Diving into the world of Real estate market analysis, get ready for a deep dive into the key aspects that drive this dynamic industry forward.

Exploring the methods, factors, and trends that shape the real estate market landscape, this overview will provide valuable insights for investors and enthusiasts alike.

Overview of Real Estate Market Analysis

Real estate market analysis plays a crucial role in understanding the current trends and dynamics of the real estate market. It helps investors, developers, and real estate professionals make informed decisions regarding buying, selling, or investing in properties.

Importance of Real Estate Market Analysis

Real estate market analysis provides valuable insights into the market conditions, helping stakeholders assess the potential risks and opportunities associated with a particular property or location.

- Identifying market trends and forecasting future demand

- Evaluating property values and determining fair market prices

- Assessing the competition and market saturation

Key Components of Real Estate Market Analysis

Several key components are involved in real estate market analysis, including:

- Market Trends: Analyzing historical data and current trends to predict future market conditions.

- Demographics: Understanding the population characteristics and trends in a specific area.

- Economic Indicators: Examining factors such as employment rates, GDP growth, and interest rates that impact the real estate market.

Data Sources Used in Real Estate Market Analysis

Real estate market analysis relies on various data sources to gather information and insights. Some common data sources include:

- MLS (Multiple Listing Service) Listings: Providing detailed information on properties for sale or rent in a specific area.

- Census Data: Offering demographic information, population trends, and household characteristics.

- Economic Reports: Including data on employment, income levels, and economic growth in a particular region.

Methods for Conducting Real Estate Market Analysis

Real estate market analysis involves various methods to gather and interpret data to make informed decisions. Two primary methods used in this analysis are quantitative and qualitative approaches.

Quantitative methods involve the use of numerical data and statistical models to analyze real estate market trends. This includes metrics such as sales prices, square footage, vacancy rates, and rental income. Quantitative analysis provides a systematic way to measure and compare data, allowing for more objective assessments of market conditions.

On the other hand, qualitative methods focus on subjective factors that may impact the real estate market, such as consumer preferences, economic indicators, and regulatory changes. Qualitative analysis relies on expert opinions, surveys, and interviews to gather insights that are not easily quantified.

SWOT Analysis in Real Estate Market Analysis

SWOT analysis is a strategic tool that can be utilized in real estate market analysis to assess the strengths, weaknesses, opportunities, and threats of a property or market. This framework helps identify internal and external factors that may affect the investment potential of a real estate asset.

- Strengths: These are the positive attributes of a property, such as location, amenities, and historical performance.

- Weaknesses: These are the negative aspects that may hinder the property’s value, such as poor maintenance or outdated features.

- Opportunities: These are external factors that could be leveraged to enhance the property’s value, such as market trends or development projects in the area.

- Threats: These are external risks that could negatively impact the property, such as economic downturns or changes in zoning regulations.

SWOT analysis provides a comprehensive overview of the factors influencing a real estate investment, helping investors make strategic decisions based on a holistic assessment of the property.

Role of Technology in Real Estate Market Analysis

Technology, including artificial intelligence (AI) and machine learning, plays a crucial role in analyzing real estate markets by processing vast amounts of data and identifying patterns and trends that may not be immediately apparent.

- AI algorithms can analyze market data to predict property values, identify investment opportunities, and optimize pricing strategies.

- Machine learning models can automate the process of data analysis, allowing for faster and more accurate insights into market dynamics.

- Technology tools like geographic information systems (GIS) can visualize market data spatially, helping investors understand the spatial relationships and trends in a real estate market.

Factors Influencing Real Estate Market Analysis

Economic factors, demographics, population trends, and government policies play significant roles in real estate market analysis, influencing the demand, supply, and pricing of properties.

Economic Factors Impacting Real Estate Market Analysis

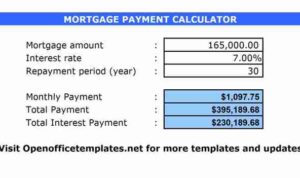

Economic factors such as interest rates, inflation, employment levels, and GDP growth can greatly impact the real estate market. For example, lower interest rates tend to stimulate housing demand by making mortgages more affordable, while high inflation can erode purchasing power and reduce demand for real estate.

Demographics and Population Trends in Real Estate Market Analysis

Demographics, including factors like age, income levels, household size, and lifestyle preferences, can shape real estate trends. Population growth, migration patterns, and urbanization also affect the demand for different types of properties in various locations. For instance, an aging population may lead to increased demand for retirement communities or assisted living facilities.

Significance of Government Policies and Regulations in Real Estate Market Analysis

Government policies and regulations, such as zoning laws, building codes, tax incentives, and environmental regulations, can influence real estate market dynamics. For example, changes in zoning regulations can impact property values and development opportunities, while tax incentives for energy-efficient buildings can drive demand for sustainable real estate projects. It is crucial for real estate investors and analysts to stay informed about these policies to make informed decisions and accurately assess market conditions.

Real Estate Market Trends

Real estate market trends are constantly evolving, influenced by various factors such as economic conditions, supply and demand, and technological advancements. It is essential for real estate professionals to stay updated on these trends to make informed decisions in the industry.

Impact of Global Events on Real Estate Market Trends

Global events, such as the COVID-19 pandemic or geopolitical tensions, have a significant impact on real estate market trends. For example, the pandemic led to an increase in remote work, resulting in higher demand for suburban homes with home offices and outdoor spaces.

Technology Innovations Shaping Real Estate Market Trends

Technology innovations are reshaping the real estate market in various ways. For instance, the use of virtual reality tours allows potential buyers to view properties remotely, reducing the need for physical visits. Additionally, data analytics and artificial intelligence are being used to analyze market trends and predict future developments.