When it comes to navigating unexpected financial storms, having a solid plan in place can make all the difference. From understanding what qualifies as a financial emergency to building an emergency fund and creating a financial emergency plan, this guide will walk you through the steps needed to be financially prepared for any curveball life throws your way.

So, buckle up and get ready to dive into the world of financial preparedness!

Understanding Financial Emergencies

Financial emergencies are unexpected events that can have a significant impact on an individual’s financial well-being. These emergencies often require immediate attention and can cause financial stress if not adequately prepared for.

Types of Financial Emergencies

- Medical emergencies – Unexpected medical expenses due to illness or injury.

- Job loss – Sudden loss of employment leading to a loss of income.

- Car repairs – Unexpected vehicle repairs that can be costly.

- Home repairs – Urgent repairs needed for home maintenance.

Importance of Being Prepared

Financial emergencies can happen to anyone at any time, and being prepared can help mitigate the impact. Having an emergency fund, insurance coverage, and a budget can provide a safety net during challenging times.

Impact of Financial Emergencies

“According to a recent survey, 40% of Americans would struggle to cover a $400 emergency expense.” – CNBC

It is crucial to understand the types of financial emergencies individuals may face, the importance of preparedness, and the significant impact these emergencies can have on one’s financial stability.

Building an Emergency Fund

Building an emergency fund is crucial for financial stability and preparedness. It serves as a safety net during unexpected events such as job loss, medical emergencies, or car repairs. Here’s how you can start building and growing your emergency fund:

The Importance of Having an Emergency Fund

An emergency fund provides financial security and peace of mind, ensuring that you can cover unexpected expenses without going into debt or draining your savings meant for other goals.

- Calculate the Ideal Emergency Fund Size

- Consider your Individual Circumstances

Financial experts recommend saving 3 to 6 months’ worth of living expenses in your emergency fund.

Evaluate your monthly expenses, income stability, and any dependents to determine the appropriate size of your emergency fund.

Strategies for Saving Towards an Emergency Fund

There are various strategies you can use to save money for your emergency fund effectively:

- Automated Savings

- Budgeting Techniques

Set up automatic transfers from your checking account to a separate savings account specifically designated for your emergency fund.

Allocate a portion of your income each month towards your emergency fund as a non-negotiable expense, just like paying bills.

Where to Store the Emergency Fund

It’s essential to keep your emergency fund in an easily accessible account, such as a high-yield savings account or a money market account. These accounts offer liquidity and allow you to withdraw funds quickly in case of emergencies.

Creating a Financial Emergency Plan

Planning for financial emergencies is crucial to ensure you are prepared for unexpected situations that may arise. Here are the steps involved in creating a solid financial emergency plan:

Role of Insurance in a Comprehensive Financial Emergency Plan

Insurance plays a key role in a comprehensive financial emergency plan by providing protection against unexpected events such as accidents, illnesses, or natural disasters. Having insurance coverage can help mitigate financial losses and provide peace of mind during difficult times.

Tips on How to Prioritize Expenses in a Financial Crisis

When facing a financial crisis, it’s important to prioritize your expenses to ensure that essential needs are met. Here are some tips to help you navigate through a challenging situation:

- First, cover basic necessities such as food, shelter, and utilities.

- Next, focus on essential bills like mortgage or rent, healthcare, and insurance premiums.

- Consider negotiating with creditors to lower payments or defer payments temporarily.

- Avoid unnecessary expenses and prioritize spending on items that are crucial for survival.

Tools and Resources for Developing a Financial Emergency Plan

There are various tools and resources available to help you develop and implement a financial emergency plan effectively. Some of these include:

- Financial planning apps like Mint or YNAB to track expenses and create a budget.

- Websites such as FEMA’s Ready.gov for guidance on emergency preparedness and financial planning.

- Consulting with a financial advisor or counselor for personalized advice and assistance in creating a plan.

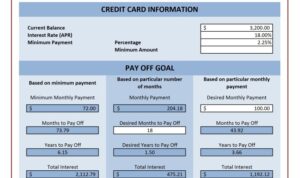

- Utilizing online calculators to determine the ideal size of your emergency fund based on your financial situation.

Seeking Professional Help

When it comes to planning for financial emergencies, there may come a time when seeking the help of a financial advisor or planner is necessary. These professionals can provide valuable guidance and expertise to help you navigate through the complexities of financial planning.

Benefits of Consulting with a Professional

- Expertise: Financial advisors and planners have the knowledge and experience to help you make informed decisions regarding your finances.

- Customized Advice: Professionals can tailor their recommendations to suit your specific financial goals and circumstances.

- Peace of Mind: Working with a financial advisor can alleviate stress and uncertainty related to financial planning.

Considerations for Selecting the Right Professional

- Qualifications: Look for professionals with relevant certifications and credentials, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

- Experience: Choose an advisor with a solid track record and experience in dealing with financial emergencies.

- Compatibility: Ensure that you feel comfortable communicating and working with the advisor on your financial matters.

Assistance in Creating a Solid Financial Emergency Plan

- Assessment: Professionals can assess your current financial situation and identify areas that need improvement to better prepare for emergencies.

- Goal Setting: Advisors can help you set realistic financial goals and create a plan to achieve them, including building an emergency fund.

- Risk Management: Planners can assist in evaluating and mitigating financial risks to protect your assets and investments during emergencies.