Diving deep into the world of mortgage loan rates today, get ready to discover how these rates impact borrowers and what factors play a role in determining them. From current trends to tips on improving credit scores, this topic is packed with valuable insights for anyone navigating the mortgage market.

Explore the different types of mortgage loan rates available today and how they can make a difference in your financial decisions.

Overview of Mortgage Loan Rates Today

Mortgage loan rates refer to the interest rates charged by lenders on loans used to purchase a home or refinance an existing mortgage. These rates have a significant impact on borrowers as they determine the cost of borrowing money for a home purchase.

Factors that influence mortgage loan rates in today’s market include the overall state of the economy, inflation rates, the Federal Reserve’s monetary policy, and the demand for mortgages. Lenders also consider the borrower’s credit score, loan amount, loan term, and the type of mortgage when determining the interest rate.

Types of Mortgage Loan Rates

- Fixed-Rate Mortgages: These loans have a set interest rate for the entire term of the loan, providing predictability and stability for borrowers.

- Adjustable-Rate Mortgages (ARMs): These loans have an initial fixed rate for a certain period, after which the rate adjusts periodically based on market conditions.

- Jumbo Loans: These are loans that exceed the conforming loan limits set by Fannie Mae and Freddie Mac, typically carrying higher interest rates due to the increased risk for lenders.

- Government-Backed Loans: Loans insured by the government, such as FHA loans or VA loans, often have competitive interest rates and more flexible qualification requirements.

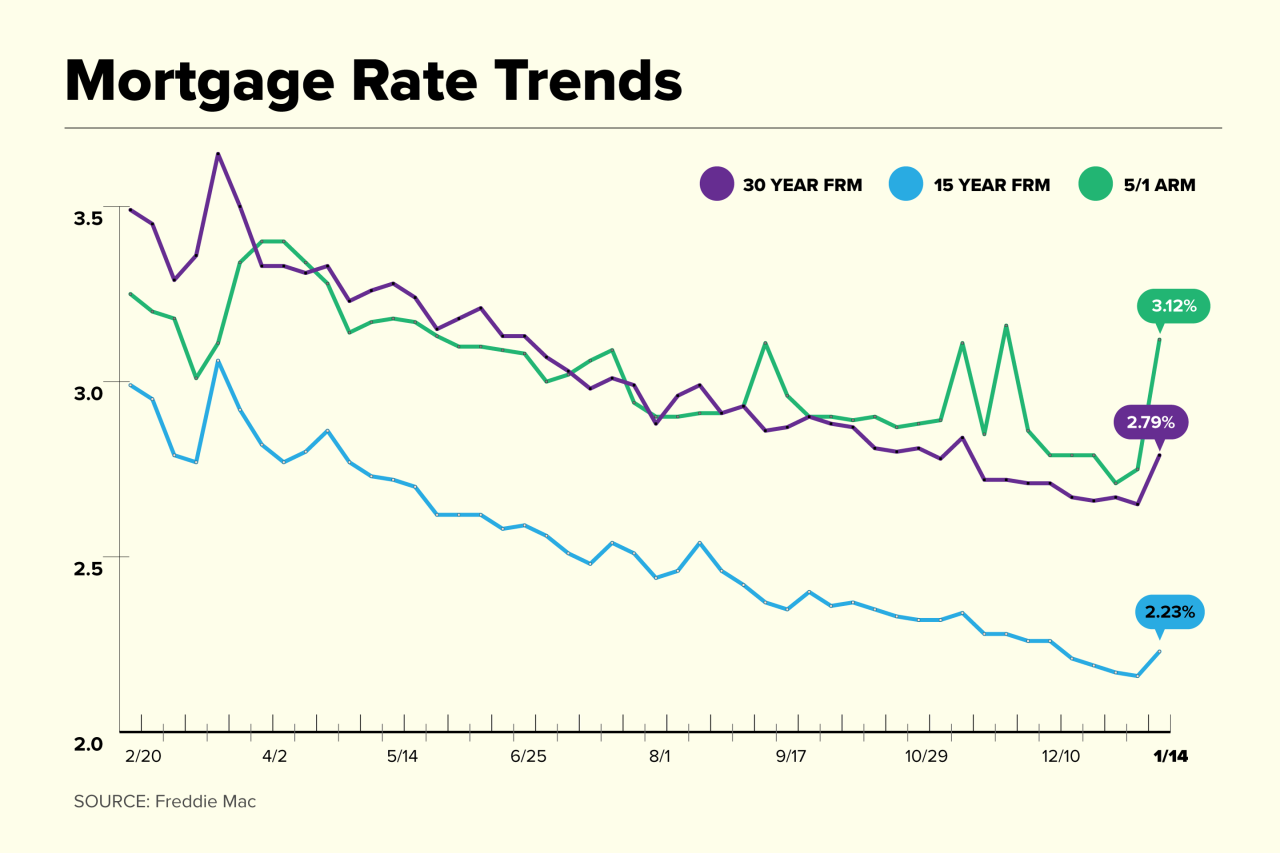

Current Trends in Mortgage Loan Rates

In recent times, mortgage loan rates have been experiencing fluctuations due to various factors influencing the market. Let’s delve deeper into the current trends in mortgage loan rates and understand how they have been evolving.

Comparison with Historical Data

When comparing mortgage loan rates today with historical data, it is evident that there have been significant changes over time. In the past, mortgage rates were much higher compared to the current rates, which are relatively low. This fluctuation can be attributed to economic conditions, government policies, and global events impacting the financial market.

External Factors Affecting Mortgage Loan Rates

External factors play a crucial role in determining mortgage loan rates today. Economic conditions, such as inflation rates, job market stability, and overall economic growth, can influence the direction of mortgage rates. Additionally, government policies, including changes in interest rates set by the Federal Reserve, can also impact mortgage loan rates. Other factors like geopolitical tensions or global economic trends can further contribute to the volatility in mortgage rates. It is essential for potential homebuyers to stay informed about these external factors to make informed decisions regarding mortgage loans.

Impact of Credit Scores on Mortgage Loan Rates

Having a good credit score is crucial when it comes to securing favorable mortgage loan rates. Lenders use credit scores to assess the risk of lending money to borrowers. The higher the credit score, the lower the risk for the lender, resulting in better interest rates for the borrower.

Credit Scores and Interest Rates

- Lenders offer lower interest rates to borrowers with high credit scores, as they are considered less risky.

- Conversely, borrowers with lower credit scores may be offered higher interest rates to compensate for the increased risk.

- Even a difference of a few points in credit score can significantly impact the interest rate offered on a mortgage loan.

Improving Credit Scores for Better Rates

- Pay bills on time and in full to maintain a positive payment history.

- Keep credit card balances low and avoid maxing out credit limits.

- Avoid opening multiple new credit accounts in a short period, as this can lower your credit score.

- Regularly check your credit report for errors and dispute any inaccuracies to improve your score.

Shopping for the Best Mortgage Loan Rates

When it comes to shopping for the best mortgage loan rates, borrowers must be proactive and diligent in their search. By comparing offers from different lenders and negotiating effectively, borrowers can potentially secure better deals that save them money in the long run.

Comparing Offers from Different Lenders

- Start by researching and gathering quotes from multiple lenders to get an idea of the current rates available.

- Compare not only the interest rates but also the loan terms, fees, and any additional costs associated with each offer.

- Consider reaching out to credit unions, online lenders, and traditional banks to explore a variety of options.

Importance of Negotiating Mortgage Loan Rates

- Don’t be afraid to negotiate with lenders to see if they can offer you a better rate based on your financial profile and creditworthiness.

- Highlight any competitive offers you have received from other lenders to leverage a better deal.

- Ask about any available discounts or promotions that could lower your overall borrowing costs.