Diving into the world of Interest rates and mortgages, get ready to explore how these crucial factors play a major role in the housing market. From understanding interest rates to different types of mortgages, this topic is about to get real interesting.

So buckle up, because we’re about to break down everything you need to know about interest rates and mortgages in a way that’s both informative and engaging.

Overview of Interest Rates

Interest rates play a crucial role in the housing market, especially when it comes to mortgages. These rates determine how much you’ll pay back in addition to the principal amount borrowed. Let’s dive deeper into how interest rates impact mortgages.

Impact of Interest Rates on Mortgage Payments

- When interest rates are low, borrowers can secure lower monthly mortgage payments because the cost of borrowing money is cheaper. This can make homeownership more affordable for many individuals.

- On the contrary, when interest rates are high, borrowers will have to pay more in interest, resulting in higher monthly mortgage payments. This can make it more challenging for people to afford a home or refinance their existing mortgage.

Factors Influencing Interest Rates in the Housing Market

- Economic conditions: Interest rates are influenced by the overall state of the economy, including inflation, employment levels, and economic growth.

- Central bank policies: The decisions made by the Federal Reserve can impact interest rates, as they have the ability to adjust the federal funds rate, which affects borrowing costs.

- Market forces: Supply and demand dynamics in the bond market also play a role in determining interest rates in the housing market.

Types of Mortgages

When it comes to mortgages, there are two main types to consider: fixed-rate mortgages and adjustable-rate mortgages. Each type has its own set of benefits and drawbacks, making them suitable for different situations.

Fixed-rate Mortgages

Fixed-rate mortgages have an interest rate that remains the same throughout the entire term of the loan. This means that your monthly payments will also remain constant, providing predictability and stability. These mortgages are ideal for individuals who prefer consistency and want to budget effectively without worrying about fluctuating interest rates.

- Benefits:

- Stable monthly payments

- Predictable long-term budgeting

- Protection against rising interest rates

- Drawbacks:

- Initial interest rates may be higher than adjustable-rate mortgages

- No potential for decreased payments if interest rates fall

Adjustable-rate Mortgages

Adjustable-rate mortgages, on the other hand, have interest rates that can fluctuate periodically based on market conditions. Initially, these mortgages may offer lower interest rates than fixed-rate mortgages, but the rates can change over time, leading to potential fluctuations in monthly payments.

- Benefits:

- Potentially lower initial interest rates

- Possible lower payments if interest rates decrease

- Drawbacks:

- Uncertainty with fluctuating interest rates

- Risk of increased payments if interest rates rise

In situations where interest rates are expected to remain low or decrease, an adjustable-rate mortgage may be more suitable for those looking to take advantage of lower initial rates. On the other hand, if you prefer stability and want to avoid any surprises in your monthly payments, a fixed-rate mortgage might be the better option for you.

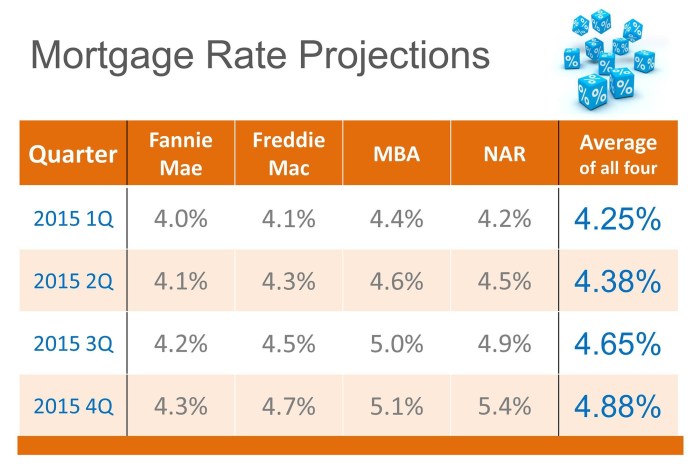

Mortgage Rates Trends

In the world of mortgages, keeping an eye on the trends of interest rates is crucial for potential homebuyers. Let’s dive into the historical trends in mortgage rates over the past decade and how economic indicators play a role in these fluctuations.

Historical Mortgage Rate Trends

- Over the past decade, mortgage rates have seen significant fluctuations, with both increases and decreases in interest rates.

- Following the 2008 financial crisis, mortgage rates hit historic lows, making homeownership more affordable for many.

- In recent years, mortgage rates have been gradually increasing due to factors like economic growth, inflation, and Federal Reserve policies.

- It’s important for borrowers to track these trends to make informed decisions on when to lock in a mortgage rate.

Influence of Economic Indicators

- Economic indicators such as GDP growth, unemployment rates, and inflation play a significant role in influencing mortgage rate fluctuations.

- When the economy is strong and growing, mortgage rates tend to rise as demand for loans increases.

- Conversely, during economic downturns, mortgage rates may decrease as the Federal Reserve implements policies to stimulate the economy.

- Borrowers should pay attention to these economic indicators to anticipate potential changes in mortgage rates.

Tracking Mortgage Rate Trends

- Borrowers can monitor mortgage rate trends through financial news outlets, online mortgage rate trackers, and by working closely with lenders.

- It’s recommended to keep an eye on the 10-year Treasury yield, as it serves as a benchmark for long-term mortgage rates.

- By staying informed about mortgage rate trends, borrowers can make timely decisions on when to apply for a mortgage and lock in a favorable rate.

Impact of Interest Rates on Homebuyers

Interest rates play a crucial role in the affordability of homes for potential buyers. When interest rates rise, the cost of borrowing money increases, making mortgages more expensive. On the other hand, lower interest rates can make homeownership more accessible. Let’s delve into how these changes affect homebuyers and explore strategies to navigate fluctuating interest rates.

Changes in Interest Rates

Fluctuations in interest rates can significantly impact the monthly mortgage payments for homebuyers. When rates are high, buyers may qualify for smaller loans due to higher monthly payments. Conversely, lower interest rates can allow buyers to afford larger loans and more expensive homes.

Strategies for Homebuyers

- Monitor Interest Rate Trends: Stay informed about market trends to make informed decisions on when to lock in a mortgage rate.

- Improve Credit Score: A higher credit score can help secure better interest rates from lenders.

- Consider Adjustable-Rate Mortgages: ARM loans may offer lower initial rates, but be aware of potential rate adjustments in the future.

Securing the Best Mortgage Rates

- Shop Around: Compare rates from multiple lenders to find the best offer.

- Negotiate with Lenders: Don’t hesitate to negotiate terms and rates with lenders to secure a favorable deal.

- Lock In Rates: When you find a favorable rate, consider locking it in to avoid potential increases before closing on your home.