Yo, diving into the world of financial advisors, let’s break down why having one is key to securing that bag and reaching your financial goals. From managing your money to long-term planning, we got you covered with all the deets.

Now, let’s get into the nitty-gritty of what a financial advisor does and why you need one in your corner.

Importance of a Financial Advisor

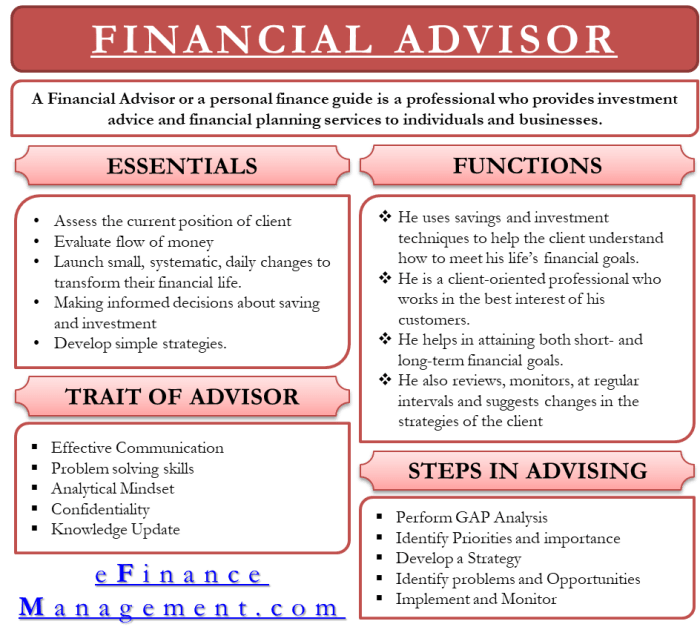

Financial advisors play a crucial role in helping individuals manage their personal finances effectively. They provide valuable guidance and expertise to assist clients in making informed decisions regarding their money matters.

Role in Setting and Achieving Financial Goals

Financial advisors work closely with clients to understand their financial objectives and develop a customized plan to help them achieve these goals. They assess the current financial situation, identify areas for improvement, and create a roadmap for success. By setting realistic and achievable financial goals, individuals can track their progress and make necessary adjustments along the way.

Benefits of Long-Term Financial Planning

Working with a financial advisor for long-term financial planning offers numerous benefits. Advisors can help clients navigate complex financial situations, such as retirement planning, investment strategies, tax optimization, and risk management. By developing a comprehensive financial plan, individuals can secure their financial future and achieve a sense of financial stability and peace of mind.

Qualifications and Expertise

Financial advisors play a crucial role in helping individuals navigate the complex world of finance. To ensure you are working with a reputable advisor, it is important to consider their qualifications and expertise.

Qualifications and Certifications

Reputable financial advisors should hold relevant qualifications and certifications to demonstrate their expertise. Some common certifications to look for include Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC), and Chartered Financial Analyst (CFA). These certifications require rigorous training and exams, ensuring that advisors have the knowledge and skills to provide sound financial advice.

Expertise vs Self-Directed Financial Planning

While self-directed financial planning can be empowering, it lacks the expertise and specialized knowledge that a financial advisor brings to the table. Financial advisors have a deep understanding of various financial products, investment strategies, tax implications, and retirement planning options. They can provide personalized guidance tailored to your specific financial goals and circumstances, helping you make informed decisions to secure your financial future.

Specialized Knowledge in Investments, Taxes, and Retirement Planning

Specialized knowledge in areas like investments, taxes, and retirement planning is crucial for a financial advisor to effectively guide their clients. Advisors with expertise in these areas can help clients optimize their investment portfolios, minimize tax liabilities, and create comprehensive retirement plans. By staying up-to-date on industry trends and regulations, financial advisors can provide valuable insights and strategies to help clients achieve their financial objectives.

Customized Financial Plans

Financial advisors play a crucial role in creating personalized financial plans that cater to individual goals and risk tolerance. By understanding a client’s unique financial situation, advisors can tailor investment strategies to meet their specific needs and objectives.

Examples of Customized Investment Strategies

- Adjusting asset allocation based on risk tolerance: A financial advisor may recommend a more conservative investment approach for clients with a low risk tolerance, while suggesting a more aggressive strategy for those comfortable with higher risk.

- Creating a diversified portfolio: Depending on a client’s financial goals and time horizon, an advisor may suggest a mix of stocks, bonds, and other assets to maximize returns and minimize risk.

Role of Regular Reviews and Adjustments

Regular reviews and adjustments are essential in maintaining a customized financial plan. Financial advisors monitor market conditions, economic trends, and changes in a client’s life circumstances to ensure the plan remains aligned with their goals. By making necessary adjustments along the way, advisors help clients stay on track towards financial success.

Market Knowledge and Trends

Financial advisors are constantly in tune with market trends and economic changes to provide the best advice to their clients. By staying up-to-date with the latest developments, they can help clients make informed investment decisions and navigate through market volatility and uncertainty.

Significance of Market Knowledge in Investment Decisions

Market knowledge plays a crucial role in making informed investment decisions. Financial advisors track market trends, analyze economic indicators, and assess potential risks to guide their clients towards profitable investment opportunities. This knowledge helps clients capitalize on market opportunities and avoid potential pitfalls.

How Financial Advisors Help Navigate Market Volatility

During times of market volatility and uncertainty, financial advisors provide valuable guidance to their clients. They offer reassurance, tailor investment strategies to mitigate risks, and adjust portfolios according to changing market conditions. By leveraging their expertise and market knowledge, financial advisors help clients stay focused on long-term financial goals despite short-term market fluctuations.