Credit card debt management is like navigating the halls of high school – full of twists, turns, and unexpected challenges. In this guide, we’ll break down the ins and outs of effectively handling your credit card debt with a cool, hip touch.

Get ready to dive into strategies, tools, and prevention tips that will help you conquer your credit card debt like a boss.

Understanding Credit Card Debt Management

Credit card debt management involves strategies and techniques used to control and reduce the amount of debt owed on credit cards. It is essential for individuals to effectively manage their credit card debt to avoid financial struggles and maintain a good credit score.

Common Causes of Credit Card Debt

- Excessive Spending: Overspending on non-essential items can lead to accumulating credit card debt.

- Unexpected Expenses: Sudden medical bills or car repairs can force individuals to rely on credit cards.

- Low Income: Insufficient income to cover basic expenses may result in the use of credit cards for daily needs.

- Minimum Payments: Making only the minimum monthly payments can prolong debt repayment and increase interest charges.

Importance of Managing Credit Card Debt Effectively

- Financial Stability: Effective debt management can help individuals achieve financial stability and security.

- Improved Credit Score: Managing credit card debt can prevent negative impacts on credit scores, allowing for better borrowing opportunities in the future.

- Reduced Stress: By controlling debt levels, individuals can reduce stress and anxiety associated with financial burdens.

- Long-Term Savings: Proper debt management can lead to increased savings and better financial planning for the future.

Strategies for Credit Card Debt Management

Creating a budget is crucial for managing credit card debt effectively. By tracking your expenses and income, you can identify areas where you can cut back and allocate more funds towards paying off your debts.

Snowball Method for Paying Off Credit Card Debt

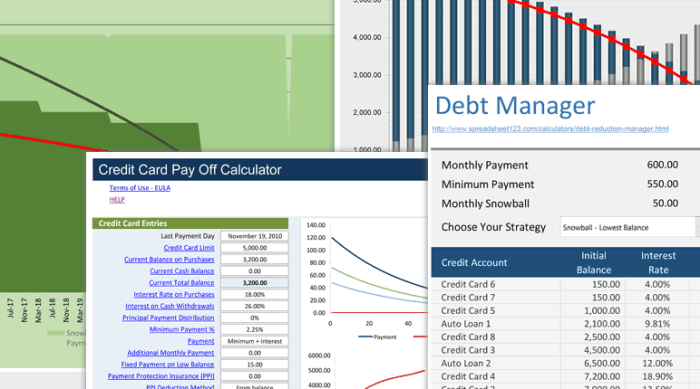

The snowball method involves paying off your smallest credit card balance first while making minimum payments on your other cards. Once the smallest balance is paid off, you move on to the next smallest balance, gradually building momentum like a snowball rolling downhill.

- List all your credit card debts from smallest to largest.

- Allocate extra funds to pay off the smallest balance while making minimum payments on other cards.

- Once the smallest balance is cleared, move on to the next smallest balance.

- Continue this process until all debts are paid off.

By focusing on small victories, the snowball method provides a sense of accomplishment that motivates you to continue paying off your debts.

Avalanche Method for Debt Repayment

The avalanche method involves paying off debts with the highest interest rates first, potentially saving you more money in the long run compared to the snowball method.

- List all your credit card debts from highest to lowest interest rates.

- Allocate extra funds to pay off the debt with the highest interest rate while making minimum payments on other cards.

- Once the highest interest debt is cleared, move on to the next highest interest debt.

- Continue this process until all debts are paid off.

While the avalanche method may take longer to see results, it can save you money on interest payments over time by tackling high-interest debts first.

Tools and Resources for Managing Credit Card Debt

When it comes to managing credit card debt, having the right tools and resources can make a significant difference in your financial well-being. From tracking your spending to seeking professional help, there are various options available to help you get a handle on your debt.

Financial Tools for Tracking Credit Card Spending

- Utilize budgeting apps or software to track your expenses and identify areas where you can cut back.

- Monitor your credit card statements regularly to catch any unauthorized charges or errors.

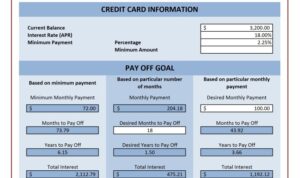

- Consider using a debt repayment calculator to create a payoff plan and stay on track with your payments.

Credit Counseling Agencies in Debt Management

- Credit counseling agencies offer financial education, budgeting assistance, and debt management plans to help you tackle your credit card debt.

- They can negotiate with your creditors to lower interest rates or reduce monthly payments, making it easier for you to pay off your debt.

- Working with a credit counseling agency can provide you with the support and guidance needed to become debt-free.

Debt Consolidation Loans and Their Impact on Credit Card Debt

- Debt consolidation loans allow you to combine multiple debts into a single loan with a lower interest rate, making it easier to manage your payments.

- By consolidating your credit card debt, you may be able to simplify your finances and save money on interest charges.

- However, it’s essential to carefully consider the terms of the loan and ensure that you can afford the monthly payments before moving forward with debt consolidation.

Preventing Credit Card Debt

To avoid falling into the trap of credit card debt, it is crucial to implement strategies that promote responsible financial habits and planning for unexpected expenses.

Strategies for Avoiding Credit Card Debt Accumulation

- Avoid unnecessary spending: Prioritize needs over wants to prevent overspending on credit cards.

- Set a budget: Create a monthly budget outlining your expenses and income to ensure you do not spend more than you earn.

- Pay off balances in full: Try to pay off your credit card balances in full each month to avoid accruing interest charges.

Importance of Responsible Credit Card Usage

Responsible credit card usage involves making timely payments, keeping track of expenses, and not exceeding your credit limit. By using credit cards responsibly, you can build a positive credit history and avoid falling into debt traps.

Building an Emergency Fund

Having an emergency fund can help you cover unexpected expenses without relying on credit cards. Aim to save at least three to six months’ worth of living expenses in an easily accessible account to prevent financial strain in times of need.