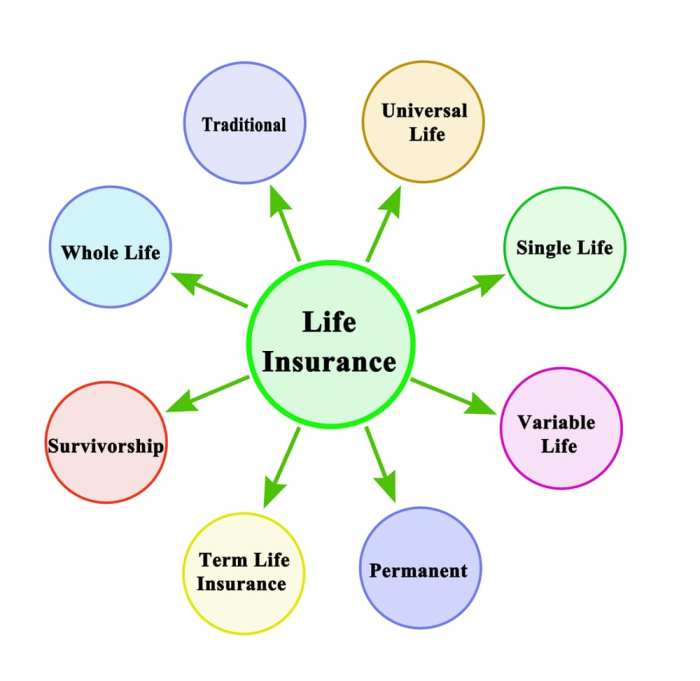

When diving into the world of life insurance, understanding the different types is crucial. From term life insurance to whole life insurance and universal life insurance, each policy comes with its own set of features and benefits. So, buckle up as we explore the ins and outs of these insurance options.

Types of life insurance

Term life insurance is a type of life insurance that provides coverage for a specific period of time, usually ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the insured passes away during the term of the policy. One key feature of term life insurance is that it tends to be more affordable compared to permanent life insurance policies.

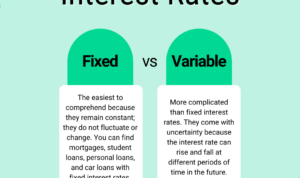

Whole life insurance vs. Universal life insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured. It offers a guaranteed death benefit, as well as a cash value component that grows over time. On the other hand, universal life insurance is another type of permanent life insurance that offers more flexibility in terms of premiums and death benefits. It also has a cash value component that earns interest based on current market rates.

Benefits of permanent life insurance

Permanent life insurance policies, such as whole life and universal life, offer several benefits. These include lifetime coverage, guaranteed death benefits, cash value growth, tax-deferred savings, and the ability to borrow against the cash value. These policies provide financial protection for the insured’s loved ones and can also serve as an investment tool for building wealth over time.

Term life insurance

Term life insurance is a type of life insurance that provides coverage for a specific period of time, typically ranging from 10 to 30 years. It is known for offering high coverage amounts at affordable premiums, making it a popular choice for individuals looking to protect their loved ones financially in case of an unexpected death.

Pros and Cons of Term Life Insurance

- Pros:

- Cost-effective premiums

- High coverage amounts

- Simple and straightforward

- Cons:

- No cash value accumulation

- Premiums can increase at renewal

- Coverage ends after the term

Situations Suitable for Term Life Insurance

- Young families with children

- Individuals with significant debts

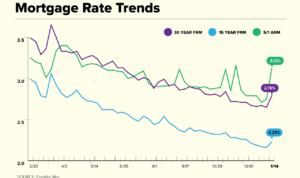

- Coverage for a specific financial obligation, such as a mortgage

Renewing or Converting Term Life Insurance

Term life insurance policies typically have the option to renew at the end of the initial term, but premiums may increase significantly. Some policies also offer the option to convert to a permanent life insurance policy without the need for a medical exam. It’s important to review your options and consider your long-term insurance needs when deciding whether to renew or convert your term life insurance policy.

Whole life insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the policyholder’s life. Unlike term life insurance, which only covers a specific period, whole life insurance guarantees a death benefit payout to the beneficiaries as long as the premiums are paid.

Cash value component

Whole life insurance policies also have a cash value component, which acts as a savings account within the policy. A portion of the premiums paid by the policyholder goes towards this cash value, which grows over time with interest. The policyholder can borrow against this cash value or even surrender the policy for a cash payout.

Payouts to beneficiaries

When the policyholder passes away, the beneficiaries can receive the death benefit payout from the whole life insurance policy in various ways. They can choose to receive a lump sum payment, which is the full amount of the death benefit, or opt for periodic payments over a specific period. Additionally, beneficiaries can also select a life income option, where they receive regular payments for the rest of their lives.

Universal life insurance

Universal life insurance is a type of permanent life insurance that offers both a death benefit and a savings component. Unlike term life insurance, universal life insurance provides flexibility to policyholders in terms of premium payments and death benefits.

Features of universal life insurance

Universal life insurance policies allow policyholders to adjust their premium payments and death benefits based on their financial situation. This flexibility makes it easier for individuals to customize their policies to meet their changing needs over time.

- Flexible premium payments

- Adjustable death benefits

- Cash value accumulation

Investment component of universal life insurance policies

Universal life insurance policies have a savings component that accumulates cash value over time. Policyholders have the option to invest this cash value in a variety of investment options, such as stocks, bonds, or money market funds.

- Policyholders can earn interest on the cash value

- Investment options offer potential for growth

- Cash value can be used to pay premiums or borrow against

Risks and benefits associated with universal life insurance

Universal life insurance offers both risks and benefits to policyholders. While the flexibility and investment component can be advantageous, there are also potential drawbacks to consider, such as fluctuating premiums and returns on investments.

- Benefits: Flexibility in premium payments and death benefits

- Risks: Fluctuating premiums and returns on investments

- Policyholders bear investment risk