As best stocks for beginners takes center stage, this opening passage beckons readers with American high school hip style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Stocks represent ownership in companies, and understanding them is key to financial success. Let’s dive into the exciting world of stock market investing for beginners.

Understand the concept of stocks

Stocks are shares of ownership in a company that investors can purchase. When you buy stocks, you essentially become a partial owner of that company. This means you have a stake in the company’s success and may benefit from its profits through dividends or by selling your shares at a higher price.

Difference between stocks and other investment options

- Stocks vs. Bonds: Stocks represent ownership in a company, while bonds are a form of debt that companies issue to raise capital.

- Stocks vs. Real Estate: Investing in stocks provides ownership in a company, while investing in real estate involves owning physical property.

- Stocks vs. Savings Accounts: Stocks have the potential for higher returns but also come with higher risks compared to savings accounts.

Risks and potential returns associated with investing in stocks

- Volatility: Stock prices can fluctuate greatly in the short term, leading to potential losses.

- Market Risk: External factors like economic conditions and geopolitical events can impact stock prices.

- Potential Returns: Investing in stocks can offer high returns over the long term, outperforming other investment options like bonds or savings accounts.

Factors to consider when choosing stocks

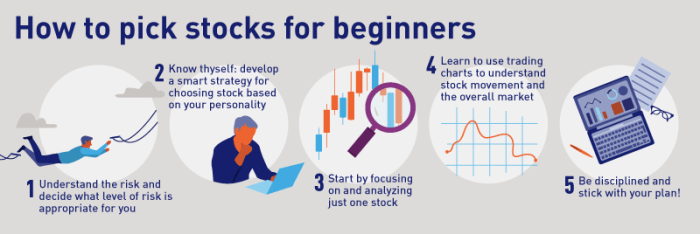

When selecting stocks, there are several key financial metrics to consider to make informed decisions. It is also important to understand the significance of diversification in building a stock portfolio and how market trends and economic factors can impact stock prices.

Key Financial Metrics

- Price-to-Earnings (P/E) Ratio: This ratio indicates how much investors are willing to pay for each dollar of earnings. A lower P/E ratio may suggest that a stock is undervalued.

- Revenue Growth: Analyzing the company’s revenue growth over time can give insights into its potential for future success.

- Profit Margin: This metric shows how much profit a company keeps for every dollar of revenue. A higher profit margin is generally favorable.

The Importance of Diversification

- Diversification involves spreading out investments across different sectors and industries to reduce risk. It helps protect against losses in any single stock or sector.

- By diversifying your portfolio, you can potentially minimize the impact of negative events affecting a specific company or sector.

Impact of Market Trends and Economic Factors

- Market trends, such as bull or bear markets, can significantly influence stock prices and overall market sentiment.

- Economic factors like interest rates, inflation, and GDP growth can also impact stock prices. Understanding these factors is crucial for making informed investment decisions.

Research tools and resources for beginners

When starting out in the stock market, beginners often rely on various research tools and resources to make informed investment decisions. These tools can help them identify potential opportunities and stay updated on market trends.

Popular online platforms for stock trading and research

- Robinhood: Known for its user-friendly interface and commission-free trading, Robinhood is a popular choice for beginners.

- E*TRADE: This platform offers a wide range of research tools, educational resources, and a variety of investment options.

- TD Ameritrade: With advanced trading platforms and robust research tools, TD Ameritrade is a go-to for many beginner investors.

How to use stock screening tools

- Stock screening tools allow investors to filter stocks based on specific criteria such as market cap, P/E ratio, and industry sector.

- Beginners can use these tools to identify potential investment opportunities that align with their investment goals and risk tolerance.

- By setting parameters and conducting thorough research, beginners can narrow down their choices and make more informed decisions.

Role of financial news and analysis

- Financial news and analysis play a crucial role in helping beginners stay informed about market developments, earnings reports, and economic indicators.

- By staying updated on financial news, beginners can make informed decisions about buying or selling stocks.

- Reading expert analysis and market commentary can provide valuable insights and help beginners understand the factors influencing stock prices.

Types of stocks suitable for beginners

Investing in the stock market can be overwhelming for beginners, but understanding the different types of stocks can help you make informed decisions. Let’s take a look at some of the options that are suitable for new investors.

Growth stocks vs. Value stocks

Growth stocks are shares of companies that are expected to grow at a rate higher than the average market growth. These companies typically reinvest their earnings into expanding the business. On the other hand, value stocks are considered undervalued by the market and are trading at a lower price compared to their intrinsic value. They are often seen as a bargain by investors looking for long-term growth potential.

Dividend stocks

Dividend stocks are shares of companies that pay out a portion of their earnings to shareholders in the form of dividends. These stocks are appealing to beginner investors because they provide a steady income stream in addition to potential capital appreciation. Dividend stocks are often less volatile compared to growth stocks, making them a more stable investment option.

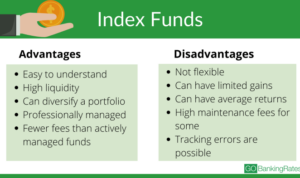

Index funds or ETFs

Index funds and Exchange-Traded Funds (ETFs) are investment vehicles that track a specific market index, such as the S&P 500. They offer a diversified portfolio of stocks, providing beginners with exposure to a broad range of companies. One advantage of investing in index funds or ETFs is the low expense ratios compared to actively managed funds. However, the downside is that you won’t outperform the market since you are essentially mirroring its performance.