Get ready to dive into the world of real estate investment strategies where lucrative opportunities await. From rental properties to fix and flip projects, this guide will equip you with the knowledge needed to thrive in the competitive real estate market.

Real Estate Investment Strategies

Real estate investment involves purchasing, owning, managing, renting, or selling real estate for profit. It can include residential properties, commercial buildings, or land.

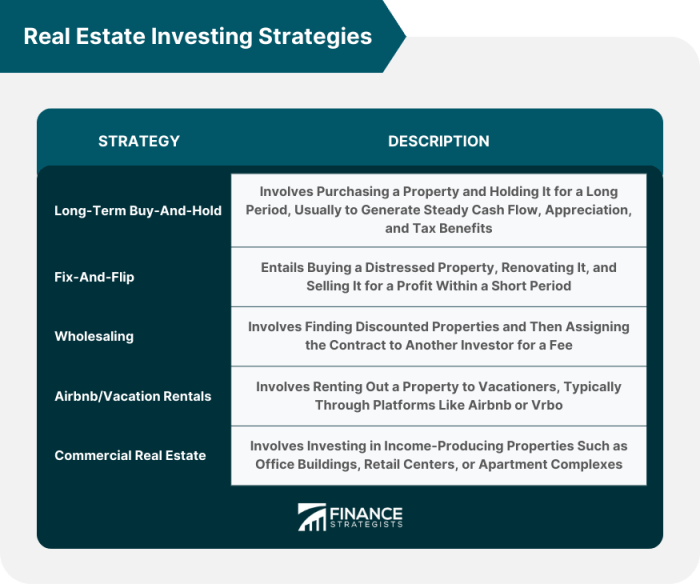

Types of Real Estate Investment Strategies

- Fix and Flip: Buying a property below market value, renovating it, and selling it for a higher price.

- Rental Properties: Owning properties to rent out for a steady income stream.

- Wholesaling: Finding discounted properties and selling them to other investors for a profit.

- Real Estate Investment Trusts (REITs): Investing in companies that own, operate, or finance income-producing real estate.

Importance of Having a Clear Investment Strategy

Having a clear investment strategy in real estate helps investors make informed decisions, manage risks, and maximize returns. It provides a roadmap for achieving financial goals and ensures a disciplined approach to investing.

Long-term vs. Short-term Investment Strategies

- Long-term: Involves holding onto properties for an extended period, benefiting from appreciation and rental income over time.

- Short-term: Involves quick buying and selling of properties for immediate profits, often through strategies like fix and flip or wholesaling.

Rental Properties

Investing in rental properties can be a lucrative strategy for building wealth over time. By purchasing a property and renting it out to tenants, investors can generate a steady stream of passive income. However, there are also challenges and considerations to keep in mind when venturing into the world of rental property investments.

Benefits of Investing in Rental Properties

- Rental income: By renting out the property, investors can receive a consistent stream of cash flow each month.

- Tax advantages: Rental property owners can benefit from tax deductions such as mortgage interest, property taxes, and operating expenses.

- Asset appreciation: Over time, the value of the property may increase, allowing investors to build equity and potentially sell the property for a profit.

Challenges of Investing in Rental Properties

- Tenant issues: Dealing with problematic tenants, vacancies, and property damage can be a major challenge for rental property owners.

- Ongoing maintenance and repairs: Property maintenance can be costly and time-consuming, cutting into potential profits.

- Market fluctuations: Real estate markets can be unpredictable, and economic downturns may impact rental property values and demand.

Tips for Maximizing Returns on Rental Property Investments

- Screen tenants thoroughly to minimize the risk of problematic renters.

- Set competitive rental rates based on market research and property value.

- Maintain the property regularly to attract and retain quality tenants.

- Consider hiring a property management company to handle day-to-day operations and tenant relations.

Cash Flow vs. Appreciation Potential of Rental Properties

When it comes to rental properties, investors often weigh the benefits of cash flow versus appreciation potential. Cash flow is the income generated from rental payments, while appreciation refers to the increase in property value over time.

While cash flow provides immediate returns, appreciation can offer long-term wealth-building opportunities as property values increase.

Fix and Flip

Fix and flip is a real estate investment strategy where an investor purchases a property, renovates it to increase its value, and then sells it for a profit. This strategy requires a keen eye for properties with potential, as well as knowledge of the local real estate market.

Steps for a Successful Fix and Flip Investment

- Research and Identify Properties: Look for properties in desirable locations with potential for value appreciation.

- Secure Financing: Obtain funding for the purchase and renovation of the property.

- Create a Budget and Timeline: Plan out the renovation process and set a budget to ensure profitability.

- Renovate the Property: Make necessary repairs and upgrades to increase the property’s value.

- Market and Sell: List the property on the market and work with real estate agents to attract potential buyers.

Risks Associated with Fix and Flip Projects

- Unexpected Costs: Renovation projects can often uncover hidden issues that may require additional funds.

- Market Fluctuations: Changes in the real estate market can impact the resale value of the property.

- Time Constraints: Delays in the renovation process can lead to increased holding costs and reduced profitability.

Examples of Successful Fix and Flip Real Estate Investments

One example of a successful fix and flip investment is when an investor purchased a run-down property, renovated it with modern amenities, and sold it for a profit margin of 30% within six months.

Another example is when an investor identified a property in a sought-after neighborhood, renovated it to enhance its curb appeal, and sold it for double the purchase price after just three months.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts, or REITs, are companies that own, operate, or finance income-producing real estate across a range of property sectors. Investors can buy shares of REITs on major stock exchanges, allowing them to invest in real estate without actually owning physical properties.

Types of REITs and Investment Potential

REITs can be categorized into equity REITs, mortgage REITs, and hybrid REITs. Equity REITs own and operate income-producing real estate, while mortgage REITs provide financing for real estate by purchasing or originating mortgages and mortgage-backed securities. Hybrid REITs combine characteristics of both equity and mortgage REITs. Each type of REIT offers different investment potential based on the sector they focus on and their financial structure.

- Equity REITs: These REITs are known for providing steady dividends and capital appreciation through property value appreciation.

- Mortgage REITs: Investors in mortgage REITs benefit from high dividend yields, but they are exposed to interest rate risks and credit risks.

- Hybrid REITs: These REITs offer a mix of income-producing properties and mortgage investments, providing a balanced approach to real estate investment.

Tips for Choosing the Right REIT Investments

When considering investing in REITs, it is essential to research and analyze the following factors to make informed decisions:

- Property Sector Focus: Evaluate the property sectors the REIT specializes in and consider the growth potential and risks associated with those sectors.

- Dividend Yield: Look for REITs with a history of consistent and growing dividend payments to maximize your investment returns.

- Financial Performance: Analyze the REIT’s financial health, including debt levels, occupancy rates, and cash flow to assess its stability and growth potential.

- Management Team: Consider the experience and track record of the REIT’s management team in successfully managing real estate investments.