Diving deep into the world of credit score myths debunked, this introduction sets the stage for an eye-opening exploration that will challenge your understanding of financial health. Get ready to uncover the truth behind common misconceptions and discover how they impact your money game.

In the following paragraphs, we’ll break down the common myths, shed light on the factors influencing credit scores, and provide strategies to navigate the murky waters of credit score knowledge.

Common Credit Score Myths

Credit scores are often shrouded in mystery, leading to several myths that can impact financial decisions. Let’s debunk three common myths about credit scores.

Myth 1: Closing a Credit Card Will Improve Your Credit Score

Closing a credit card account can actually harm your credit score. This action can reduce your available credit and increase your credit utilization ratio, which is a key factor in determining your credit score. Keeping the card open and using it responsibly is a better way to maintain a healthy credit score.

Myth 2: Checking Your Credit Score Will Lower It

Contrary to popular belief, checking your own credit score is considered a “soft inquiry” and does not affect your score. In fact, regularly monitoring your credit score can help you identify errors and take steps to improve it.

Myth 3: You Need to Carry a Balance on Your Credit Card to Build Credit

Carrying a balance on your credit card does not improve your credit score. In fact, it can lead to unnecessary interest charges. Paying off your balance in full and on time every month demonstrates responsible credit management and can help build a positive credit history.

Factors Influencing Credit Scores

When it comes to credit scores, there are several key factors that can have a significant impact on an individual’s overall score. Understanding these factors is crucial in managing and improving one’s creditworthiness.

Some of the main factors that influence credit scores include payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries. Let’s dive into each of these factors to understand how they play a role in determining an individual’s credit score.

Payment History

Payment history is one of the most critical factors in determining a person’s credit score. It reflects whether an individual has made timely payments on their credit accounts. Missing payments or making late payments can have a negative impact on credit scores, while consistently making on-time payments can boost one’s score.

Credit Utilization

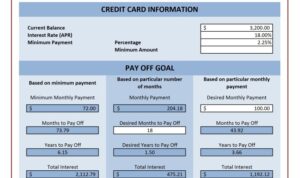

Credit utilization refers to the amount of credit being used compared to the total credit available. High credit utilization can signal financial distress and lead to a lower credit score. Keeping credit utilization low, ideally below 30%, can have a positive impact on credit scores.

Length of Credit History

The length of credit history is another important factor in determining credit scores. A longer credit history demonstrates a track record of responsible credit management, which can positively influence one’s creditworthiness. Closing old accounts can shorten credit history, potentially lowering credit scores.

Types of Credit Used

Having a mix of credit accounts, such as credit cards, installment loans, and mortgages, can positively impact credit scores. Lenders like to see that individuals can manage different types of credit responsibly. However, too many accounts or opening new accounts too quickly can negatively impact credit scores.

New Credit Inquiries

When individuals apply for new credit, lenders typically perform a hard inquiry on their credit report. Multiple hard inquiries within a short period can signal financial distress and lower credit scores. It’s important to be strategic about applying for new credit to avoid unnecessary dings on credit scores.

Debunking Credit Score Myths

Credit scores can be a confusing topic, and there are many myths surrounding them that can lead to misinformation. Let’s debunk three prevalent myths about credit scores, explain the truth behind each myth, and provide strategies to counteract these myths to improve credit score knowledge.

Myth 1: Closing a Credit Card Will Improve Your Credit Score

Many people believe that closing a credit card will automatically boost their credit score. However, this is a common misconception. In reality, closing a credit card can actually harm your credit score. When you close a credit card account, it can affect your credit utilization ratio, which is a key factor in determining your credit score. To counteract this myth, consider keeping your credit card accounts open, especially if they have a long credit history, to maintain a healthy credit utilization ratio.

Myth 2: Checking Your Credit Score Will Lower It

There is a widespread belief that checking your credit score will have a negative impact on your score. This is simply not true. When you check your own credit score, it is considered a “soft inquiry” and does not affect your credit score. In fact, regularly monitoring your credit score can help you identify any errors or fraudulent activity and take steps to address them. To counteract this myth, make it a habit to monitor your credit score regularly through reputable credit monitoring services.

Myth 3: You Need to Carry a Balance on Your Credit Cards to Build Credit

Another common myth is that you need to carry a balance on your credit cards in order to build credit. This is false. You do not need to carry a balance from month to month to build credit. In fact, carrying a balance can lead to unnecessary interest charges. To improve your credit score, focus on making on-time payments, keeping your credit utilization low, and only charging what you can afford to pay off in full each month.

Impact of Credit Score Myths on Financial Health

Believing in credit score myths can have detrimental effects on an individual’s financial health. Misinformation about credit scores can lead to poor financial decisions, which can result in long-term consequences.

Consequences of Making Financial Decisions Based on Credit Score Myths

- Being afraid to check your credit score regularly: Some people believe that checking their credit score can lower it, leading them to avoid monitoring their credit health. This can result in missed errors or fraudulent activity that could harm their financial well-being.

- Ignoring credit utilization rates: Misunderstanding the impact of credit utilization on credit scores can lead to overspending or not paying off credit card balances in full each month. This can negatively affect credit scores and lead to higher interest payments.

- Believing in quick fixes: Falling for myths about quick ways to improve credit scores, such as closing old accounts or opening multiple new lines of credit, can actually harm credit scores in the long run.

Tips to Avoid Falling for Common Credit Score Myths

- Educate yourself: Take the time to understand how credit scores work and what factors influence them. This knowledge can help you separate fact from fiction when it comes to credit score myths.

- Consult reputable sources: Instead of relying on hearsay or rumors, seek information from trusted financial experts or official credit bureaus to get accurate information about credit scores.

- Ask questions: If you come across a credit score myth or something that seems too good to be true, don’t hesitate to ask questions and verify the information before making any financial decisions based on it.