mutual funds vs ETFs sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Whether you’re a seasoned investor or just starting out, understanding the differences between mutual funds and ETFs is crucial in navigating the complex world of investing. Let’s dive into the nuances of these two investment options and uncover the key factors that can help you make informed decisions.

Overview of Mutual Funds and ETFs

Mutual funds and ETFs are popular investment vehicles that allow individuals to pool their money together to invest in a diversified portfolio of stocks, bonds, or other assets.

Mutual Funds

Mutual funds are managed by professional fund managers who make investment decisions on behalf of the investors. These funds are priced at the end of each trading day based on the net asset value (NAV) of the securities held in the fund. Some popular mutual funds include Vanguard Total Stock Market Index Fund and Fidelity Contrafund.

ETFs

ETFs, or exchange-traded funds, are similar to mutual funds but are traded on stock exchanges like individual stocks. They are passively managed and aim to replicate the performance of a specific index or asset class. Examples of popular ETFs include SPDR S&P 500 ETF Trust and Invesco QQQ Trust.

Investment Strategies

When it comes to investment strategies, mutual funds and ETFs have distinct approaches that cater to different investor needs and preferences.

Diversification Levels

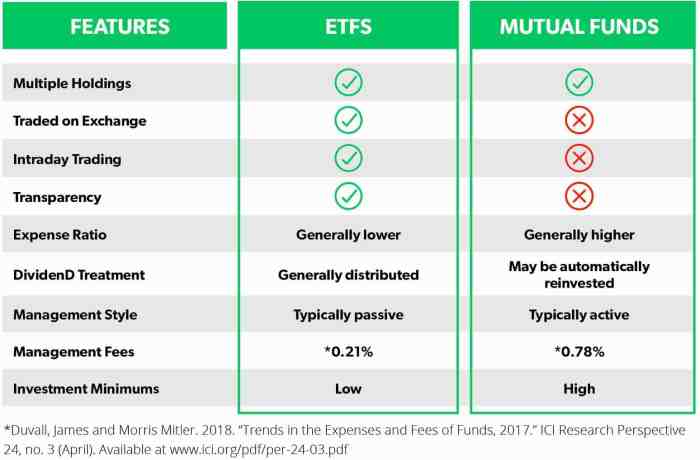

Both mutual funds and ETFs offer diversification benefits to investors, spreading their investments across a range of assets. However, the diversification levels in mutual funds tend to be higher compared to ETFs. Mutual funds typically hold a larger number of individual securities, providing investors with greater exposure to different companies and sectors. On the other hand, ETFs may track a specific index or sector, resulting in slightly lower diversification levels.

Investment Goals Influence

The investment goals of an individual play a crucial role in determining whether mutual funds or ETFs are the more suitable investment vehicle. Mutual funds are often favored by investors seeking active management and professional expertise in selecting investments to achieve specific objectives. In contrast, ETFs are popular among investors looking for passive investment strategies that aim to mirror the performance of a particular index or asset class. Therefore, understanding one’s investment goals and risk tolerance is essential in choosing between mutual funds and ETFs.

Cost Comparison

In the world of investing, understanding the costs associated with different types of investments is crucial for maximizing returns. Let’s take a closer look at the cost comparison between mutual funds and ETFs.

Fees Associated with Investing in Mutual Funds

When it comes to mutual funds, investors typically encounter various fees such as management fees, administrative fees, and 12b-1 fees. These fees can eat into the overall returns of the investment, making it important for investors to consider the total cost of owning mutual funds.

Expense Ratios of Mutual Funds versus ETFs

Expense ratios are a key factor in comparing the cost-effectiveness of mutual funds and ETFs. Mutual funds generally have higher expense ratios compared to ETFs, mainly due to the active management involved in mutual funds. ETFs, on the other hand, usually have lower expense ratios as they are passively managed and designed to track a specific index.

Impact of Cost-Effectiveness on Investor’s Returns

The cost-effectiveness of mutual funds and ETFs can significantly impact an investor’s overall returns. Lower expense ratios in ETFs mean that investors get to keep more of their investment gains, allowing for potentially higher returns over the long term. On the other hand, the higher fees associated with mutual funds can erode a significant portion of the returns, making it essential for investors to carefully consider the cost implications when choosing between mutual funds and ETFs.

Liquidity and Trading

When it comes to liquidity and trading, mutual funds and ETFs have some key differences that investors should be aware of.

Liquidity Differences

- Mutual funds are only priced and traded at the end of the trading day, after the markets have closed. This can result in delays for investors looking to buy or sell shares.

- ETFs, on the other hand, are traded on stock exchanges throughout the day, allowing investors to buy or sell shares at any point during market hours. This provides greater flexibility and liquidity compared to mutual funds.

Buying and Selling Process

- When buying or selling mutual funds, investors typically place their orders with the fund company directly. The orders are executed at the net asset value (NAV) of the fund at the end of the trading day.

- For ETFs, investors can buy and sell shares through a brokerage account, similar to trading individual stocks. The prices of ETFs fluctuate throughout the trading day based on supply and demand.

Impact on Investor Behavior

- The trading mechanisms of mutual funds and ETFs can influence investor behavior. The ability to trade ETFs intraday may lead to more frequent buying and selling, which can increase trading costs and potentially result in higher taxes for investors.

- On the other hand, the delayed pricing of mutual funds may discourage investors from making impulsive decisions based on short-term market movements, promoting a more long-term investment approach.