As retirement savings plans take center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Get ready to dive into the realm of retirement savings plans, where financial security meets smart investment choices for your golden years.

Types of Retirement Savings Plans

Saving for retirement is crucial to ensure financial security in your golden years. There are several types of retirement savings plans available, each with its own features and eligibility requirements. Let’s take a closer look at some common options:

401(k) Plans

- 401(k) plans are employer-sponsored retirement accounts where employees can contribute a portion of their pre-tax income.

- Employers may match a certain percentage of employee contributions, which is essentially free money towards retirement savings.

- Contributions are typically invested in a selection of mutual funds or other investment options.

- Withdrawals before age 59 ½ may incur penalties, but contributions are tax-deferred until retirement.

Individual Retirement Accounts (IRAs)

- IRAs are retirement accounts that individuals can open independently, regardless of employer sponsorship.

- There are traditional IRAs, where contributions are tax-deductible, and Roth IRAs, where contributions are made with after-tax dollars.

- Both traditional and Roth IRAs have annual contribution limits and eligibility requirements based on income levels.

- Withdrawal rules and tax implications vary between traditional and Roth IRAs.

Pension Plans

- Pension plans are retirement plans typically offered by employers, providing a fixed, pre-determined benefit upon retirement.

- Employers manage pension plan investments and assume the risk, providing retirees with a steady income stream in retirement.

- Eligibility and benefit calculations for pension plans vary by employer and may be based on factors like years of service and salary history.

Comparison and Contrast

- 401(k) plans offer employer matching contributions, while IRAs are individually managed.

- Roth IRAs offer tax-free withdrawals in retirement, unlike traditional IRAs and 401(k) plans.

- Pension plans provide a guaranteed income stream, but contributions and benefits are solely determined by the employer.

Benefits of Retirement Savings Plans

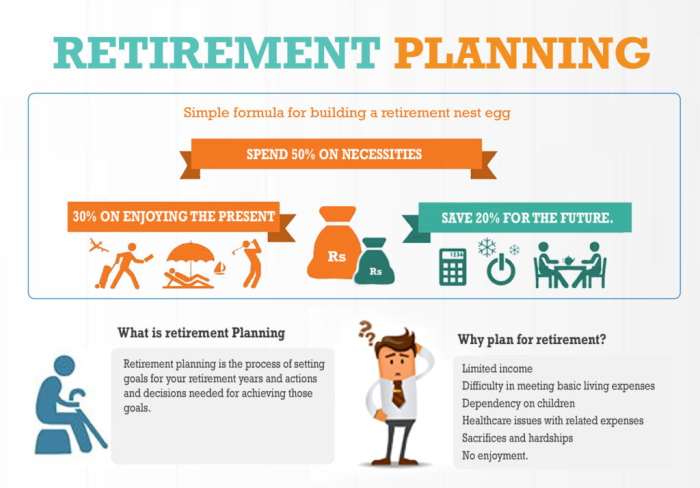

Saving for retirement through a retirement savings plan comes with numerous advantages that can help individuals achieve financial security in their post-retirement years. Let’s delve into the benefits of contributing to a retirement savings plan below.

Financial Security Post-Retirement

By contributing to a retirement savings plan, individuals are setting aside money for their future needs when they are no longer earning a regular income. This ensures that they can maintain their standard of living and cover expenses such as healthcare, housing, and other necessities during retirement.

Tax Benefits

Contributing to a retirement savings plan offers tax benefits that can help individuals reduce their taxable income. For example, traditional 401(k) plans allow contributions to be made on a pre-tax basis, lowering the individual’s taxable income in the year of contribution. In addition, the investment growth within the retirement savings plan is tax-deferred, meaning individuals do not pay taxes on the earnings until they withdraw the funds in retirement. This tax advantage can help individuals maximize their savings and build a more substantial nest egg for the future.

Strategies for Maximizing Retirement Savings

When it comes to maximizing your retirement savings, there are several key strategies to keep in mind. By taking advantage of these tips and tricks, you can ensure that you are setting yourself up for a comfortable retirement.

Maximizing Contributions

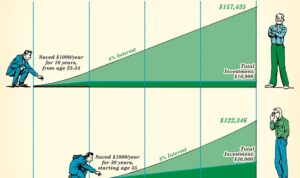

- Contribute the maximum amount allowed by your retirement savings plan each year. This will help you take full advantage of tax benefits and compound interest over time.

- Consider making catch-up contributions if you are over the age of 50. This can help boost your savings as you approach retirement age.

- Automate your contributions to ensure consistency and discipline in saving for retirement.

Employer Matching

- Take full advantage of any employer matching contributions offered in your retirement savings plan. This is essentially free money that can significantly boost your savings.

- Ensure you understand the vesting schedule for employer matching contributions, as this will determine when you have full ownership of these funds.

- Consult with your HR department to maximize your employer matching contributions and make informed decisions about your retirement savings.

Diversifying Investments

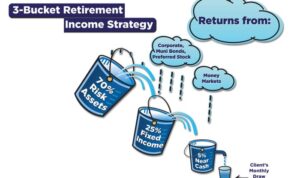

- Explore different investment options within your retirement savings plan to spread risk and potentially increase returns.

- Consider a mix of stocks, bonds, and other assets to create a diversified portfolio that aligns with your risk tolerance and retirement goals.

- Regularly review and adjust your investment allocations based on your age, retirement timeline, and market conditions to optimize your returns.

Withdrawal Rules and Considerations

When it comes to withdrawing money from your retirement savings plan, there are rules and considerations that you need to keep in mind to avoid penalties and make the most of your hard-earned savings.

Early Withdrawals

Early withdrawals from retirement savings plans, typically before the age of 59 ½, may result in penalties. These penalties can include a 10% early withdrawal fee on top of the regular income tax you would owe on the withdrawn amount. It’s important to only withdraw funds when absolutely necessary to avoid these penalties.

Required Minimum Distribution Rules

Once you reach the age of 72, you are required to start taking minimum distributions from your retirement savings plan. These required minimum distributions are calculated based on your life expectancy and the amount of money in your account. Failing to take these distributions can result in hefty penalties, so it’s crucial to stay informed about the rules and requirements.

Factors to Consider for Withdrawal Timing

When deciding on the timing of your withdrawals from your retirement savings plan, there are several factors to consider. These include your current financial needs, tax implications, future expenses, and potential investment growth. It’s important to have a well-thought-out plan in place to ensure you make the most of your retirement savings while avoiding unnecessary penalties.