements:

Adding or Removing Categories

- Consider adding categories that are relevant to your spending habits and financial goals. For example, if you frequently spend on dining out, you may want to create a category specifically for restaurants.

- On the other hand, if you find that certain categories are not applicable to your budget or are too detailed, feel free to remove them to streamline your spreadsheet.

Adjusting Columns and Formulas

- Customize the columns in your spreadsheet to include information that is important to you. You may want to add columns for savings goals, debt repayment progress, or any other financial metrics you want to track.

- Modify formulas to calculate totals, averages, or any other financial calculations that are relevant to your budgeting process. Make sure the formulas accurately reflect your financial situation.

Importance of Customization

Customizing your budget spreadsheet is crucial for effective budget tracking because it allows you to focus on the specific aspects of your finances that matter most to you. By tailoring the template to your needs, you can gain a clearer understanding of your financial situation and make more informed decisions about your money.

Best Practices for Using Budget Spreadsheet Templates

When it comes to managing your finances like a boss, budget spreadsheet templates are your best friend. Here are some tips to help you make the most of them:

Setting Up Your Budget Spreadsheet Template

Creating your budget spreadsheet template is the first step to financial success. Follow these simple steps to set it up like a pro:

- List all your sources of income, including paychecks, side hustles, and any other money coming in.

- Next, jot down all your expenses, from rent and utilities to groceries and entertainment.

- Organize your expenses into categories like fixed costs (e.g., rent) and variable costs (e.g., dining out).

- Don’t forget to include a section for savings and financial goals to keep you on track.

- Set up formulas to automatically calculate totals, savings percentages, and other key financial metrics.

Maintaining and Updating Your Template Regularly

Consistency is key when it comes to using budget spreadsheet templates effectively. Here’s how to stay on top of your finances:

- Update your template regularly with new income and expenses to ensure accurate tracking.

- Review your budget at least once a month to identify any areas where you may be overspending.

- Adjust your budget as needed to reflect changes in income, expenses, or financial goals.

- Use color-coding or conditional formatting to highlight areas that require attention or where you’re exceeding your budget.

Analyzing Data and Making Informed Financial Decisions

Now that you’ve got your budget spreadsheet template up and running, it’s time to put that data to good use:

- Regularly review your spending patterns and identify areas where you can cut back or reallocate funds.

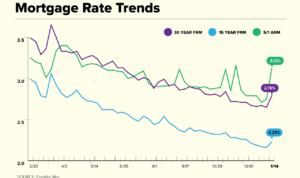

- Look for trends in your income and expenses to help you plan for future financial goals.

- Use tools like charts and graphs to visualize your financial data and gain a better understanding of your overall financial health.

- Make informed decisions about saving, investing, and spending based on the insights provided by your budget spreadsheet template.

Comparison with Budgeting Apps

When it comes to managing your finances, you have the option of using budget spreadsheet templates or budgeting apps. Each method has its own set of benefits and limitations, so let’s take a closer look at how they compare.

Customization and Flexibility

One of the key advantages of using budget spreadsheet templates is the level of customization and flexibility they offer. You can tailor the template to suit your specific financial goals and needs, adding or removing categories as needed. This allows for a personalized approach to budgeting that may not be possible with budgeting apps, which often have pre-set categories and features.

On the other hand, budgeting apps are typically more user-friendly and intuitive, making them a great option for those who prefer a more hands-off approach to budgeting. They often come with features like automatic categorization and syncing with bank accounts, making it easier to track your expenses in real-time.

In terms of customization and flexibility, budget spreadsheet templates are ideal for individuals who want full control over their budgeting process and prefer a more detailed approach. Budgeting apps, on the other hand, are better suited for those who want a more automated and streamlined experience.

Cost and Accessibility

Budget spreadsheet templates are usually free or low-cost, making them a budget-friendly option for those looking to save money. They can be accessed offline without the need for an internet connection, which is great for individuals who prefer to keep their financial information private and secure.

Budgeting apps, on the other hand, may come with a monthly or annual subscription fee, depending on the features and services offered. While they offer the convenience of accessing your budget on-the-go through your smartphone, they may not be as cost-effective for individuals on a tight budget.

When it comes to cost and accessibility, budget spreadsheet templates are a great choice for those who want a simple and affordable way to manage their finances. Budgeting apps are more suitable for individuals who prioritize convenience and are willing to invest in a more high-tech solution.