Diving into the world of Investment property financing, get ready to explore the ins and outs of securing funding for your next real estate venture. From traditional bank loans to private money lending, we’ll break down the options and help you navigate the path to financial success.

With a focus on different financing types, qualifying criteria, down payment requirements, loan terms, and using home equity, this guide will equip you with the knowledge needed to make informed decisions in the competitive world of real estate investing.

Types of Investment Property Financing

Investing in property can be a major key to building wealth, but figuring out the financing can be a real game changer. Let’s break down the different types of investment property financing options available to help you make those money moves.

Traditional Bank Loans vs. Private Money Lending

When it comes to financing your investment property, you can go the traditional route with bank loans or opt for private money lending. Traditional bank loans typically have lower interest rates and longer repayment terms, but they also come with stricter eligibility requirements and longer approval times. On the other hand, private money lending involves borrowing from individuals or private investors who are willing to fund your investment property. While the interest rates may be higher, the approval process is usually quicker and more flexible, making it a popular choice for investors looking to move fast.

How Hard Money Loans Work

Hard money loans are another option for financing investment properties, especially for those who may not qualify for traditional bank loans. These loans are typically short-term, high-interest loans secured by the value of the property itself. Hard money lenders focus more on the property’s value rather than the borrower’s credit score, making it a viable option for investors looking to secure financing quickly. However, these loans usually come with higher interest rates and fees, so it’s important to weigh the pros and cons before diving in.

Qualifying for Investment Property Loans

When it comes to securing financing for investment properties, there are certain eligibility criteria that lenders typically look for. Understanding these requirements can help you prepare and improve your chances of loan approval.

Credit Scores and Income Levels

One of the key factors that lenders consider when approving investment property loans is the borrower’s credit score. A higher credit score indicates a lower risk for the lender, making it easier to qualify for the loan. Additionally, lenders will also assess the borrower’s income level to ensure that they have the financial capacity to repay the loan.

Debt-to-Income Ratio

The debt-to-income ratio is another crucial factor in qualifying for investment property loans. This ratio compares the borrower’s monthly debt payments to their gross monthly income. Lenders prefer a lower debt-to-income ratio as it signifies that the borrower has sufficient income to cover their existing debts as well as the new loan payments. A lower ratio increases the likelihood of loan approval.

Down Payment Requirements

When it comes to investment property financing, down payment requirements play a crucial role in determining the terms of your loan. Let’s dive into the usual down payment percentages required for investment property financing, strategies for saving up for a down payment, and how different down payment amounts can impact the overall financing terms.

Usual Down Payment Percentages

- For conventional loans, the typical down payment percentage for an investment property is around 20-25% of the purchase price.

- Some lenders may require a higher down payment, up to 30% or more, depending on factors like credit score, property type, and loan amount.

- Government-backed loans, such as FHA or VA loans, may offer lower down payment options, but these are usually reserved for primary residences, not investment properties.

Strategies for Saving Up

- Set a specific savings goal and create a budget to allocate a portion of your income towards saving for the down payment.

- Consider cutting back on expenses, finding additional sources of income, or investing in high-yield savings accounts or other investment vehicles to grow your down payment fund faster.

- Explore options like partnering with other investors or seeking down payment assistance programs to help cover the initial investment.

Impact of Different Down Payment Amounts

- A higher down payment typically results in lower monthly mortgage payments and less interest paid over the life of the loan.

- Conversely, a lower down payment may lead to higher monthly payments, potentially requiring private mortgage insurance (PMI), and a higher overall cost of financing.

- Having a larger down payment can also make you a more attractive borrower to lenders, potentially leading to better loan terms and lower interest rates.

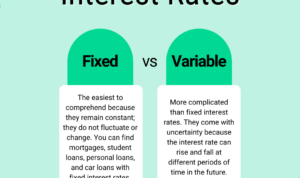

Loan Terms and Interest Rates

When it comes to investment property financing, understanding the loan terms and interest rates is crucial for making informed decisions. Let’s dive into the details.

Interest rates for investment properties are typically higher than those for primary residences. This is because lenders view investment properties as riskier investments due to factors like potential vacancy rates, property maintenance, and market fluctuations.

Common Loan Terms for Investment Property Financing

- Loan-to-Value (LTV) Ratio: Lenders often require a lower LTV ratio for investment properties, typically around 75-80%.

- Loan Duration: Investment property loans usually have shorter loan terms, such as 15 or 30 years.

- Amortization: Some lenders may offer interest-only payments for a certain period before fully amortizing the loan.

Factors Influencing Interest Rates on Investment Property Loans

- Risk Assessment: Lenders assess the risk associated with the investment property, considering factors like location, condition, and potential rental income.

- Borrower’s Credit Score: A higher credit score can lead to lower interest rates, as it demonstrates the borrower’s creditworthiness.

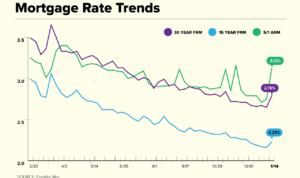

- Market Conditions: Interest rates can fluctuate based on overall market conditions, economic trends, and the lender’s own policies.

Using Home Equity for Investment Property Financing

Using home equity to finance investment properties can be a smart strategy for homeowners looking to expand their real estate portfolio. By tapping into the equity built up in their primary residence, individuals can access funds to purchase additional properties and potentially increase their overall wealth.

Benefits of Using Home Equity for Investment Property Financing

- Lower Interest Rates: Home equity loans typically offer lower interest rates compared to other types of financing, making it a cost-effective option for investment property purchases.

- Tax Deductible Interest: Interest paid on home equity loans used for investment properties may be tax deductible, providing potential tax benefits for homeowners.

- Flexible Terms: Home equity loans often come with flexible repayment terms, allowing homeowners to tailor the loan to their financial situation.

Risks of Using Home Equity for Investment Property Financing

- Risk of Foreclosure: Using home equity puts the primary residence at risk, as failure to repay the loan could lead to foreclosure.

- Increased Debt Burden: Taking on additional debt through a home equity loan can increase overall debt levels, impacting the homeowner’s financial stability.

- Market Volatility: The real estate market can be unpredictable, and using home equity to invest in properties exposes homeowners to market fluctuations.

Strategies for Maximizing Benefits

- Invest Wisely: Conduct thorough research and due diligence before using home equity to invest in properties to minimize risks and maximize returns.

- Consider Cash Flow: Ensure that the rental income from the investment property is sufficient to cover loan payments and expenses to avoid financial strain.

- Monitor Market Trends: Stay informed about real estate market trends and property values to make informed decisions about investment opportunities.