With Benefits of a Roth IRA at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

Let’s dive into the world of Roth IRAs and uncover the wealth-building opportunities they offer to savvy investors.

Introduction to Roth IRA

A Roth IRA is a type of individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. Unlike a traditional IRA, contributions to a Roth IRA are made with after-tax dollars, meaning you don’t get a tax deduction when you contribute, but you also won’t have to pay taxes when you withdraw the money in retirement.

Difference between Roth IRA and Traditional IRA

One key difference between a Roth IRA and a traditional IRA is how they are taxed. With a traditional IRA, contributions are typically tax-deductible, but withdrawals in retirement are taxed as ordinary income. On the other hand, Roth IRA contributions are not tax-deductible, but qualified withdrawals are tax-free.

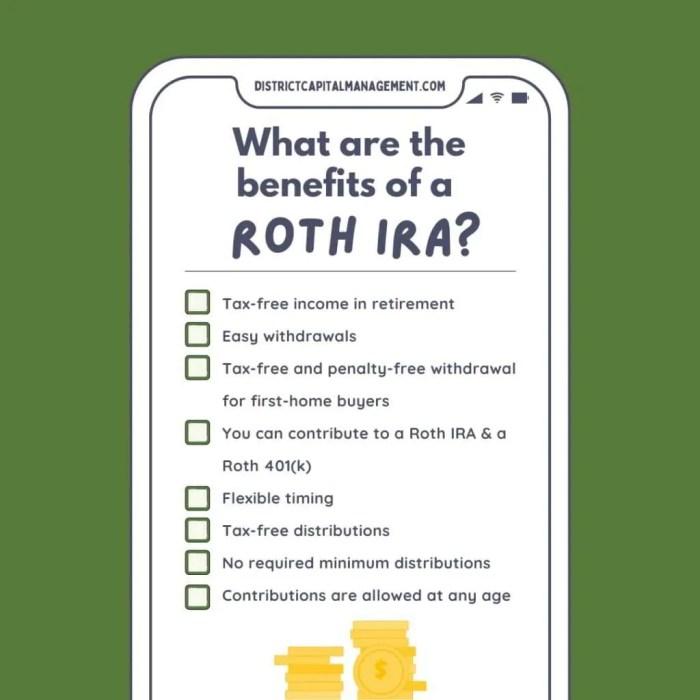

Main Features and Benefits of a Roth IRA

- Roth IRAs offer tax-free growth: Any earnings in a Roth IRA grow tax-free, allowing your investments to compound over time without being subject to capital gains taxes.

- Tax-free withdrawals in retirement: Qualified withdrawals from a Roth IRA in retirement are not taxed, providing a source of tax-free income during your retirement years.

- No required minimum distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not have RMDs, so you can let your money continue to grow tax-free for as long as you like.

- Flexibility for withdrawals: You can withdraw your contributions (but not earnings) from a Roth IRA at any time without penalty, making it a flexible savings vehicle for emergencies or large expenses.

- Potential estate planning benefits: Roth IRAs can be passed on to your heirs tax-free, providing a valuable legacy for future generations.

Tax Advantages

When it comes to Roth IRAs, one of the biggest perks is the tax advantages they offer. Unlike traditional retirement accounts, contributions to a Roth IRA are made with after-tax dollars, meaning you won’t get a tax deduction upfront. However, the real magic happens when you start making withdrawals in retirement.

Tax-Free Growth

In a Roth IRA, your investments can grow tax-free over time. This means you won’t have to pay taxes on any capital gains, dividends, or interest earned within the account. This can lead to significant savings compared to taxable investment accounts where you would be subject to annual capital gains taxes.

Tax-Free Withdrawals

One of the most attractive features of a Roth IRA is the ability to make tax-free withdrawals in retirement. Since you already paid taxes on your contributions, you can access both your original contributions and any investment gains without owing any additional taxes. This can provide a huge advantage in retirement when you may need a tax-efficient source of income.

Comparison with Other Retirement Accounts

When comparing Roth IRAs with traditional IRAs or 401(k) accounts, the tax benefits are clear. Traditional retirement accounts offer tax-deferred growth, meaning you don’t pay taxes on your contributions now, but you will owe taxes on withdrawals in retirement. On the other hand, Roth IRAs provide tax-free growth and withdrawals, offering more flexibility and potentially lower tax liabilities in the long run.

Overall, the tax advantages of a Roth IRA can make it a powerful tool for retirement planning, allowing you to maximize your savings and minimize your tax burden in the future.

Contribution Limits and Eligibility

When it comes to Roth IRAs, understanding the contribution limits and eligibility criteria is crucial for effective retirement planning.

Contribution Limits

- Roth IRA contribution limits for 2021 are $6,000 for individuals under 50 years old and $7,000 for those 50 and older.

- Contributions cannot exceed your earned income for the year.

- These limits are set by the IRS and may change annually based on inflation adjustments.

Eligibility Criteria

- To be eligible to contribute to a Roth IRA, your income must fall below certain limits.

- For single filers in 2021, the income limit starts at $125,000 and phases out completely at $140,000.

- For married couples filing jointly, the income limit begins at $198,000 and phases out completely at $208,000.

Impact on Retirement Planning

- Understanding contribution limits helps individuals plan and maximize their retirement savings within the allowed thresholds.

- Eligibility criteria ensure that those who benefit from Roth IRAs are within certain income brackets, maintaining fairness in the system.

- Knowing these limits and criteria can guide individuals in making informed decisions about their retirement investments and financial goals.

Investment Options

When it comes to Roth IRAs, there are a variety of investment options available to account holders. These options allow individuals to tailor their investments based on their risk tolerance, investment goals, and timeline for retirement.

Comparison with Other Retirement Accounts

Roth IRAs offer more flexibility in terms of investment options compared to traditional retirement accounts like 401(k)s or IRAs. While traditional accounts often limit investors to a selection of mutual funds or company stock, Roth IRAs allow for a broader range of investments including stocks, bonds, ETFs, and even real estate investment trusts (REITs). This flexibility can provide greater opportunities for diversification and potentially higher returns.

Example Investment Strategies

1. Diversified Portfolio: One common strategy is to create a diversified portfolio within a Roth IRA. This can involve investing in a mix of stocks, bonds, and other assets to spread out risk and maximize potential returns over the long term.

2. Long-Term Growth Stocks: Another strategy is to focus on investing in growth stocks that have the potential for significant long-term appreciation. Since Roth IRAs allow for tax-free growth, this can be a beneficial strategy for maximizing returns over time.

3. Index Funds or ETFs: Investing in low-cost index funds or exchange-traded funds (ETFs) can be a simple yet effective strategy for Roth IRA investors. These funds offer broad exposure to the market and can help minimize fees, allowing for more of your investment to grow tax-free.

4. Real Estate: Some Roth IRA custodians allow for investments in real estate, which can provide a hedge against inflation and potentially higher returns compared to traditional investments. However, it’s essential to understand the rules and regulations surrounding real estate investments within a Roth IRA.

By exploring these different investment options and strategies, individuals can make informed decisions on how to best grow their retirement savings within a Roth IRA.

Withdrawal Rules and Penalties

When it comes to a Roth IRA, understanding the withdrawal rules and potential penalties is crucial for effective retirement planning.

Withdrawal Rules

- Qualified distributions from a Roth IRA are tax-free and penalty-free.

- To be considered qualified, the Roth IRA account must have been open for at least five years, and the account owner must be at least 59 and a half years old.

- Non-qualified distributions may result in taxes and penalties.

Penalties for Early Withdrawals

- Early withdrawals from a Roth IRA before age 59 and a half may result in a 10% penalty on the amount withdrawn.

- Exceptions to the penalty include using the funds for a first-time home purchase, qualified education expenses, or in case of disability or death.

Implications on Retirement Income Planning

- Understanding the withdrawal rules and penalties can help individuals make informed decisions about when and how to access their Roth IRA funds during retirement.

- Early withdrawals can significantly impact retirement income by reducing the account balance and incurring penalties, so careful planning is essential.

Estate Planning Benefits

When it comes to estate planning, a Roth IRA can be a valuable tool to consider. Not only does it provide tax advantages during your lifetime, but it also offers benefits for your heirs after you pass away.

Advantages of Leaving a Roth IRA as an Inheritance

- Income Tax-Free Inheritance: Unlike traditional IRAs, beneficiaries of a Roth IRA do not pay income tax on the distributions they receive.

- Stretch IRA Strategy: Beneficiaries have the option to “stretch” the distributions over their own lifetime, allowing for continued tax-free growth.

- Flexible Withdrawal Options: Beneficiaries can choose when and how much to withdraw, giving them control over their tax liabilities.

Estate Planning Strategies with a Roth IRA

- Designating Multiple Beneficiaries: By naming multiple beneficiaries, you can divide the assets among family members or charities, maximizing wealth transfer.

- Converting Traditional IRA to Roth IRA: Converting a traditional IRA to a Roth IRA can reduce the tax burden on heirs and provide long-term benefits.

- Creating a Trust: Establishing a trust as the beneficiary of a Roth IRA can offer added protection and control over the distribution of assets.