Yo, diving into the world of asset allocation strategies is like navigating a maze of investment opportunities. Get ready to explore the ins and outs of diversifying your assets and maximizing those returns with a hip twist.

So buckle up as we break down the different types of strategies, factors that influence your decisions, and how to keep your portfolio in check for those sweet gains.

Importance of Asset Allocation Strategies

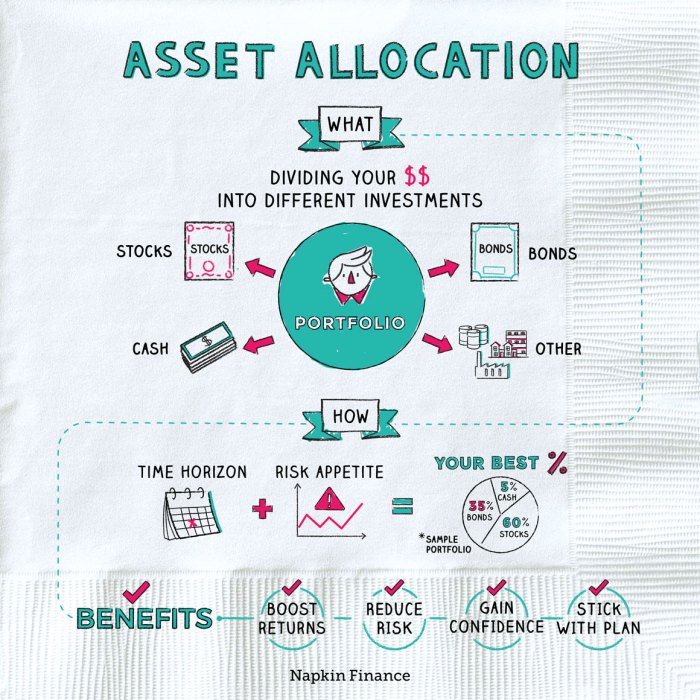

Asset allocation is a crucial component of investment planning as it involves spreading investments across different asset classes to reduce risk and enhance returns. By diversifying into various assets, investors can mitigate the impact of volatility in a particular market segment and potentially achieve a more stable portfolio.

Diversifying Investments Through Asset Allocation

Asset allocation helps in diversifying investments by distributing funds among different types of assets such as stocks, bonds, real estate, and commodities. Each asset class behaves differently under various market conditions, so having a mix of them can help balance out the overall performance of a portfolio.

- Stocks: Represent ownership in a company and offer growth potential but come with higher risk.

- Bonds: Debt securities that provide fixed income and stability, suitable for risk-averse investors.

- Real Estate: Includes properties like residential, commercial, or land, offering diversification and potential income.

- Commodities: Raw materials like gold, oil, or agricultural products that can act as a hedge against inflation or market fluctuations.

Types of Asset Allocation Strategies

When it comes to asset allocation, there are various strategies that investors can utilize to manage their portfolios effectively. Let’s dive into the different types of asset allocation strategies to understand how they work and their pros and cons.

Strategic Asset Allocation

Strategic asset allocation involves setting a target mix of asset classes and sticking to it for the long term. This approach aims to maintain a consistent level of risk and return based on the investor’s financial goals and risk tolerance. While it provides a disciplined framework, it may not adapt well to changing market conditions.

Tactical Asset Allocation

Tactical asset allocation involves making short-term adjustments to the portfolio based on market conditions and economic outlook. This strategy allows investors to capitalize on opportunities and reduce risks as they arise. However, it requires active monitoring and may result in higher transaction costs.

Dynamic Asset Allocation

Dynamic asset allocation combines elements of both strategic and tactical approaches. It involves continuously adjusting the asset mix based on market conditions, valuation metrics, and economic indicators. This strategy aims to optimize returns while managing risks dynamically. However, it requires a high level of expertise and active management.

Passive vs. Active Asset Allocation

Passive asset allocation involves maintaining a fixed asset allocation without frequent changes. It aims to replicate the performance of a specific index or benchmark. On the other hand, active asset allocation involves making strategic decisions to outperform the market through research and analysis.

Recommended Percentage Allocation

– Stocks: 60-80%

– Bonds: 20-40%

– Other Asset Classes (Real Estate, Commodities, etc.): 0-20%

Remember, the ideal allocation may vary based on individual goals, risk tolerance, and time horizon. It’s essential to review and adjust your asset allocation periodically to ensure it aligns with your financial objectives.

Factors Influencing Asset Allocation

When determining an asset allocation strategy, investors should consider various key factors that can significantly impact their investment decisions. Factors such as age, risk tolerance, financial goals, and market conditions play a crucial role in shaping asset allocation strategies.

Age

Age is a major factor that influences asset allocation decisions. Younger investors typically have a longer investment horizon and can afford to take on more risk in their portfolios. As investors approach retirement age, they may shift towards more conservative investments to protect their capital.

Risk Tolerance

Understanding one’s risk tolerance is essential in determining the appropriate asset allocation mix. Investors who are more risk-averse may opt for a more conservative allocation, while those comfortable with risk may choose a more aggressive approach to potentially achieve higher returns.

Financial Goals

Investors’ financial goals, whether short-term or long-term, also play a significant role in asset allocation decisions. Those with specific financial objectives, such as buying a house or funding education, may tailor their asset allocation to align with these goals.

Market Conditions

Market conditions, such as economic indicators and trends, can impact asset allocation strategies. Investors may adjust their allocations based on market trends, interest rates, inflation, and overall economic outlook to optimize their portfolios and navigate changing market conditions effectively.

Rebalancing and Monitoring Asset Allocation

Regularly rebalancing an investment portfolio is crucial to maintain the desired risk and return profile. Over time, market fluctuations can cause the original asset allocation to drift, leading to unintended exposure to certain asset classes. By rebalancing, investors can realign their portfolio with their financial goals and risk tolerance.

Importance of Rebalancing

- Rebalancing ensures that the portfolio remains diversified and in line with the investor’s risk tolerance.

- It helps to control risk by preventing overexposure to any single asset class that may have outperformed in the short term.

- Rebalancing allows investors to buy low and sell high, as they are forced to sell assets that have performed well and buy those that have underperformed.

Monitoring Asset Allocation Process

Monitoring asset allocation involves regularly reviewing the portfolio to ensure it still aligns with the investor’s financial goals. This process typically includes:

- Reviewing the current asset allocation percentages compared to the target allocation.

- Assessing any changes in market conditions that may impact the portfolio’s risk and return profile.

- Considering any changes in personal circumstances, such as a change in investment horizon or risk tolerance.

Adjusting Asset Allocation

Knowing when and how to adjust asset allocation is crucial for optimizing investment returns. Some tips for adjusting asset allocation include:

- Reevaluate asset allocation at least annually or when significant market events occur.

- Consider rebalancing if an asset class deviates significantly from its target allocation.

- Adjust asset allocation based on changes in personal circumstances, such as retirement or a new financial goal.