When it comes to navigating the financial landscape as a couple, strategic planning is key. From setting joint goals to managing debt and investments, the journey towards financial security is a collaborative effort that can strengthen the bond between partners. Let’s dive into the world of financial planning for couples and uncover the secrets to a prosperous future together.

As we explore the intricacies of financial planning for couples, we’ll discover the tools and techniques that can pave the way for a stable and harmonious financial future.

Importance of Financial Planning for Couples

Financial planning is crucial for couples as it helps them align their goals, priorities, and spending habits. By creating a solid financial plan together, couples can work towards a common future and build a strong foundation for their relationship.

Benefits of Financial Planning for Couples

- Improved Communication: Financial planning encourages open and honest discussions about money, leading to better communication between partners.

- Goal Setting: Setting financial goals together helps couples stay motivated and focused on their shared objectives.

- Reduced Stress: A well-thought-out financial plan can reduce financial stress, which is a common source of tension in relationships.

- Financial Security: Planning for the future ensures that couples are prepared for unexpected expenses and emergencies.

Impact of Financial Stress on Relationships

Financial stress can have a detrimental effect on relationships, leading to arguments, resentment, and even separation. Couples who do not address financial issues may struggle to trust each other and may find it challenging to work together towards common goals. Therefore, it is essential for couples to prioritize financial planning to maintain a healthy and harmonious relationship.

Setting Financial Goals Together

When it comes to setting financial goals as a couple, communication is key. Sit down with your partner and have an open discussion about your individual financial aspirations and dreams. This will help you both understand each other’s priorities and work towards a common goal.

Strategies for Setting Joint Financial Goals

- Brainstorm together: Take the time to brainstorm and come up with a list of financial goals that are important to both of you. This can include short-term goals like saving for a vacation, as well as long-term goals like buying a house.

- Compromise: Be willing to compromise and prioritize certain goals over others. This may mean making sacrifices in the short term to achieve bigger goals in the future.

- Create a timeline: Establish a timeline for each goal to stay on track and hold each other accountable. Set specific deadlines and milestones to measure your progress.

Aligning Individual Goals with Shared Objectives

- Discuss personal goals: Share your individual financial goals with each other and find ways to align them with your shared objectives. This will help you both feel supported and motivated to achieve your goals together.

- Identify common priorities: Identify common priorities and values that you both share. This will make it easier to set financial goals that reflect your shared vision for the future.

- Regular check-ins: Schedule regular check-ins to review your progress and make adjustments as needed. This will help you stay on track and ensure that you are both working towards the same goals.

Importance of Compromise in Setting Financial Goals

- Be flexible: Understand that compromise is a natural part of setting financial goals as a couple. Be open to adjusting your goals and priorities to accommodate each other’s needs.

- Communication is key: Keep the lines of communication open and be willing to listen to your partner’s perspective. This will help you find common ground and make decisions together.

- Focus on the bigger picture: Remember that setting financial goals together is about building a strong foundation for your future as a couple. Keep your eyes on the prize and work together towards a brighter financial future.

Budgeting as a Couple

Budgeting as a couple is crucial for managing finances effectively and achieving financial goals together. It involves creating a plan to track expenses, allocate funds, and save for the future. Here are some tips on how couples can create and maintain a budget together:

Creating a Joint Budget

- Start by listing all sources of income for both partners, including salaries, bonuses, and any other earnings.

- Next, make a list of all monthly expenses, such as rent or mortgage payments, utilities, groceries, and entertainment costs.

- Allocate funds for savings and investments, setting specific goals for each category to ensure financial stability.

- Regularly review and adjust the budget as needed to accommodate changes in income or expenses.

Tracking Expenses and Managing Finances

- Use budgeting apps or spreadsheets to track spending and monitor progress towards financial goals.

- Set aside time each month to review expenses together and identify areas where adjustments can be made.

- Agree on spending limits for discretionary purchases to avoid overspending and maintain financial discipline.

- Consider setting up joint accounts for shared expenses and individual accounts for personal spending.

Transparency and Communication

- Be open and honest about financial goals, concerns, and priorities to ensure alignment in budgeting decisions.

- Regularly communicate about any changes in income, expenses, or financial goals to stay on track with the budget.

- Avoid keeping financial secrets or making major financial decisions without consulting your partner to maintain trust and transparency.

- Schedule regular budget meetings to discuss progress, celebrate achievements, and address any challenges together.

Managing Debt and Savings

When it comes to managing debt and savings as a couple, it’s crucial to work together towards financial stability. Tackling debt and building savings are key components of a solid financial plan for any couple.

Tackling Debt Together

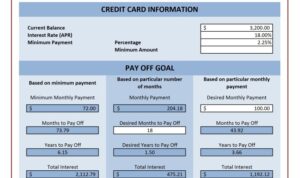

- Start by listing out all debts individually, including credit cards, student loans, car loans, and any other outstanding balances.

- Discuss and prioritize which debts to pay off first based on interest rates and amounts owed.

- Consider consolidating high-interest debts into a lower-interest loan or credit card to save on interest payments.

- Set a realistic budget for debt repayment each month and hold each other accountable for sticking to it.

Building Savings and Emergency Funds

- Establish a joint savings account specifically for emergency funds, setting aside a portion of each paycheck to contribute to it.

- Automate savings by setting up automatic transfers from your checking account to your savings account to ensure consistent contributions.

- Consider saving for specific goals such as a down payment on a house, a vacation, or retirement, in addition to emergency funds.

- Regularly review and adjust your savings goals based on changes in income, expenses, and financial priorities.

Prioritizing Debt Repayment and Savings Goals

- Find a balance between paying off debt and saving by allocating a percentage of your income to each goal.

- Consider using windfalls like tax refunds, bonuses, or gifts to make extra payments towards debt or boost your savings.

- Communicate openly and regularly about your financial goals and progress to ensure you are both on the same page.

- Track your progress towards debt repayment and savings goals using apps or spreadsheets to stay motivated and accountable.

Investing as a Couple

Investing as a couple can be a great way to work towards your financial goals together. By combining your resources and knowledge, you can create a diversified investment portfolio that suits both of your needs and risk tolerance levels.

Types of Investment Options for Couples

- Stocks: Investing in individual stocks can provide high returns but also comes with higher risks.

- Bonds: Bonds are considered safer investments compared to stocks and can provide a steady income stream.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Real Estate: Investing in real estate properties can provide rental income and potential appreciation over time.

Remember to diversify your investment portfolio to reduce risk and maximize returns.

Tips for Creating an Investment Portfolio Together

- Identify your financial goals and time horizon for each goal.

- Assess your risk tolerance as a couple to determine the right mix of investments.

- Regularly review and rebalance your portfolio to ensure it aligns with your goals and risk tolerance.

- Consider seeking advice from a financial advisor to help you make informed investment decisions.

Estate Planning and Insurance

Estate planning and insurance are crucial aspects for couples to consider in order to protect their assets and plan for the future. Let’s delve into the importance of estate planning and the types of insurance couples should consider.

Importance of Estate Planning

Estate planning involves making arrangements for the management and distribution of your assets in the event of your passing. For couples, estate planning is essential to ensure that your loved ones are taken care of and your wishes are carried out.

Types of Insurance for Couples

- Life Insurance: Provides financial protection for your partner in the event of your death. It can help cover expenses and replace lost income.

- Health Insurance: Ensures access to quality healthcare for both partners, protecting against high medical costs.

- Disability Insurance: Offers income replacement if one partner becomes disabled and is unable to work.

- Long-Term Care Insurance: Covers the costs of long-term care services, which can be expensive as you age.

Protecting Assets and Planning for the Future

Couples can protect their assets and plan for the future by creating a will or trust to Artikel how their assets will be distributed. It’s important to update these documents regularly to reflect any changes in circumstances. Additionally, consider setting up a power of attorney to designate someone to make financial and medical decisions on your behalf if you become incapacitated.