Diving into the world of financial education, we uncover the crucial aspects that shape our understanding of money and investments. Buckle up as we explore the ins and outs of budgeting, saving, debt management, investing, retirement planning, and more. Get ready to level up your financial literacy game!

The Basics of Financial Education

Financial education is key to managing your money wisely and making informed decisions. Understanding basic financial concepts can help you build a strong foundation for your financial future. Let’s dive into some important aspects of financial education.

Key Financial Terms

- Income: The money you earn from working or investments.

- Expenses: The money you spend on goods and services.

- Budget: A plan that Artikels your income and expenses to help you manage your money effectively.

- Savings: Money set aside for future needs or emergencies.

- Debt: Money borrowed that needs to be repaid with interest.

Impact of Financial Literacy

Financial literacy can greatly impact your daily financial decisions. By understanding financial concepts, you can make informed choices about spending, saving, and investing. It can also help you avoid debt traps and plan for a secure financial future. Remember, knowledge is power when it comes to managing your finances!

Budgeting and Saving

Budgeting and saving are crucial aspects of personal finance that can lead to financial stability and security. By creating a budget and prioritizing saving, individuals can better manage their expenses and prepare for unexpected financial challenges.

Significance of Budgeting

Creating a budget allows individuals to track their income and expenses, providing a clear overview of where their money is going. It helps in identifying areas where spending can be reduced or eliminated, ultimately leading to better financial decision-making and increased savings.

- Set financial goals: Establish short-term and long-term financial goals to guide your budgeting process.

- Track expenses: Keep a record of all expenses to understand spending patterns and identify areas for improvement.

- Allocate funds: Prioritize essential expenses such as bills, groceries, and debt payments before allocating money to discretionary spending.

- Review and adjust: Regularly review your budget to ensure it aligns with your financial goals and make adjustments as needed.

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

Importance of Saving

Saving money is essential for building financial stability and preparing for future expenses or emergencies. It provides a financial cushion in times of need and allows individuals to work towards achieving their financial goals without relying on debt.

- Emergency fund: Save a portion of your income in an emergency fund to cover unexpected expenses like medical bills or car repairs.

- Retirement savings: Start saving for retirement early to take advantage of compound interest and secure your financial future.

- Financial freedom: Saving money gives you the freedom to pursue opportunities, invest in your future, and enjoy peace of mind knowing you have a safety net.

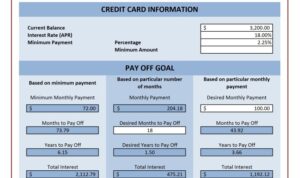

Debt Management

Debt can have serious consequences if not managed properly. It can lead to financial stress, high interest payments, and even damage to credit scores. That’s why it’s crucial to understand how to effectively manage debt to secure a stable financial future.

Consequences of Debt

- Accumulating interest: Debt with high-interest rates can quickly grow, making it harder to pay off.

- Credit score impact: Unpaid debt can negatively affect your credit score, making it harder to qualify for loans or credit cards in the future.

- Financial stress: Constant worries about debt can impact your mental health and overall well-being.

Strategies for Paying Off Debt Efficiently

- Create a budget: Allocate a portion of your income towards debt repayment to ensure consistent progress.

- Focus on high-interest debt first: Targeting debts with the highest interest rates can save you money in the long run.

- Consider debt consolidation: Combining multiple debts into one lower interest loan can simplify payments and reduce overall interest costs.

- Avoid accruing more debt: Cut back on unnecessary expenses and focus on living within your means to prevent further debt accumulation.

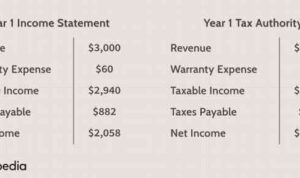

Role of Financial Education in Debt Management

Financial education plays a crucial role in helping individuals avoid falling into debt traps. By understanding concepts like interest rates, credit scores, and budgeting, individuals can make informed decisions about borrowing and spending. With the right knowledge, individuals can proactively manage their debt and work towards a debt-free future.

Investing and Wealth Building

Investing plays a crucial role in building long-term wealth. By putting your money into various investment options, you have the potential to grow your wealth over time. It’s important to understand the different investment options available and how diversification can help minimize risk and maximize returns.

Types of Investment Options

- Stocks: Investing in individual companies by purchasing shares of their stock, offering potential high returns but also high risk.

- Bonds: Loaning money to a company or government in exchange for regular interest payments and the return of the principal amount at maturity.

- Mutual Funds: Pooled funds from multiple investors invested in a diversified portfolio of stocks, bonds, or other securities.

The Importance of Diversification

Diversification involves spreading your investments across different asset classes to reduce risk. By not putting all your eggs in one basket, you can protect your investments from the volatility of individual assets. A well-diversified portfolio can help you weather market fluctuations and improve your chances of long-term success.

Retirement Planning

Planning for retirement is crucial for ensuring financial security in the future. The earlier you start, the more time your money has to grow through compounding interest. This allows you to build a substantial nest egg for your golden years.

Retirement Account Options and Benefits

- 401(k): A retirement account offered by many employers where you can contribute a portion of your pre-tax income. Employers often match a percentage of your contributions, helping your savings grow faster.

- IRA (Individual Retirement Account): A retirement account you can open on your own. Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free withdrawals in retirement.

- Roth 401(k): Similar to a Roth IRA, this retirement account allows for tax-free withdrawals in retirement, but with higher contribution limits.

Remember, the key benefits of retirement accounts are tax advantages and potential employer matches, which can significantly boost your savings over time.

Impact of Compounding Interest on Retirement Savings

Compounding interest is the concept of earning interest on both your initial investment and any interest that has already been earned. This means that your money grows exponentially over time, especially the longer it stays invested.

| Starting Age | Ending Age | Final Amount |

|---|---|---|

| 25 | 65 | $1,000,000 |

| 35 | 65 | $500,000 |

This table illustrates the significant impact of starting early on retirement savings. Starting at 25 can lead to a final amount twice as much as starting at 35, even with the same investment and growth rate.

Financial Risks and Insurance

Understanding financial risks and protecting against them is crucial in managing your finances effectively. Financial risks can arise from various sources such as market fluctuations, unexpected expenses, or loss of income. It is essential to be aware of these risks and take necessary steps to mitigate them.

Insurance plays a significant role in mitigating financial risks by providing a safety net in case of unforeseen events. By paying a premium, individuals transfer the financial risk to the insurance company, which then covers the costs in case of a covered event. This helps protect individuals from facing significant financial losses that could impact their financial stability.

Role of Insurance in Mitigating Financial Risks

Insurance helps individuals protect themselves against various financial risks by providing coverage for specific events. Some common types of insurance include:

- Health Insurance: Covers medical expenses in case of illness or injury.

- Auto Insurance: Provides coverage for damages or theft of vehicles.

- Homeowners Insurance: Protects against damages to the home and personal belongings.

- Life Insurance: Offers financial protection to beneficiaries in case of the insured’s death.

Benefits of Insurance

Insurance offers several benefits, including:

- Financial Security: Insurance provides a safety net to protect against unexpected events that could lead to financial hardship.

- Peace of Mind: Knowing that you are covered by insurance can give you peace of mind and reduce financial stress.

- Risk Management: Insurance helps individuals manage and mitigate various financial risks effectively.

- Compliance: Some types of insurance, such as auto insurance, are mandatory by law, ensuring compliance and avoiding legal issues.