Ready to level up your financial literacy game? Dive into this guide and discover the keys to making savvy money decisions that will set you up for success. From budgeting basics to debt management strategies, we’ve got you covered. Get ready to take charge of your financial future!

Whether you’re a financial newbie or looking to fine-tune your money skills, this guide will equip you with the knowledge and tools you need to navigate the world of personal finance like a pro.

Importance of Financial Literacy

Financial literacy is like the keys to the money kingdom, helping individuals navigate the complex world of personal finance with confidence and clarity. Without a solid understanding of financial concepts, it’s easy to fall into money traps that can have serious consequences.

Lacking financial literacy can lead to a cycle of debt, poor credit scores, and limited access to financial opportunities. Individuals may struggle to make informed decisions about saving, investing, and budgeting, ultimately hindering their ability to build wealth and achieve financial stability.

Improving financial literacy opens doors to better financial decisions. With knowledge about budgeting, investing, and managing debt, individuals can make informed choices that align with their financial goals. This can lead to increased savings, reduced debt, and a stronger financial future.

Understanding Basic Financial Concepts

To navigate the world of personal finance successfully, it’s crucial to grasp key financial terms and concepts. Let’s break down some essential concepts that can help you make informed financial decisions.

Budgeting:

Budgeting is the process of creating a plan to manage your income and expenses. By setting a budget, you can track where your money is going and ensure that you are living within your means. For example, creating a monthly budget that Artikels your income, expenses, and savings goals can help you prioritize spending and avoid overspending.

Investing:

Investing involves putting your money into assets with the expectation of generating a return. This can include buying stocks, bonds, mutual funds, or real estate. For instance, investing in a diversified portfolio of stocks can help you grow your wealth over time through capital appreciation and dividends.

Saving:

Saving involves setting aside a portion of your income for future use. This can include building an emergency fund, saving for a big purchase, or investing in retirement accounts. For example, saving a portion of your paycheck each month can help you build financial security and reach your long-term financial goals.

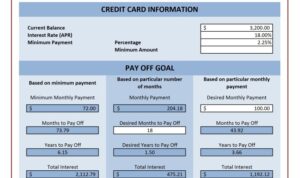

Debt Management:

Debt management involves effectively managing and paying off any debts you may have, such as credit card debt, student loans, or mortgages. By creating a debt repayment plan and prioritizing high-interest debts, you can reduce the amount of interest you pay over time and improve your overall financial health.

Comparison of Investment Options for Beginners

When it comes to investing, beginners have several options to consider. Let’s compare some popular investment options for those who are just starting out:

- Stocks: Investing in individual stocks allows you to own a share of a company’s ownership and potentially benefit from its growth and profitability. However, stock prices can be volatile, so it’s important to do thorough research and diversify your investments.

- Bonds: Bonds are debt securities issued by corporations or governments. They typically offer a fixed interest rate and return of principal at maturity, making them a more stable investment option compared to stocks.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. This can provide beginners with instant diversification and professional management.

Developing Budgeting Skills

Budgeting is a crucial skill that can help individuals manage their finances effectively and work towards their financial goals. By creating a personal budget, tracking expenses and income, and sticking to the budget, individuals can avoid overspending and achieve financial stability.

Steps to Create a Personal Budget

- List all sources of income, including salaries, bonuses, and any other money you receive regularly.

- Calculate all your monthly expenses, such as rent, utilities, groceries, and transportation costs.

- Subtract your total expenses from your total income to determine your discretionary income.

- Allocate a portion of your discretionary income towards savings and investments.

- Review and adjust your budget regularly to account for any changes in income or expenses.

Importance of Tracking Expenses and Income

- Tracking expenses helps you understand where your money is going and identify areas where you can cut back.

- Monitoring income ensures that you have an accurate picture of your financial situation and can make informed decisions.

- Tracking expenses and income allows you to stay on top of your budget and make adjustments as needed to meet your financial goals.

Tips on How to Stick to a Budget and Avoid Overspending

- Set realistic financial goals that align with your budget and prioritize them to stay motivated.

- Avoid impulse purchases by creating a shopping list and sticking to it when making purchases.

- Use cash for discretionary expenses to limit spending and prevent exceeding your budget.

- Avoid using credit cards for unnecessary purchases to prevent accumulating debt.

- Review your budget regularly and make adjustments to ensure you are staying on track with your financial goals.

Building Savings and Emergency Funds

Saving money regularly is crucial for financial stability and future planning. By consistently setting aside a portion of your income, you can build savings that will provide a safety net during unexpected events or help you achieve long-term financial goals.

Setting Financial Goals and Saving Strategies

- Establish clear financial goals, whether it’s saving for a down payment on a house, starting a business, or planning for retirement.

- Create a budget that Artikels your income, expenses, and savings targets. This will help you track your progress and make adjustments as needed.

- Avoid impulsive purchases and prioritize saving by automating transfers to a separate savings account or investment fund.

- Consider using financial apps or tools to set savings goals and track your spending habits for better financial management.

Importance of Emergency Funds

An emergency fund is a crucial component of financial planning, providing a financial cushion during unexpected events like medical emergencies, job loss, or major car repairs. Here’s how to establish one:

- Set a target amount for your emergency fund, typically three to six months’ worth of living expenses.

- Start by saving small amounts regularly until you reach your target goal.

- Keep your emergency fund in a separate savings account that is easily accessible but separate from your regular spending account.

- Only use your emergency fund for true emergencies to ensure it remains intact for when you need it most.

Managing Debt Wisely

When it comes to managing debt, it’s essential to understand the different types of debt, how to pay it off efficiently, and how to avoid falling into debt traps. Let’s dive into these important aspects of managing debt wisely.

Types of Debt and Their Implications

- Credit Card Debt: High-interest rates can lead to significant financial burden if not paid off on time.

- Student Loans: Long repayment terms can affect your financial stability and delay other life milestones.

- Mortgage: Defaulting on mortgage payments can result in foreclosure and the loss of your home.

Strategies for Paying Off Debt Efficiently

- Create a debt repayment plan: Prioritize debts with the highest interest rates first.

- Consider debt consolidation: Combining multiple debts into one lower-interest loan can make repayment more manageable.

- Increase your income: Look for ways to boost your income to allocate more towards debt repayment.

Tips to Avoid Falling Into Debt Traps

- Stick to a budget: Track your expenses and avoid overspending to prevent accumulating more debt.

- Build an emergency fund: Having savings for unexpected expenses can prevent you from relying on credit cards or loans.

- Avoid unnecessary debt: Only borrow what you need and can afford to repay to avoid getting trapped in a cycle of debt.

Investing Basics

Investing is a key component of financial literacy that involves putting money into assets with the expectation of generating income or profit over time. By investing, individuals have the opportunity to grow their wealth and achieve their financial goals.

Types of Investment Vehicles

- Stocks: Represent ownership in a company and can offer high returns but also come with high risk.

- Bonds: Debt securities issued by governments or corporations, providing a fixed interest payment over time.

- Mutual Funds: Pooled funds from multiple investors to invest in a diversified portfolio of assets managed by professionals.

Diversification is key in creating a well-rounded investment portfolio, spreading risk across different asset classes to minimize potential losses.

Understanding Credit Scores and Reports

Credit scores are numerical representations of an individual’s creditworthiness, indicating how likely they are to repay borrowed money. These scores are calculated based on various factors and play a crucial role in determining one’s ability to access credit and loans.

Definition of Credit Scores

A credit score is a three-digit number that ranges between 300 and 850, with higher scores reflecting better creditworthiness. It is calculated using information from credit reports, including payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries.

Factors Impacting Credit Scores

- Payment History: Timely payments positively impact credit scores, while late or missed payments can lower them.

- Credit Utilization: Keeping credit card balances low in relation to credit limits can boost scores.

- Length of Credit History: Longer credit histories generally result in higher scores.

- Types of Credit Used: A mix of credit types, such as credit cards and loans, can positively affect scores.

- New Credit Inquiries: Applying for multiple new credit accounts within a short period may lower scores.

Tips to Improve and Maintain a Good Credit Score

- Pay Bills on Time: Ensure timely payments for all credit accounts.

- Manage Credit Utilization: Keep credit card balances low to avoid high utilization rates.

- Monitor Credit Reports: Regularly check credit reports for errors and address any discrepancies promptly.

- Avoid Opening Too Many Accounts: Limit new credit applications to prevent a negative impact on scores.

- Use Credit Responsibly: Borrow only what you can afford to repay and maintain a healthy credit mix.