Buckle up, folks! We’re diving into the world of boosting your net worth with some serious knowledge dropped in an American high school hip style. Get ready to level up your financial game and secure that bag!

Now, let’s break it down and explore the key strategies for increasing your net worth like a boss.

Understanding Net Worth

Net worth is the total value of assets minus liabilities that an individual or entity possesses. It represents the financial health and wealth of a person or business.

Calculating Net Worth

- Assets include cash, investments, real estate, vehicles, and other valuable possessions.

- Liabilities consist of debts, loans, mortgages, and other financial obligations.

Importance of Knowing Your Net Worth

- Helps in tracking financial progress and setting financial goals.

- Allows for better decision-making regarding investments, savings, and spending.

Assets vs. Liabilities

- Assets are resources that hold value and contribute to your net worth.

- Liabilities are debts and financial responsibilities that reduce your net worth.

Increasing Assets

When it comes to increasing your net worth, one key strategy is to focus on growing your assets. By building up your investments, savings, and income streams, you can boost your overall financial health and stability. Diversifying your assets can also play a crucial role in protecting your wealth and maximizing returns. Additionally, reducing debt can have a positive impact on your net worth by freeing up more funds to allocate towards building assets.

Investments

- Consider investing in a diverse range of assets, such as stocks, bonds, real estate, and mutual funds.

- Regularly review and adjust your investment portfolio to ensure it aligns with your financial goals and risk tolerance.

- Seek guidance from financial advisors or investment professionals to make informed decisions.

Savings

- Set specific savings goals and automate contributions to your savings accounts.

- Take advantage of high-yield savings accounts or certificates of deposit to maximize your savings growth.

- Cut back on unnecessary expenses to free up more funds for savings.

Income Streams

- Explore opportunities to increase your income through side gigs, freelance work, or passive income streams.

- Invest in your skills and education to enhance your earning potential in your career.

- Diversify your sources of income to create a more stable financial foundation.

Diversifying Assets

- Diversification can help spread risk and enhance returns by investing in various asset classes.

- Consider allocating your assets across different industries, geographic regions, and investment types.

- Regularly reassess your asset allocation to adapt to changing market conditions and economic trends.

Reducing Debt

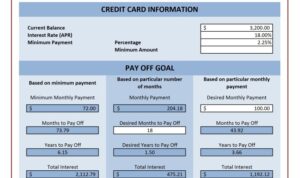

- Focus on paying off high-interest debts first to minimize interest payments and free up more funds for asset building.

- Consolidate debts or negotiate lower interest rates to reduce the overall cost of debt repayment.

- Create a debt repayment plan and stick to it to gradually reduce and eliminate debt over time.

Managing Liabilities

When it comes to managing liabilities, it’s crucial to have a solid plan in place to reduce debt effectively and improve your overall financial health. By addressing your liabilities strategically, you can make a significant impact on your net worth.

Impact of High-Interest Debt

High-interest debt can be a major obstacle to increasing your net worth. Whether it’s credit card debt, payday loans, or other high-interest loans, the interest payments can quickly add up and eat into your finances. It’s essential to prioritize paying off high-interest debt as soon as possible to stop the cycle of accumulating interest and start building wealth.

- Avoid making only minimum payments on high-interest debt. By paying more than the minimum each month, you can reduce the amount of interest you pay over time.

- Consider consolidating high-interest debt with a lower-interest loan or balance transfer to save money on interest payments.

- Create a budget and cut unnecessary expenses to free up more money to put towards paying off high-interest debt.

Reducing high-interest debt can have a significant positive impact on your net worth over time.

Leveraging Debt to Increase Net Worth

While high-interest debt can be detrimental to your financial health, leveraging debt strategically can actually help increase your net worth. Leveraging debt involves using borrowed funds to invest in assets that have the potential to grow in value over time.

- Consider taking out a mortgage to purchase a home, which can appreciate in value and build equity over time.

- Use low-interest loans to invest in education or training that can increase your earning potential in the future.

- Explore opportunities to invest in stocks, real estate, or other assets that have the potential for long-term growth and returns that exceed the cost of borrowing.

When used wisely, leveraging debt can be a powerful tool for increasing your net worth and achieving your financial goals.

Building Passive Income

Building passive income is a key strategy in increasing net worth without having to actively work for every dollar earned. By generating income passively, individuals can create a steady stream of money that continues to grow over time, ultimately contributing to their overall wealth.

Types of Passive Income Streams

- Investing in Dividend-Paying Stocks: By purchasing stocks from companies that pay dividends, investors can receive regular payments based on their share ownership.

- Rental Properties: Owning real estate properties and renting them out to tenants can provide a consistent source of passive income through monthly rental payments.

- Peer-to-Peer Lending: Investing in peer-to-peer lending platforms allows individuals to earn interest on the money they lend to others.

Passive income streams can help diversify one’s sources of revenue and reduce reliance on a single income source.

Benefits of Passive Income

- Financial Stability: Passive income provides a safety net in case of job loss or unforeseen financial hardship.

- Wealth Accumulation: By continuously growing passive income streams, individuals can accumulate wealth over time and increase their net worth.

- Flexibility: Passive income allows for more flexibility in terms of time and location, as it does not require constant active involvement.

Examples of Passive Income Contributions

- John earns $500 per month in dividends from his stock investments, contributing to his passive income stream.

- Sarah generates $1,000 monthly from rental properties she owns, adding to her passive income sources.

- Michael earns interest on peer-to-peer loans, averaging $300 monthly in passive income.

Investing Wisely

Investing wisely is crucial when it comes to growing your wealth and increasing your net worth. By making informed decisions and managing risks effectively, you can set yourself up for financial success in the long run.

Role of Risk Management

Risk management plays a key role in investment decisions as it helps you protect your capital and minimize potential losses. By diversifying your portfolio, conducting thorough research, and staying informed about market trends, you can make more strategic investment choices that align with your financial goals.

Importance of Long-Term Investing

Long-term investing is essential for increasing your net worth over time. By staying committed to your investment strategy and resisting the urge to make impulsive decisions based on short-term market fluctuations, you give your investments the opportunity to grow and compound over the years. Remember, patience is key when it comes to building wealth through wise investments.

Setting Financial Goals

Setting clear financial goals is crucial in the journey to increase net worth. By having specific objectives in mind, individuals can stay focused, motivated, and accountable in managing their finances effectively.

Tips for Setting Achievable Goals

- Start by assessing your current financial situation and identifying areas for improvement.

- Set realistic and measurable goals that align with your long-term financial aspirations.

- Break down your goals into smaller, manageable tasks to track progress more effectively.

- Prioritize your goals based on urgency and importance to stay organized and focused.

- Regularly review and adjust your goals as needed to adapt to changing circumstances or priorities.

Impact of Tracking Progress

Tracking progress towards financial goals allows individuals to monitor their performance, celebrate achievements, and make informed decisions for improvement. It provides a sense of accomplishment and motivation to continue pursuing financial success.