Diving into the world of money management for teenagers, this guide offers a fresh perspective on handling finances at a young age. From budgeting to saving and investing, teenagers are empowered to take control of their financial future in a way that’s both educational and empowering.

Unveiling the secrets behind financial success for teenagers, this guide breaks down complex concepts into easy-to-understand tips and tricks.

Importance of Money Management

Money management is crucial for teenagers as it sets the foundation for financial responsibility and independence later in life. By learning how to manage money effectively at a young age, teenagers can avoid falling into debt traps and develop healthy spending habits that will benefit them in the long run.

Benefits of Good Money Management

- Allows teenagers to save for future goals such as college education, travel, or starting a business.

- Teaches the importance of budgeting and living within one’s means, preventing overspending and debt accumulation.

- Instills a sense of financial discipline and responsibility, leading to better decision-making in the future.

Long-Term Impact of Learning Money Management

Learning money management at a young age can lead to increased financial stability and security in adulthood.

Teens who understand the value of saving and investing early on are more likely to build wealth over time and achieve financial goals. Additionally, good money management skills acquired in adolescence can help teenagers navigate financial challenges and unexpected expenses as they transition into adulthood.

Budgeting for Teenagers

Managing money as a teenager can be challenging, but creating a budget is a crucial step towards financial independence and responsibility. By setting up a budget, teenagers can track their expenses, save money, and work towards achieving their financial goals.

Basics of Creating a Budget

- Start by calculating your total income, including allowances, part-time job earnings, or any other sources of money.

- Next, list all your expenses, such as school supplies, entertainment, clothing, and savings.

- Differentiate between your needs and wants to prioritize essential expenses over discretionary spending.

- Allocate a portion of your income to savings and set aside money for emergencies or unexpected costs.

Tips for Tracking Expenses Effectively

- Keep a spending journal or use budgeting apps to monitor your purchases and categorize your expenses.

- Avoid impulsive buying by creating a shopping list and sticking to it when purchasing items.

- Review your expenses regularly to identify areas where you can cut back and save more money.

- Consider setting a weekly or monthly spending limit to stay within your budget and avoid overspending.

Importance of Setting Financial Goals within a Budget

Setting financial goals within a budget helps teenagers stay focused on their objectives and motivates them to save money effectively. Whether it’s saving for a new gadget, a college fund, or a dream vacation, having clear financial goals allows teenagers to make informed decisions about their spending habits and prioritize their long-term aspirations.

Earning Money

In today’s fast-paced world, teenagers have various opportunities to earn money while balancing their school responsibilities. It is essential to understand the different ways to earn money, how to manage time effectively, and the importance of saving a portion of what is earned.

Part-time Jobs

- Consider working at local retail stores, restaurants, or tutoring services.

- Look for opportunities at summer camps, babysitting, or pet sitting.

- Check with neighbors for odd jobs like lawn mowing or snow shoveling.

Freelancing

- Explore freelance opportunities in writing, graphic design, social media management, or web development.

- Offer services such as dog walking, house cleaning, or car washing in the neighborhood.

- Use online platforms like Fiverr, Upwork, or TaskRabbit to find freelance gigs.

Balance with School Responsibilities

It is crucial to prioritize schoolwork and extracurricular activities while earning money. Create a schedule that allows time for studying, completing assignments, and attending classes. Remember to communicate with employers about your availability and any scheduling conflicts.

Importance of Saving

“A penny saved is a penny earned.”

Saving a portion of the money earned is essential for future financial goals. Consider opening a savings account and deposit a percentage of each paycheck. Start building an emergency fund for unexpected expenses and learn the value of delayed gratification.

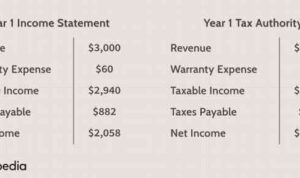

Saving and Investing

Saving and investing are both important aspects of managing money for teenagers. Saving involves setting aside a portion of your income for future needs or emergencies, while investing focuses on putting your money into assets that have the potential to grow over time.

Difference between Saving and Investing

Saving is usually done by putting money into a savings account or a piggy bank, where it earns a small amount of interest. On the other hand, investing involves purchasing assets like stocks, bonds, or mutual funds, with the goal of generating a higher return on investment over a longer period.

Strategies for Saving Money Effectively

- Set specific savings goals, such as saving for a new gadget or a future trip.

- Track your expenses to identify areas where you can cut back and save more.

- Avoid impulse purchases and think carefully before spending money on non-essential items.

- Automate your savings by setting up automatic transfers from your checking account to your savings account.

Simple Investment Options for Teenagers

- Consider investing in a low-cost index fund, which provides diversification and can help spread risk.

- Explore investing in individual stocks of companies you believe in and have researched thoroughly.

- Look into opening a custodial account with the help of a parent or guardian to start investing in the stock market.

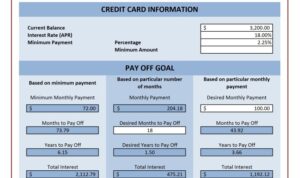

Avoiding Debt and Managing Credit

When it comes to managing money, avoiding debt and understanding how credit works are essential skills for teenagers to learn. Let’s dive into the risks associated with debt, tips for avoiding debt traps, and the responsible use of credit cards.

Risks Associated with Debt

Debt can quickly spiral out of control for teenagers who may not have a steady income or fully understand the consequences. It can lead to high-interest payments, damaged credit scores, and limited financial opportunities in the future.

Tips for Avoiding Debt Traps

- Avoid unnecessary purchases and prioritize needs over wants.

- Create a budget and stick to it to track your spending.

- Build an emergency fund to cover unexpected expenses without relying on credit.

- Avoid borrowing money from friends or using payday loans that come with high interest rates.

Responsible Use of Credit Cards and Building Good Credit History

Using a credit card responsibly can help teenagers build a positive credit history, which is crucial for future financial endeavors like buying a car or a home. Here are some tips:

- Pay your credit card bill on time and in full to avoid interest charges.

- Keep your credit utilization low by not maxing out your credit limit.

- Avoid opening multiple credit cards at once to prevent overspending.

- Monitor your credit report regularly to spot any errors or signs of identity theft.