Diving into the world of finance for beginners, this guide is here to break down complex money matters into easy-to-understand concepts. From budgeting basics to investment insights, get ready to level up your financial knowledge.

Ready to take charge of your financial future? Let’s get started!

Understanding Finance Basics

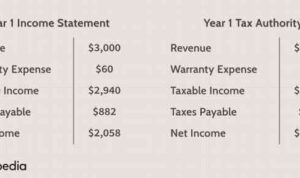

Finance is all about managing money. It involves making decisions about how to earn, save, invest, and spend money. Understanding finance basics is crucial for achieving financial stability and success.

Financial Instruments

Financial instruments are assets that can be traded. Here are some common examples:

- Stocks: Represent ownership in a company and can be bought and sold on stock exchanges.

- Bonds: Debt securities issued by companies or governments to raise capital. Investors earn interest on bonds.

- Mutual Funds: Pools of money collected from many investors to invest in a diversified portfolio of securities.

Importance of Budgeting

Budgeting is the process of creating a plan for how you will spend your money. It helps you track your expenses, prioritize your spending, and save for future goals. Without a budget, it’s easy to overspend and struggle with financial stability.

Remember, a budget is not about restricting your spending, but rather about being intentional with your money to reach your financial goals.

Setting Financial Goals

Setting financial goals is crucial for a solid financial plan. It helps you stay motivated, focused, and disciplined in managing your money effectively. By setting realistic financial goals, you can track your progress and make necessary adjustments along the way.

Short-term and long-term financial objectives play different roles in your financial journey. Short-term goals are usually achievable within a year and can include building an emergency fund, paying off credit card debt, or saving for a vacation. On the other hand, long-term goals take several years to achieve and may involve buying a house, saving for retirement, or funding your child’s education.

Creating a budget aligned with your financial goals is essential for success. Start by determining your income and expenses, then allocate a portion of your income towards your goals. Make sure to prioritize your goals based on their importance and urgency. Regularly review and adjust your budget to stay on track and ensure you’re making progress towards your financial goals.

Managing Income and Expenses

Managing income effectively is crucial for achieving financial stability. By understanding the concept of needs versus wants in financial decision-making, individuals can make informed choices about their spending habits. Additionally, reducing unnecessary expenses can help save money for future financial goals.

Strategies for Managing Income Effectively

- Create a budget outlining your monthly income and expenses.

- Track your spending to identify areas where you can cut back.

- Allocate a portion of your income to savings and investments.

- Avoid overspending on non-essential items.

Needs vs. Wants in Financial Decision-Making

It’s important to differentiate between needs and wants when managing expenses. Needs are essential for survival and well-being, while wants are non-essential items that provide enjoyment or luxury.

Understanding this distinction can help prioritize spending on necessities while reducing unnecessary expenses on wants.

Tips for Reducing Unnecessary Expenses

- Avoid impulse purchases by creating a shopping list and sticking to it.

- Compare prices before making big purchases to ensure you’re getting the best deal.

- Cut back on dining out and prepare meals at home to save money on food expenses.

- Cancel unused subscriptions or services to free up extra cash.

Introduction to Savings and Investment

Saving and investing are two important concepts in personal finance. Saving involves setting aside a portion of your income for future needs or emergencies, usually in a low-risk account like a savings account. On the other hand, investing is the process of putting your money into assets with the expectation of earning a profit, typically with higher risks but potentially higher returns.

Low-Risk and High-Risk Investment Options

- Low-risk investment options include savings accounts, certificates of deposit (CDs), and government bonds. These investments offer lower returns but are considered safer.

- High-risk investment options include stocks, mutual funds, and real estate. These investments have the potential for higher returns but also come with higher levels of risk.

Compounding Interest and its Benefits

Compounding interest is the process where your initial investment earns interest, and over time, that interest also earns interest. This results in exponential growth of your money. The benefits of compounding interest include:

- Increased wealth accumulation over time due to the exponential growth of your investments.

- The ability to reach your financial goals faster by taking advantage of the power of compounding.

- Compound interest allows you to earn interest on both your initial investment and the interest that has been added to your account.

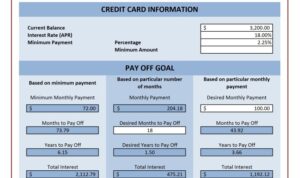

Understanding Credit and Debt

When it comes to managing your finances, understanding credit and debt is crucial for your financial health. Your credit score plays a significant role in determining your ability to borrow money, while debt management strategies can help you stay on top of your financial obligations.

Importance of Credit Scores

Your credit score is a numerical representation of your creditworthiness, based on your credit history. Lenders use this score to assess the risk of lending you money. A higher credit score can result in better loan terms and lower interest rates, while a lower score may limit your borrowing options.

Remember, a good credit score can open doors to financial opportunities, while a poor score can lead to higher costs and limited access to credit.

Types of Debt and Debt Management Strategies

- There are two main types of debt: secured debt (backed by collateral like a mortgage or car loan) and unsecured debt (such as credit card debt or personal loans).

- To manage debt effectively, consider creating a budget, prioritizing high-interest debt, negotiating with creditors for lower rates, and exploring debt consolidation options.

Tips for Building Good Credit and Avoiding Debt Traps

- Pay your bills on time to establish a positive payment history.

- Keep your credit card balances low and avoid maxing out your credit limits.

- Regularly review your credit report for errors and report any discrepancies.

- Avoid taking on more debt than you can afford to repay.

Financial Planning for the Future

In order to secure a stable financial future, it is essential to consider aspects such as emergency funds, retirement planning, insurance, and creating a comprehensive financial plan.

Emergency Funds and Retirement Planning

Emergency funds are crucial for unexpected expenses such as medical emergencies or job loss. It is recommended to have at least 3-6 months’ worth of expenses saved up in a separate account. Retirement planning involves setting aside funds for your post-working years through retirement accounts like 401(k) or IRA.

Insurance in Financial Planning

Insurance plays a vital role in financial planning by providing protection against unforeseen events like accidents, illness, or property damage. Health insurance, life insurance, and car insurance are some of the common types that can safeguard your finances in times of need.

Creating a Comprehensive Financial Plan

- Assess your current financial situation by calculating your income, expenses, assets, and liabilities.

- Set long-term financial goals such as buying a home, saving for children’s education, or retiring comfortably.

- Develop a budget to track your spending and ensure you are saving enough for your future goals.

- Diversify your investments to reduce risk and maximize returns over time.

- Regularly review and adjust your financial plan as your circumstances change.